Summary

- Recently, although Bitcoin prices have reached new highs, it is analyzed that network indicators remain stagnant.

- Major network indicators such as the number of active addresses, network activity index, and mempool continue to show poor performance.

- Experts state that the current low activity of Bitcoin cannot be interpreted as a positive sign for market reactivation.

Despite the fact that Bitcoin (BTC) prices have been hitting all-time highs and the bull market continues, network indicators are actually showing negative conditions.

On the 28th (Korean time), the CryptoMe CryptoQuant contributor stated in a report, "If you look at the Bitcoin blockchain, unlike the price movement, the network metrics are lacking," he analyzed. The indicators highlighted by the CryptoMe contributor include the number of active addresses, the network activity index, and the mempool.

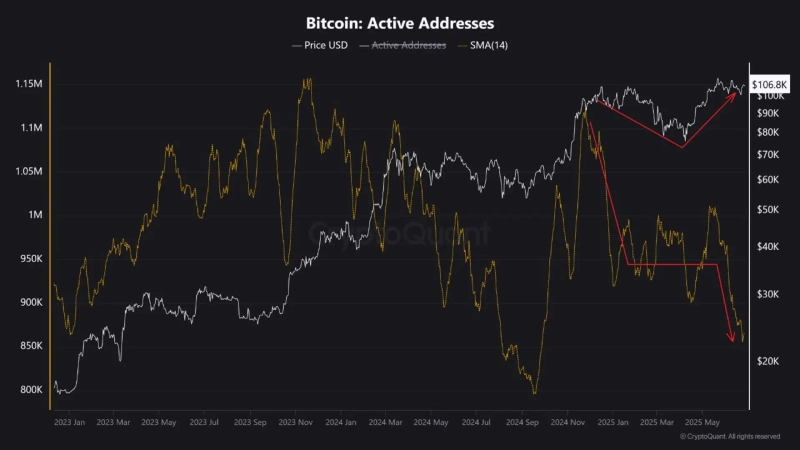

First, the number of active addresses sharply declined when the price of Bitcoin fell to the $70,000 range last April, and it still remains at a low level. The number of active addresses surged to 1.1 million last September when the price of Bitcoin soared. However, as the Bitcoin price weakened thereafter, the count decreased, and it is currently holding at around 850,000.

Also, the network activity index—a composite of several metrics such as active addresses, transaction count, total unspent transaction output (UTXO), and bytes per block—has not corresponded to the price of Bitcoin and has recently fallen sharply.

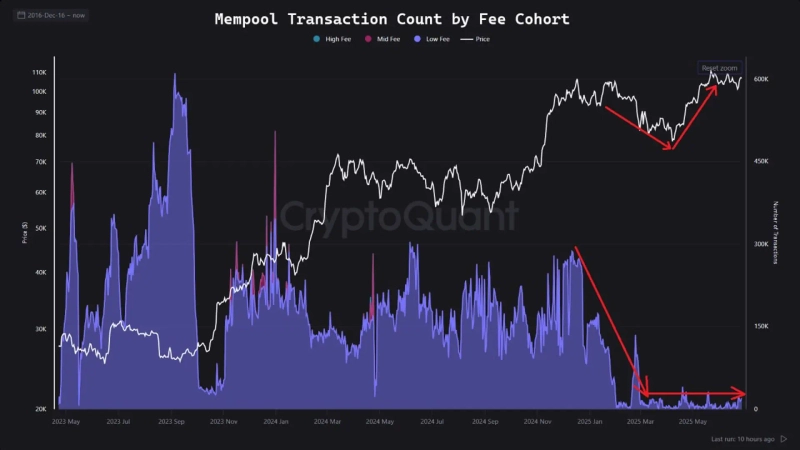

Lastly, the mempool indicator, which shows pending unconfirmed transactions, reveals that there are currently very few Bitcoin transactions waiting in the queue.

The CryptoMe contributor explained, "The current low level of activity on the Bitcoin blockchain is the result of a steep decline in investor interest, and this cannot be interpreted as a positive sign for the reactivation of the market. For Bitcoin to regain its past vibrancy, changes in macroeconomic conditions and investor sentiment will play key roles."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)