Summary

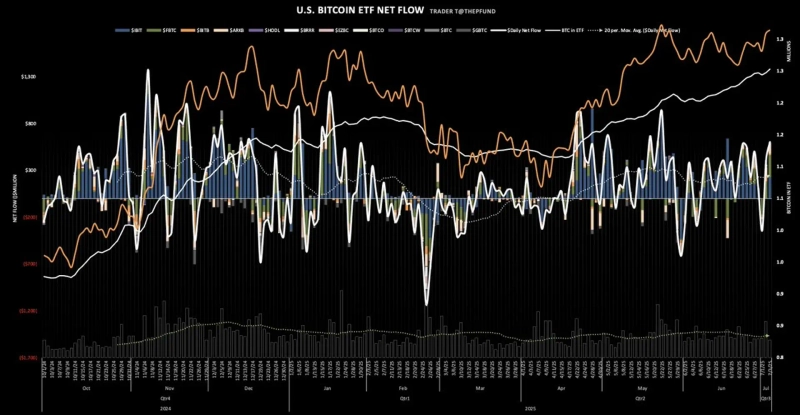

- $603 million in net inflows entered the US spot Bitcoin ETF market.

- Fidelity's 'FBTC' recorded $237.13 million, while BlackRock's 'IBIT' saw $225.59 million.

- Grayscale Investments' 'GBTC' had no fund flow, while some other products also saw no change.

A total of $603 million flowed into the US spot Bitcoin Exchange-Traded Fund (ETF) market. This marks the second consecutive trading day of net inflows.

According to data from TraderT on the 3rd (local time), the product that attracted the most capital on this day was Fidelity's 'FBTC', which recorded a net inflow of $237.13 million. BlackRock's 'IBIT' followed with an inflow of $225.59 million. Next, ARK Invest's 'ARKB' saw $114.25 million, and Bitwise Asset Management's 'BITB' had $15.53 million.

Grayscale Investments' 'GBTC' saw no net flow of funds, while 'BTC' received $5.84 million. VanEck's 'HODL' also recorded an inflow of $4.66 million. In contrast, Invesco's 'BTCO', Franklin Templeton's 'EZBC', Valkyrie Investments' 'BRRR', and WisdomTree's 'BTCW' had no net inflows or outflows.

Doohyun Hwang

cow5361@bloomingbit.ioKEEP CALM AND HODL🍀

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)