The Future of Payments Demonstrated by Shopify, Coinbase, and Stripe [ASA Opinion #5]

Summary

- Shopify introduced the USDC payment option, showcasing innovation in payment systems together with Coinbase and Stripe.

- This stablecoin-based payment centers on bypassing card networks and issuing banks to cut fees, and brings in smart contracts for dispute mediation.

- It is worth watching whether the expansion of stablecoin payment systems will become a trend that replaces existing payment systems.

1. Shopify, a Leading E-Commerce Solution Provider

Shopify is an all-in-one e-commerce service that helps you handle everything on one platform—from product sales and marketing to logistics, payments, and analytics. While Amazon allows countless sellers to offer products on a single marketplace platform, Shopify provides tools for sellers to build independent websites, enabling them to directly manage their own domain, design, branding, and customers.

Depending on the plan, Shopify offers sellers dozens of features. These cover every aspect of e-commerce from A to Z, including popular features such as an online store editor, online payments, offline POS support, as well as marketing, shipping, B2B, payments, analytics and reporting, developer tools, financial management, and more. Representative brands using Shopify include Gymshark, Allbirds, and Red Bull.

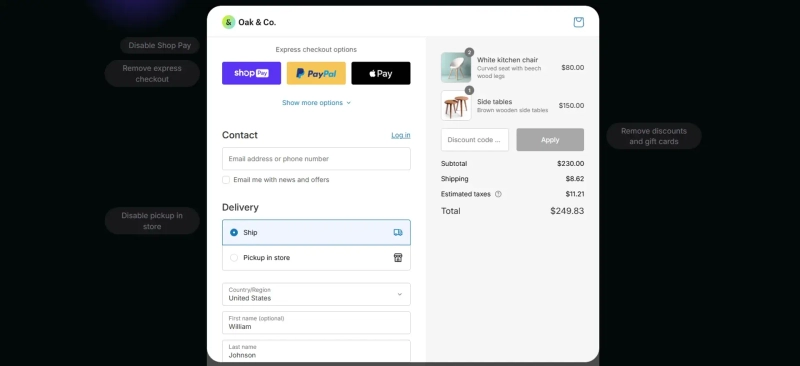

Shopify enables sellers to offer various payment options. By default, it supports payments via credit/debit cards and PayPal, and additionally provides an accelerated checkout service through the Shop Pay feature. With Shop Pay, customers can save their credit card, billing/shipping addresses, email, and phone number, allowing them to complete purchases quickly at any store using just Shop Pay.

By providing convenient solutions, Shopify currently supports about 2.5 million online stores, and in just the first quarter of 2025, it recorded ~$75B in GMV (Gross Merchandise Volume), with over 150 million Shop Pay users worldwide.

2. Shopify: Shaping the Future of Payments with Coinbase and Stripe

2.1 Announcement of Shopify's USDC Payment Support

On June 12, 2025, Shopify announced together with Coinbase and Stripe that it would support USDC payment options. Customers will be able to pay in Shopify-based online stores using USDC on the Base network. Going forward, by supporting USDC payment options, sellers using Shopify can reach a broader global customer base.

With stablecoins representing innovative next-generation payment systems, the support of USDC payments by Shopify, Coinbase, and Stripe has two key implications: 1) a payment system that bypasses card networks and issuing banks, and 2) dispute resolution for payments implemented through smart contracts.

2.2 How Does USDC Payment Work?

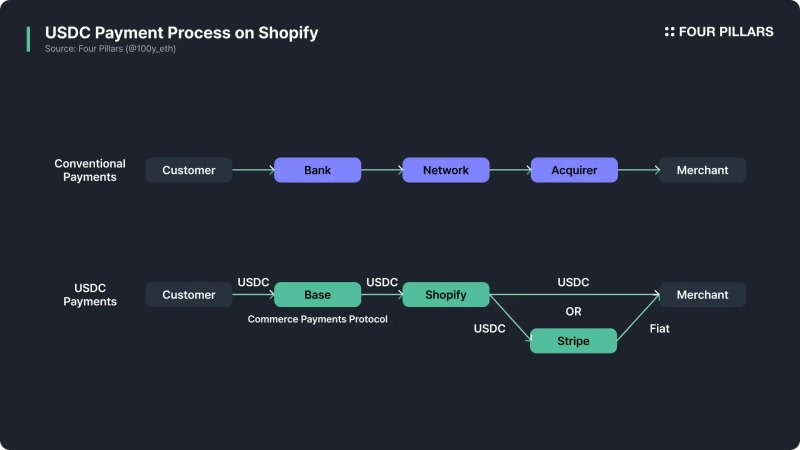

USDC payments in Shopify’s USDC payment option work as follows:

-

The customer connects a crypto wallet holding USDC on the Base network and pays.

-

USDC is processed via the "Commerce Payments Protocol" on the Base network and delivered to Shopify.

-

By default, Shopify converts USDC to fiat currency for settlement to merchants, but if the merchant prefers, they can receive USDC directly in their crypto wallet.

Isn't it remarkably simple? This is far simpler than the existing card payment model, where PSPs, acquirers, card networks, and issuing banks are involved. Most importantly, it has the advantage of not needing to go through card networks or issuing banks.

In the traditional payment model, the card network connects the merchant's bank account and the issuing bank holding the customer’s money, but this mediation process adds high fees and slow settlements.

Why does Shopify’s USDC payment not require card networks or issuing banks?

-

Because customers now hold USDC in their own web3 wallet. Where previously payments were made from fiat held in the customer’s bank account, now they directly use USDC stored in their own wallet for payment.

-

The Base network replaces the role of the card network. Customers’ USDC is transferred to Shopify and merchants via intermediary smart contracts on the Base network.

2.3 Commerce Payments Protocol

2.3.1 Overview

Traditional payment systems have built-in mechanisms beyond simply transferring money—for example, inventory could sell out before payment is completed, or customers and merchants might cancel or refund orders, necessitating a variety of scenarios. If the payment system merely sent funds directly from customer to merchant, this could create significant problems.

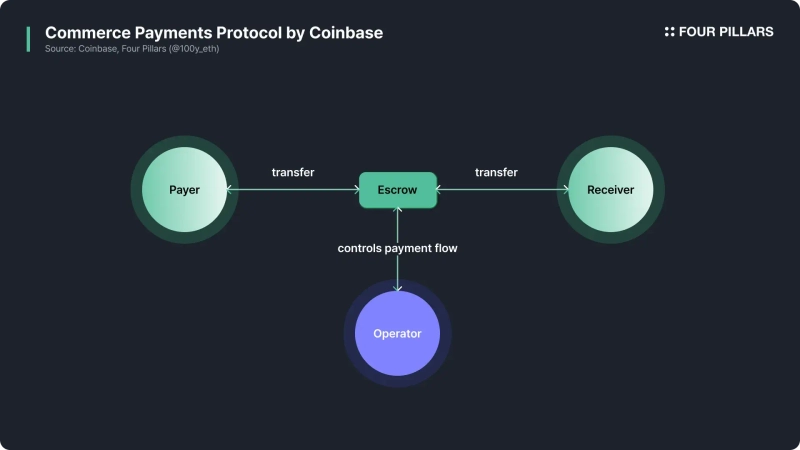

For this reason, blockchain-based stablecoin payment systems often receive criticism: since blockchain payments occur instantly and irreversibly, how can payment disputes be resolved? To address this, Coinbase introduced a new smart contract protocol for transaction dispute resolution, called Commerce Payments Protocol, and it’s now incorporated into Shopify’s USDC payment option.

The core of the Commerce Payments Protocol is to separate the traditional payment steps into authorization and capture, just like in legacy systems. The buyer’s funds are first held in escrow by a smart contract, later to be captured, decreasing risks of payment disputes or failures for both buyer and seller. Notably, while traditional payments do not require the buyer to pay transaction fees, on the blockchain, a network fee is needed for transactions—so an additional role, the Operator, is introduced to handle these fees on behalf of customers.

The Operator is a third-party address that executes the actual blockchain transactions between buyer and seller. Once the customer expresses intent and signs the payment, the Operator relays this transaction on-chain. No trust assumptions are needed for the Operator. There are three key restrictions for Operators:

- Cannot change payment intent: The Operator cannot edit the payment info (recipient, amount, token type, expiration, etc.) signed by the user. If changed, the signature’s hash changes, allowing instant fraud detection. Also, the user’s signature can be used only once, so there’s no risk of malicious reuse.

- Cannot lock funds: The Operator cannot arbitrarily transfer or seize customer funds.

- Cannot interfere with other Operators: Since anyone can be an Operator, the system ensures that malicious Operators can’t attack honest ones. To achieve this, customers include the designated Operator’s address in the signed payment info, making the payment processable by only that specific Operator, and payments managed by different Operators are held in separate escrows.

2.3.2 Types of Operation

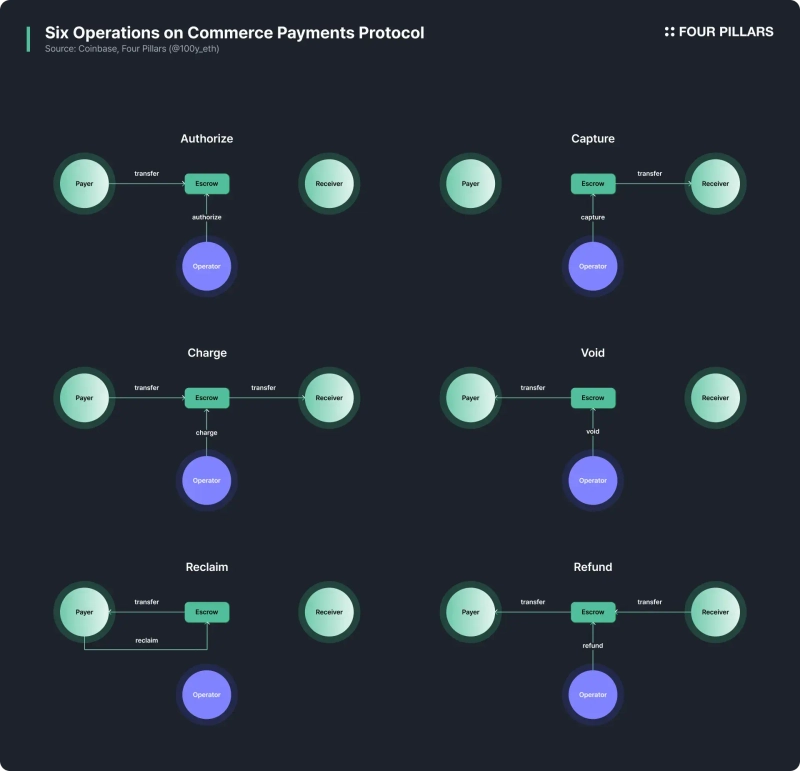

Payment processing in the Commerce Payments Protocol consists of six core operations:

Authorize

Using the ERC-3009 standard, when the buyer signs, the Operator can, via "authorize," transfer buyer funds to the escrow smart contract. Buyers don’t pay network fees here. The protocol enforces signatures be valid only within a set timeframe. With funds locked in escrow, sellers are guaranteed payment, while settlement can occur later.

Capture

The Operator uses "capture" to transfer authorized funds from the escrow smart contract to the seller, completing the payment. Notably, "capture" can be executed partially and multiple times, allowing payouts to be made incrementally based on product delivery or service milestones. "Capture" must occur before the authorized expiration.

Charge

"Charge" is an operation allowing "authorize" and "capture" to be performed in a single transaction, for cases such as micropayments or digital goods where delays aren’t necessary.

Void

If funds are authorized in escrow but not yet captured, the Operator can execute "void" to cancel the payment. Since funds haven’t been delivered to the seller, a full refund is possible. This applies in cases of system errors, duplicate orders, incorrect addresses, out-of-stock, or undeliverable items.

Reclaim

Functionally similar to "void," but unlike "void" (which the Operator executes), "reclaim" is executed directly by the buyer. If, after authorization, the Operator neither captures nor voids the payment within a certain period, once the validity period expires, the buyer can reclaim locked funds from escrow.

Refund

Even after "capture" is completed and funds delivered to the seller, the Operator can process an after-sale refund via "refund," also leveraging ERC-3009. All refund processes are subject to expiration windows—once this passes, "capture" is irrevocable and "refund" is no longer possible, preventing endless refund requests.

2.3.3 End-to-End Payment Flow

Here’s the full payment flow based on the above operations:

-

The seller asks the buyer to sign the payment info.

-

The buyer signs via a web3 wallet; the seller passes this to the Operator.

-

The Operator uses the signed data to send an "authorize" transaction.

-

Once authorization is successful, the buyer’s funds are transferred to the escrow smart contract, and the system notifies the buyer that payment is complete (although funds have not yet been delivered).

-

Later, depending on delivery, the seller can, through the Operator, execute "capture" or "void" to finalize the payment.

2.3.4 Advanced Capabilities Beyond Basic Payments

This smart contract-based Commerce Payments Protocol enables not only basic payments and refunds, but also more advanced features. If the Operator or merchant is a smart contract (not just an EOA address), the payment protocol can be further extended.

For example, with the Operator implemented as a smart contract, additional logic such as KYC, conditional approvals, payment splitting, royalty contracts, fee distribution, or approval verification can be automated. Likewise, merchants could be smart contracts themselves, allowing for automatic partner revenue sharing, token swap upon receipt, and other advanced capabilities.

3. The Foundation of Next-Generation Payment Systems: Stablecoins

The collaboration between Shopify, Coinbase, and Stripe sets a direction and blueprint for stablecoin-based payments. Their stablecoin payment system allows customers to use self-custody wallets, bypassing issuing banks, while the Base network replaces the card network to reduce fees. Further, the smart contract-based Commerce Payments Protocol enables on-chain dispute arbitration.

Similar moves are being made elsewhere. PayPal’s PYUSD is settled on PayPal’s backend but, like the above, does not go through card networks or issuing banks. USDC issuer Circle also introduced a ‘Refund Protocol’—like the Commerce Payments Protocol—enabling payment mediation via smart contracts.

Based on these examples, the future direction of payment systems seems clear: stablecoin-based payments, with only PSPs and acquirers playing a role, may be sufficient to replace current payment systems. It remains to be seen whether other fintechs will follow Shopify’s lead.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)