Editor's PiCK

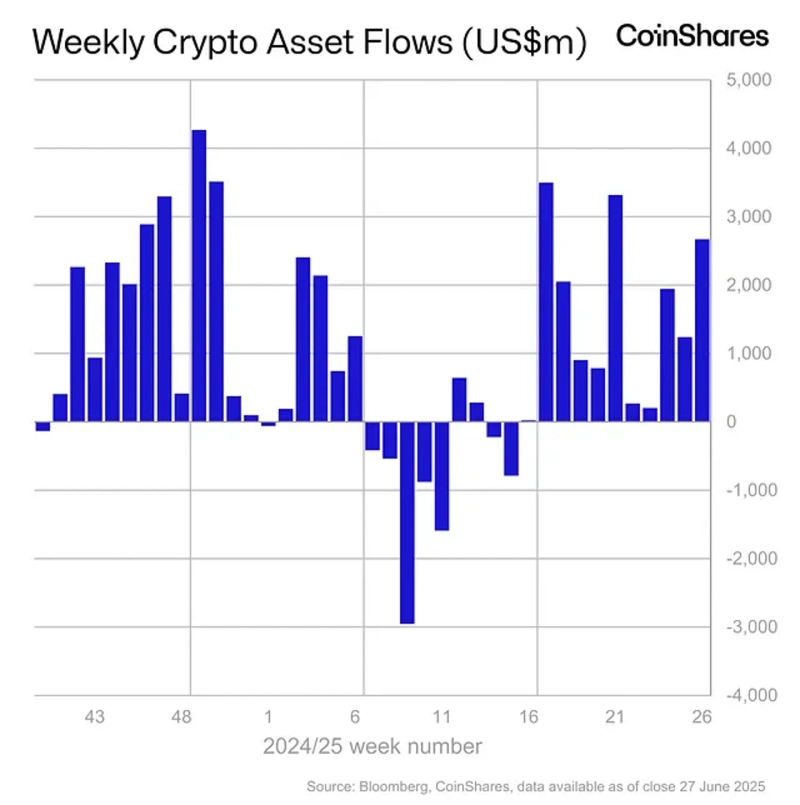

Last week, global virtual asset investment products saw a net inflow of $2.7 billion... 11 consecutive weeks

Summary

- CoinShares announced that last week, global virtual asset investment products saw net inflows of $2.7 billion, marking the 11th consecutive week of positive inflows.

- Notably, Bitcoin products attracted $2.2 billion, accounting for 83% of the total inflows, while Ethereum and key altcoins also recorded net positive inflows.

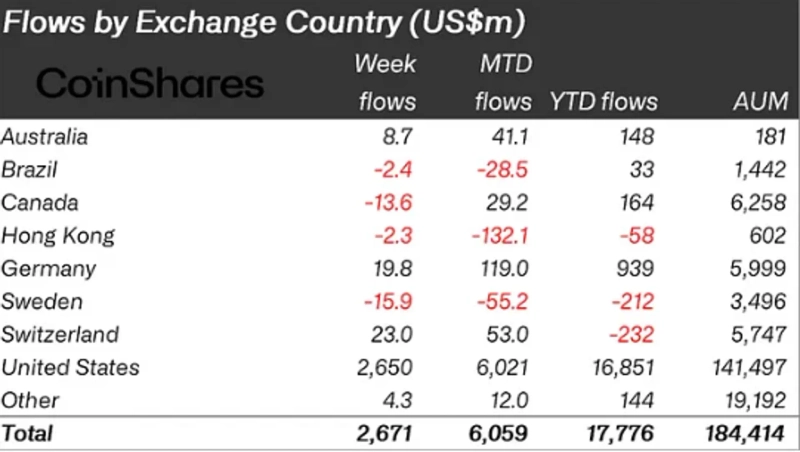

- By country, U.S.-based products stood out for their net inflows, while Sweden and Canada experienced net outflows.

Last week, global virtual asset (cryptocurrency) investment products saw inflows totaling $2.7 billion, marking an 11th consecutive week of net inflows.

On the 30th (local time), CoinShares announced in a report, "Last week, virtual asset investment products saw inflows of $2.671 billion (₩3.6117 trillion), posting an 11th straight week of net inflows," adding, "Just in the first half of this year, inflows have reached $16.9 billion, nearing the $18.3 billion that was recorded by the end of June last year." The report continued, "Rising geopolitical volatility and monetary policy uncertainty have helped sustain robust investor demand."

By asset, Bitcoin (BTC) products recorded a net inflow of $2.2 billion, ranking first. The report noted, "This amounts to 83% of last week's global investment product inflows," and added, "Short (sell) Bitcoin products saw an outflow of $2.9 million, further strengthening the positive sentiment toward Bitcoin's rise." Ethereum (ETH) products attracted $429 million, coming in second. The report stated, "Since the beginning of the year, more than $2.9 billion has flowed into Ethereum," and, "Investors continue to anticipate strength for Ethereum."

Major altcoins also showed positive trends. XRP and Solana (SOL) products recorded inflows of $10.6 million and $5.3 million, respectively.

By country, the United States led with strong inflows. U.S.-based virtual asset investment products alone posted a net inflow of about $2.65 billion, while Switzerland, Germany, and Australia saw inflows of $23 million, $19.8 million, and $8.7 million, respectively. In contrast, Sweden and Canada saw net outflows of $23 million and $13.6 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit