Summary

- It was revealed that about 22,500 Bitcoin (BTC) were recently withdrawn in bulk from centralized exchanges.

- Such large-scale withdrawals are likely for long-term holding strategies for custody purposes, and are interpreted as actions by institutional investors and other 'large players'.

- The withdrawal is explained as having no immediate effect on price rise, but could be positive for price stability in the long term by reducing the circulating market supply.

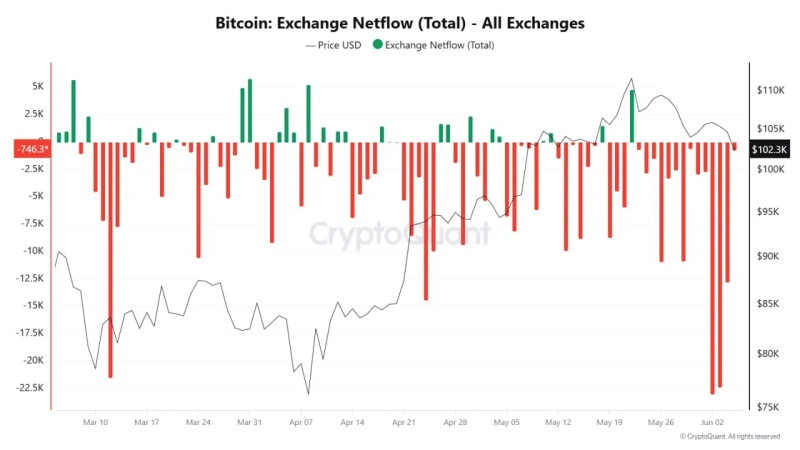

At the beginning of this month, about 22,500 Bitcoin (BTC) were massively withdrawn from centralized exchanges, and analysts say this could have a positive impact on price stability in the long term.

On the 6th (local time), CryptoQuant contributor BaykusCharts stated, "In early June, 22,500 BTC were withdrawn from centralized exchanges. This is a scale that far exceeds the level of ordinary retail investor transactions, and it is likely for the purpose of long-term holding through custody rather than short-term trading."

According to the contributor, such movements are usually interpreted as the actions of 'large players' such as ETF issuers, institutional investors, and those leading over-the-counter (OTC) trading. They tend to prefer storing assets in their own wallets rather than keeping them on exchanges, aiming to minimize market exposure and quietly build positions.

Regarding this, the author explained, "While this may not lead to an immediate increase in price, it can be seen as a sign that market participation is happening from a long-term perspective rather than for short-term speculation. Such large-scale withdrawals may reduce the amount of sellable supply circulating in the market, which could positively affect price stability."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.