Summary

- It was reported that a bill to exempt taxes on small-scale virtual asset transactions under $300 is expected to be introduced in the United States.

- Senator Lummis stated that tax exemption on small transactions within an annual total limit of $5,000 would reduce the capital gains calculation burden for small investors.

- It was reported that the Senate vote on the proposed amendment has not yet taken place.

A bill that fully exempts small-scale virtual asset (cryptocurrency) transactions from taxes is expected to be introduced in the United States.

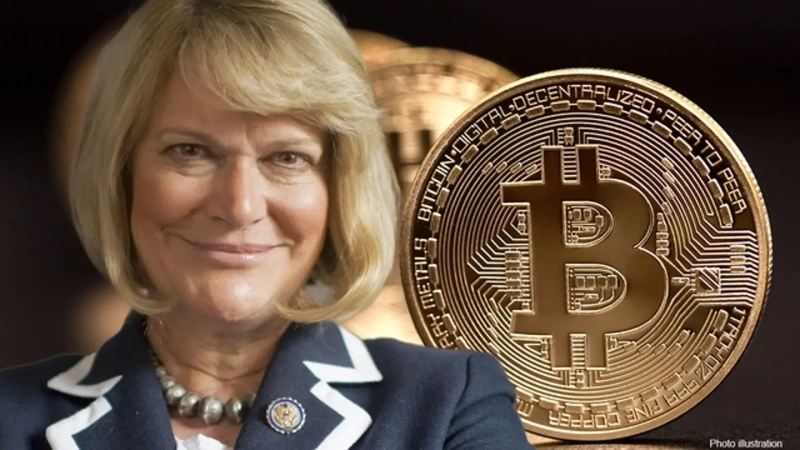

According to the cryptocurrency-focused media outlet CoinDesk on the 30th (local time), Senator Cynthia Lummis is seeking to add provisions such as 'tax exemptions for virtual asset transactions under $300' to President Donald Trump's tax reform bill (Big Beautiful Bill).

Senator Lummis stated, "If tax exemptions for small transactions are provided within an annual total transaction limit of $5,000, this would significantly reduce the capital gains calculation burden on small investors participating in digital asset transactions," adding, "this could increase the accessibility of virtual assets."

A Senate vote on the proposed amendment has not yet taken place.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)