Summary

- Recently, it was analyzed that Bitcoin continues to show a sideways trend.

- On-chain indicators show that investors' selling sentiment remains low.

- As realized profits are low and fear sentiment has weakened, it is not leading to large-scale selling.

Recently, Bitcoin has continued to move sideways amid macroeconomic uncertainty and geopolitical factors. According to an analysis, on-chain indicators signal that investors' selling sentiment remains low.

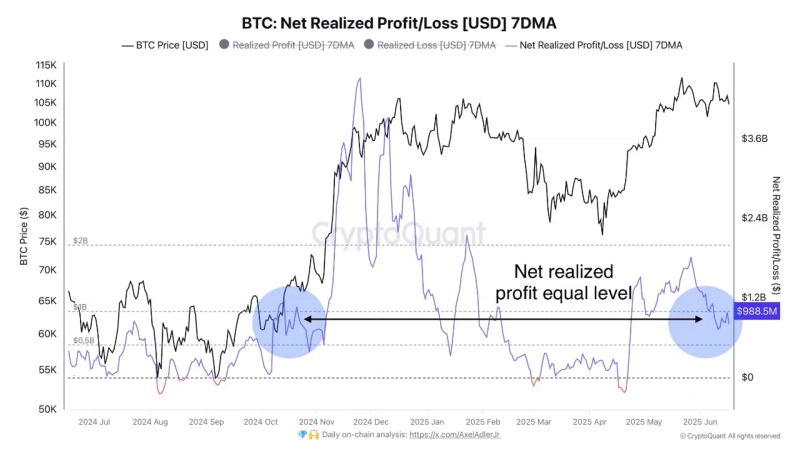

On the 19th (local time), Darkfost, an analyst at the on-chain data analysis platform CryptoQuant, stated, "Based on the 7-day moving average, Bitcoin's Realized Profit is currently below $1 billion. This level is similar to that at the end of the correction phase in October 2024."

He added, "Even at the recent time when Bitcoin hit its all-time high, realized profit saw only a slight increase, falling short of the selling surge witnessed last January. This indicates investors have not yet realized sufficient profits. At the same time, fear sentiment has weakened, so this is not leading to large-scale selling."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)