Summary

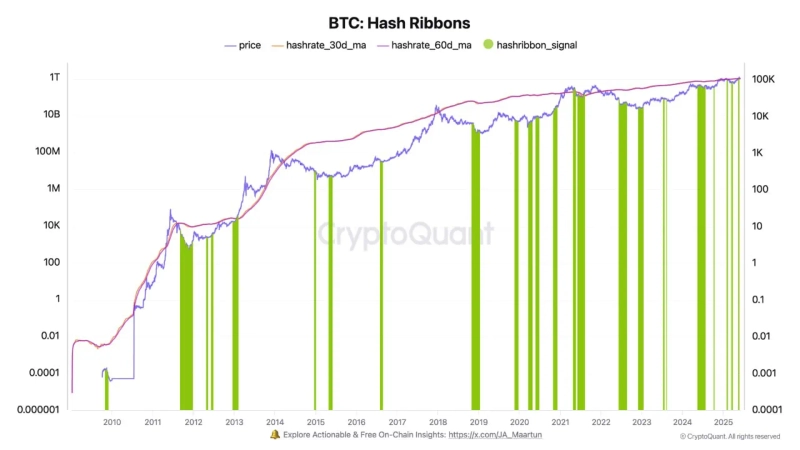

- A new buy signal has been detected on the Bitcoin Hash Ribbons indicator.

- It was noted that the recent death cross of the 30-day and 60-day hash rate moving averages has previously resulted in buying opportunities after price corrections.

- According to past cases, the short-term selling pressure from miners has actually led to long-term buying opportunities at low prices.

A new buy signal has been detected on the on-chain indicator 'Hash Ribbons', which reflects the stress levels of Bitcoin (BTC) miners.

On the 5th (local time), CryptoQuant contributor DarkPost reported, "The Bitcoin Hash Ribbons indicator compares the 30-day and 60-day moving averages of the hash rate. Recently, a death cross has occurred between these two moving averages, and in similar past situations, price corrections have presented good buying opportunities."

The contributor added, "Such a death cross is typically seen when mining profitability worsens. As mining becomes less profitable, some miners are forced to sell their Bitcoin holdings to continue operations, leading to short-term price corrections," and explained, "However, according to past cases, this selling pressure has actually served as a long-term buying opportunity at low prices."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.