Summary

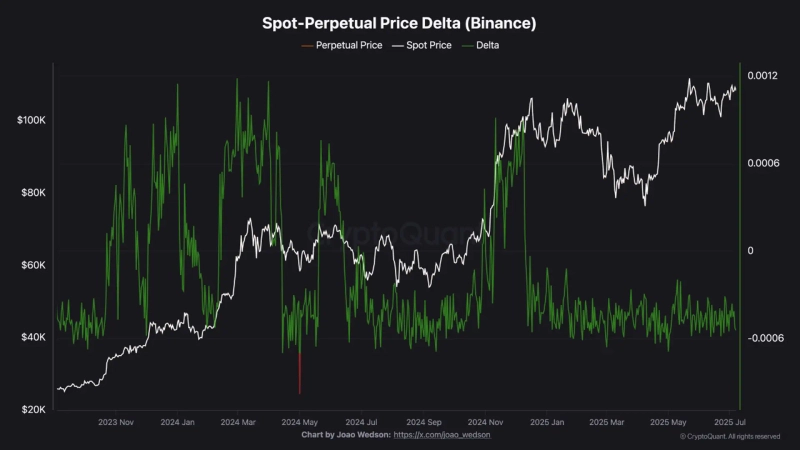

- It was stated that the negative difference between Bitcoin spot and futures prices on Binance suggests an 'accumulation' phase.

- BorisVest, a contributor at CryptoQuant, said this signals low participation from futures traders.

- If the indicator turns positive, a correction is possible and there may be greater downward pressure due to leverage liquidations.

The price difference between Bitcoin (BTC) spot and perpetual futures on the global cryptocurrency exchange Binance has recorded negative values, indicating an accumulation phase, according to analysis.

On the 9th (local time), BorisVest, a contributor at CryptoQuant, stated in a report, "Since December last year, the price gap between Bitcoin spot and futures on Binance has consistently remained negative," adding, "This means the spot price is higher than the futures price, signaling weak participation from futures traders." He continued, "This tendency generally appears when the market enters an 'accumulation' phase."

However, if this indicator turns positive, there may be a correction. The analyst noted, "When the Bitcoin futures price exceeds the spot price, it signals a significant influx of long leverage funds," and explained, "In such cases, downward pressure for leverage liquidation may intensify."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit