Editor's PiCK

Ethereum turns to L1 expansion, Base dominates... L2 ecosystem faces 'zombification' crisis [Doohyun Hwang's Web3+]

Summary

- Ethereum's renewed focus on Layer 1 expansion has put the existing Layer 2 (L2) ecosystem at risk of diminished competitiveness and even 'zombification.'

- Despite stagnant user demand and transaction volumes, L2 tokens are abnormally overvalued, intensifying bubble concerns.

- The industry diagnoses that L2 projects urgently need to overhaul survival strategies, such as partnering with major platforms, pursuing niche strategies, or migrating to Bitcoin.

Ethereum focuses on Layer 1 expansion

Layer 2 crisis theory... Token bubble controversy

Three networks including Base account for 85% of total fees

Need to recalibrate strategy... Bitcoin transition as an alternative

As Ethereum (ETH) refocuses on Layer 1 (L1) expansion, the Layer 2 (L2) ecosystem built on the Ethereum network is at a crossroads. L2 is an 'expansion solution' operating atop the main chain to increase Ethereum's speed and efficiency.

Previously, Ethereum improved scalability and user experience (UX) by using L2 technologies like 'rollups' that offload complex transactions externally. However, it has now shifted focus to enhancing its own mainnet's performance, thereby beginning to compete with L2 projects.

Particularly, the L2 network Base, developed by the United States' largest crypto exchange Coinbase, has virtually overtaken the L2 market, raising a sense of crisis throughout L2 projects. User demand has stagnated, but token values are abnormally inflated, continuing to spark bubble concerns.

Ethereum reverts to L1 expansion... L2 ecosystem faces 'zombification' risk

The Ethereum Foundation has set 'L1 expansion,' 'blob (transaction data storage) expansion,' and 'UX improvement' as top priorities this year, effectively moving away from a rollup-centric stance. Notably, attempts to boost L1 throughput through increasing block size and integrating zero-knowledge technologies are in full swing. As a result, it's now difficult for L2s to justify their existence based solely on reducing fees.

The competitive landscape has also changed. Ethereum continues to lose market share to Solana (SOL) and Tron (TRX). Compared to the start of the year, Ethereum's market share has dropped to 25%, with total fees of $279.4 million. In contrast, during the same period, Solana's share and fees reached 38% and $429.1 million, significantly surpassing Ethereum.

Additionally, 67% of all L2 fees are now concentrated in Base, and conventional general-purpose L2s are rapidly being pushed out in both profitability and market share. L2's monthly fees, which reached $91.4 million in March last year, have plummeted 90% in just over a year, lingering at $8.9 million as of May this year. Even including Arbitrum (ARB) and Optimism (OP)'s shares, 85% of all L2 fees are now held by just three networks, including Base. The rest of the L2 ecosystem is, in effect, being reduced to 'zombie networks,' as observers note.

Crypto data analytics firm Messari explained, "Ethereum's network fees and market share are declining, while alternative L1s are meeting increased demand," adding, "Meanwhile, the economic utility available in the L2 ecosystem is diminishing, which raises questions about L2 projects."

Jinsol Bok, a researcher at Populous, commented, "The recent organizational restructuring at the Ethereum Foundation signals a strategic shift," and evaluated, "Ethereum is focusing on short-term L1 expansion after becoming conscious of lagging behind platforms like Solana and Sui." He continued, "In fact, compared to L2s, L1's scalability and UX are very far behind," and added, "With technological progress and hardware performance improving, now is the right time for L1 expansion."

Profits are bottoming out, but valuations soar... L2 token bubble controversy

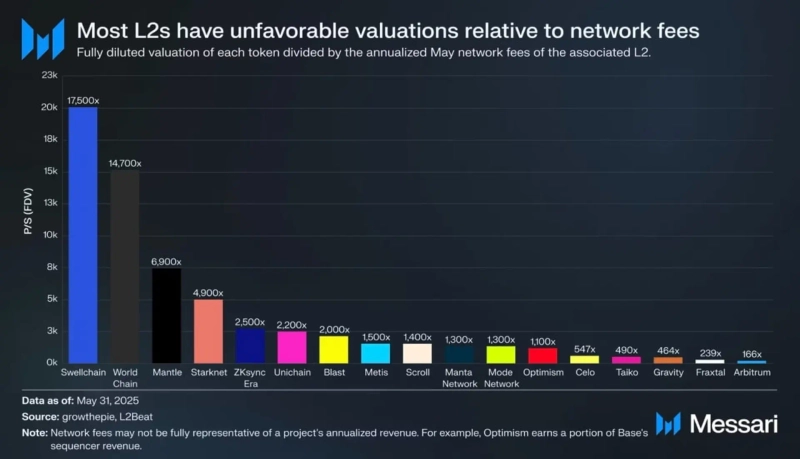

Despite stagnant user demand and transaction volumes, there are also claims that L2 token enterprise values are excessively overblown. According to the market data platform growthepie, as of May this year, the price-to-sales (P/S) ratio for L2 tokens averaged 3,481 times, with a median of 1,447 times.

Swell Chain (SWELL) earns only tens of thousands of dollars annually, yet boasts a market cap exceeding $100 million. The enterprise value-to-sales ratios for projects like Optimism, StarkNet (STRK), and zkSync (ZK) also range from 1,000 to 5,000 times. That is, most tokens are overvalued purely on anticipation, lacking a realistic revenue model.

The bigger issue is that even projects whose profitability is proven still suffer from accumulated long-term losses. According to Messari, as of May, Arbitrum recorded a monthly net profit of $910,000, but had an accumulated loss of $126.6 million. UniChain (UNI) injected about $15 million in token incentives starting April 2025, but generated only $380,000 in profit.

The diagnosis is that if token values keep inflating under these circumstances, a loss of market trust and inevitable repricing are on the horizon. Messari assessed, "With network fee revenue dominating, the high market caps of L2 tokens exist without economic substance," adding, "Sustaining solely on short-term incentives or solely on traffic attraction may no longer be viable."

L2 needs to overhaul survival strategies... Bitcoin transition also an option

The industry suggests three main survival strategies for L2 projects. The first is to partner with large platforms and share revenue, like Optimism and Base. However, though Optimism provided OP incentives worth $187 million to Base, cumulative profit was only $16.9 million, raising critiques over cost-effectiveness.

The second is a rollup strategy tailored to specific industries. Hyperliquid introduced an on-chain central limit order book (CLOB) structure on its own L1, producing monthly profits of $70 million and drawing attention. Similarly, some projects are taking niche approaches in areas such as gaming, privacy, and proof of personhood (PoP).

The third is a strategy of migrating to networks other than Ethereum, like Bitcoin (BTC). Since Bitcoin's mainnet has limited smart contract capability, only L2s can implement advanced features. The absence of a clear market winner is seen as an opportunity. In fact, StarkNet recently announced the first-ever rollup structure using both Ethereum and Bitcoin as settlement layers.

Messari emphasized, "With limited smart contract capacity and no single dominant L2 in the Bitcoin ecosystem, rollups have a new opportunity," adding, "For L2 projects seeking sustainable economics, now is the time to pursue bold strategic shifts, rather than incremental optimization."

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)