US Long-Term Bond Yields Surge: A Harbinger of Shifting Investment Dynamics in the Asset Market

Summary

- It is reported that the recent surge in US long-term Treasury yields has shaken the longstanding notion that 'Treasuries = safe assets.'

- As major long-term bond ETFs are posting significant negative returns, both global institutional and domestic investors are actively rebalancing their portfolios.

- Currently, dividend yields, cash flow, and liquidity management focusing on short-term bonds have become key considerations in investment decisions.

'Treasuries = Safe Assets' Paradigm Shaken

30-Year Yield Rises to 4.8% Annually

Long-Term Bond ETFs Reporting Negative Returns This Year

US Treasuries Perceived as 'Risk Factors'

'Stocks 60 : Bonds 40' Asset Allocation

Portfolio Strategy Trends Shifting

Short-Term Bond ETFs Attracting Funds in Korea

'Long-Term Bonds Now Act as Risks

Necessity to Manage Liquidity through Dividend Yields, etc.'

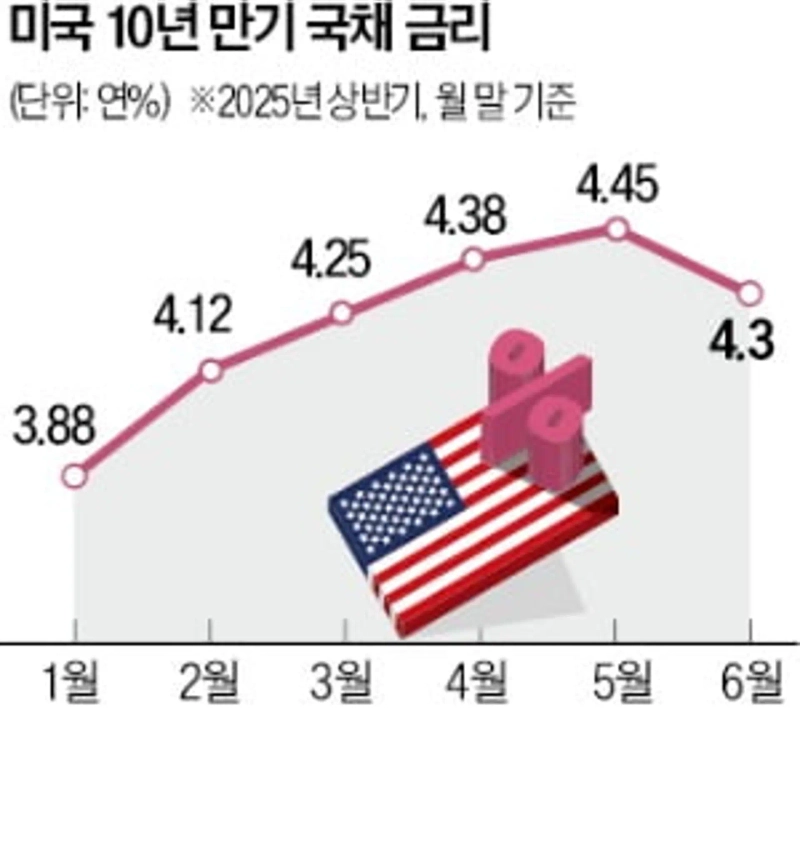

Recently, the global investment market has been focusing on the rapid surge in US long-term government bond yields. At the end of last month, contrary to market expectations, the US central bank (Fed) ruled out a rate cut within the year, and Jerome Powell, Chair of the Fed, emphasized, 'As long as the economy and employment remain strong, the high interest rate policy will be maintained.' Following these comments, the US 10-year yield exceeded 4.6% per annum, with the 30-year yield climbing as high as 4.8%.

The issue now is that the long-held formula 'Treasuries = safe assets' is being shaken. Rising long-term bond yields directly mean falling bond prices, prompting a growing perception among global institutional investors that US Treasuries are becoming a 'risk factor' in their portfolios.

◇Long-Term Bond ETFs with Double-Digit Losses This Year

US Long-Term Bond Yields Surge: A Harbinger of Shifting Investment Dynamics in the Asset Market

One of the major US long-term government bond ETFs, TLT, dropped 11.7% year-to-date, pushing its cumulative loss since 2022 past 40%. The IEF ETF, which tracks 7–10 year treasuries, also fell by more than 5% this year, posting negative returns. Even during the 2008 global financial crisis, treasuries played a defensive role, but this time, they have instead turned into a 'deflation asset' triggering portfolio losses.

Major US investment banks noted, 'The Fed appears committed to keeping real interest rates positive,' and that 'the market is searching for a new equilibrium amid weakening long-term demand.' Domestic institutional investors have also taken action. The National Pension Service (NPS) reduced the proportion of overseas bonds to 8.6% as of Q1 this year; insurers and asset managers are likewise revising portfolios to reduce exposure to US Treasuries.

The shock in the bond market is echoing in the equities market. As long-term rates rise, the present value of future earnings is more heavily discounted, impacting growth and tech stocks with high P/E ratios. The US Nasdaq index has erased most of its strong performance since March due to high interest rate pressure, experiencing a more significant correction than the S&P 500. The ARK Innovation ETF (ARKK), a leading tech ETF, has returned to negative territory year-to-date and is showing particular vulnerability in this rising rate environment.

Conversely, ETFs centered on sectors with stable cash flows, such as defense, energy, infrastructure, and dividend stocks, have outperformed. Notably, the Vanguard High Dividend ETF (VYM) and the energy sector ETF (XLE) have logged solid returns of around 5–10% since the beginning of the year.

◇ 'Dividend and Cash Flow Are Key'

Traditionally, institutional investors have used a '60 (stocks) : 40 (bonds)' asset allocation strategy. However, as long-term rates rise and the '40%' in bonds sees losses, the viability of the entire portfolio is under question. Some large US pension funds have experienced a sharp decline in returns due to losses from TLT investments. Recently, certain financial advisory firms even released rebalancing reports advising 'reduce long-term bonds to zero (0) in your portfolio.'

Against this backdrop, investors are now focusing more on 'predictable cash flow' rather than expected returns. In the US, monthly dividend ETFs, short-term high-grade corporate bond ETFs, and money market funds (MMFs) are receiving substantial inflows, reflecting this trend.

In Korea, investor fund flows are also shifting. This year, dollar-denominated short-term bond ETFs such as 'KODEX U.S. Short-Term Bond Active ETF (530750.KQ)' and 'TIGER U.S. Dollar Short-Term Bond Active ETF (436180.KQ)' have attracted significant capital, and some brokerages have re-launched portfolio products centered on overseas REITs and high-dividend ETFs that offer dividend yields above 5% per annum. One head of a major securities firm's asset management division explained, 'If there are assets capable of delivering guaranteed dividends above 5% per year, the incentive to take risks on volatile government bonds or high-growth stocks decreases,' and 'In this era of high rates, sustainable cash flow outweighs growth prospects as the key investment metric.'

However, experts caution that traditional methods of 'diversified investing' are not enough. They advise a management strategy focused on risk avoidance rather than mere returns. Jin-Soo Kim, head of the WM Research Center at Samsung Securities, stated, 'Long-term government bonds used to reduce portfolio risk, but now they have become the risk themselves,' adding, 'For now, priority should be on assets whose dividend yields exceed the benchmark rate, and on liquidity managed mainly through short-term bonds and MMFs.'

Some interpret rising long-term rates as a reflection of the robust fundamentals of the US economy. Nonetheless, there is a widespread view that without reconstructing portfolios for the high-interest environment, it will be difficult to avoid losses. Experts agree that the current surge in long-term rates signals a shift in the investment landscape for asset markets. Jeffrey Gundlach, Chair of DoubleLine Capital and known as the 'Bond King,' recently stated in an interview with Bloomberg, 'With rates rising, the riskiest asset now may be Treasuries themselves,' and, 'This is an era where risk must be actively managed, not avoided.'

Reporter: Sohyun Lee y2eonlee@hankyung.com

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit