Summary

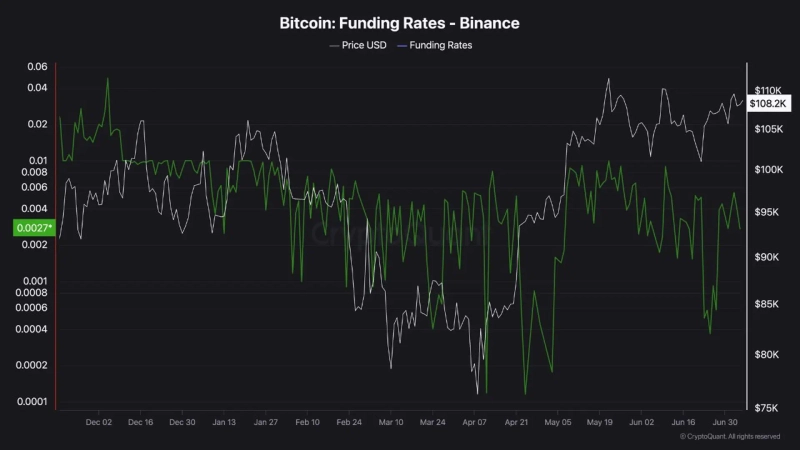

- As Bitcoin's price is hovering between $100,000 and $110,000, the funding rate continues to decrease.

- It has been observed that the number of traders opening short positions on Binance is increasing.

- It is also explained that if the price rises, a short covering phenomenon could occur, potentially further strengthening Bitcoin's upward momentum.

As Bitcoin (BTC) continues to trade sideways between $100,000 and $110,000, it has been observed that the number of investors making bearish bets is increasing.

On the 7th (KST), Boris Best CryptoQuant contributor reported in a note, "Bitcoin's funding rate on Binance is continuously trending lower," adding, "A declining funding rate means that more traders are opening short positions on Binance."

The contributor also explained that the rise in bearish traders could, on the contrary, benefit Bitcoin's price. He stated, "If prices rise, traders holding short positions may be forced to liquidate and will need to inject additional funds to maintain their positions," adding, "Ultimately, this could further strengthen Bitcoin's upward momentum."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Exclusive] KakaoBank meets with global custody heavyweight…possible stablecoin partnership](https://media.bloomingbit.io/PROD/news/a954cd68-58b5-4033-9c8b-39f2c3803242.webp?w=250)

![Trump ally Myron, a Fed governor, resigns White House post…pushing for rate cuts until Warsh arrives? [Fed Watch]](https://media.bloomingbit.io/PROD/news/75fa6df8-a2d5-495e-aa9d-0a367358164c.webp?w=250)