Korbit Research Center: "Stablecoins Emerging as Major Demand Source for US Treasuries"

Summary

- Korbit Research Center stated that stablecoins are emerging as a major demand source for US Treasuries.

- Global companies like Visa, Mastercard, and PayPal are expanding the use of stablecoins as means of payment and rewards.

- Korbit Research Center emphasized that domestic regulation is unclear, imposing institutional constraints on pursuing stablecoin-related businesses.

Korbit Research Center, under the domestic virtual asset (cryptocurrency) exchange Korbit, announced on the 26th that it has published a report titled 'The Era of Stablecoins: Are We Prepared?'. The report comprehensively analyzes the structural classification of stablecoins, their function as a demand source for US Treasuries, cases of their spread within the global payment infrastructure, and the potential for changes in the domestic regulatory environment.

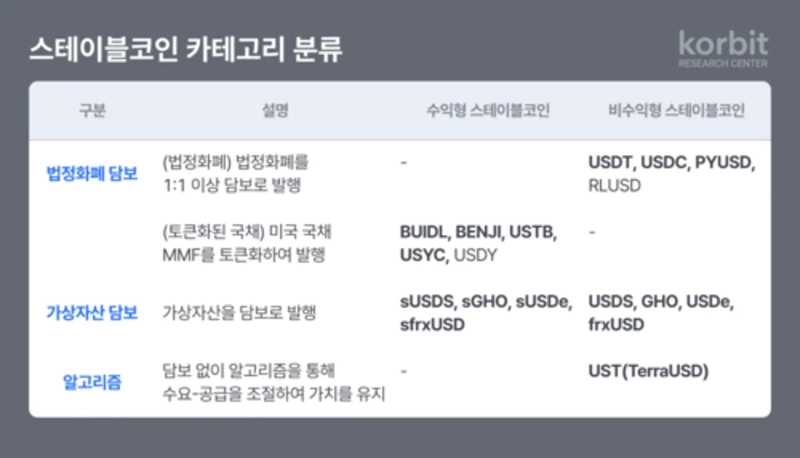

The report argues that stablecoins are evolving beyond being a store of value and a means of payment, into revenue-generating structures linked to real assets, with various collateral methods.

The report highlights that stablecoins are emerging as a significant private demand source in the treasury market. Fiat-collateralized stablecoins are creating direct demand by composing a substantial portion of their reserve assets with US short-term treasuries, contributing to diversifying the treasury demand base.

It also explains that global companies are paying attention to the potential of stablecoins. Visa, Mastercard, and PayPal are rapidly expanding their real-world use by introducing stablecoins as means of payment and rewards.

Furthermore, the report emphasizes the need to accelerate the establishment of domestic regulatory proposals. The report states, "In Korea, the absence of clear systems and guidelines makes even private-level experiments difficult. Despite being in the same technological and demand environment as global competitors, we are experiencing reverse discrimination due to institutional constraints, unable to enjoy the same opportunities."

It continues, "Neither won-based nor foreign currency-linked stablecoins have established clear authorization or legal status, and if domestic companies pursue related businesses, they are likely to conflict with multiple regulations such as the Foreign Exchange Transactions Act and the Banking Act. This raises concerns about high legal uncertainty and sanction risks for issuers, as well as companies looking to entrust or integrate with payment systems, preventing them from actual commercialization. This suggests the possibility of Korea being excluded from the flow of digital payment innovation."

Choi Yoon-young, head of Korbit Research Center, said, "What is needed now is not cautious introduction within permitted limits, but the establishment of a testbed based on real-world use and securing institutional flexibility for proactive response."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)