Editor's PiCK

Record-High Altcoin Trading Volume in Korea: Korean Crypto Weekly [INFCL Research]

Summary

- Last week, the Korean virtual asset market set a new record for altcoin trading volume, highlighting active retail participation and a strong rally in small and mid-cap tokens.

- Upbit and Bithumb saw triple-digit rallies in altcoins like XLM, PENGU, KNC, OMNI, CROSS, with retail investors showing an even clearer risk-on tendency.

- Discussions around a KRW stablecoin sandbox by the Korean government, tick size and fee adjustments by exchanges, and changing market conditions have heightened expectations and volatility in the investor community.

1. Market Overview

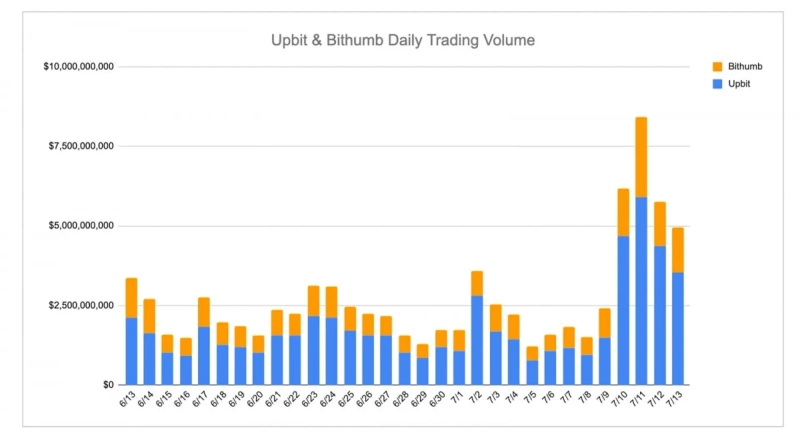

Last week, the Korean crypto market gained attention with new listings and surging retail momentum. Upbit listed Hyperlane and Ethena, while Bithumb listed Hyperlane and Resolv. Among them, Hyperlane rapidly climbed to the second spot in weekly trading volume by driving speculative interest in Upbit. The two exchanges saw trading volumes spike particularly after July 10, reaching a combined peak of nearly $9 billion on July 11. While XRP remained strong on both platforms, mid-cap tokens such as HYPER, PENGU, and BONK made significant contributions to this week's altcoin rally, indicating an increasing appetite for small caps among Korean investors.

Top gainers reflected these speculative conditions. Upbit’s XLM, PENGU, and KNC achieved gains between 70−90% alongside meme and ecosystem tokens like BONK and 1INCH. Bithumb showed a similar pattern, with OMNI and PENGU leading the rally and new tokens like INIT and KERNEL drawing attention. Upbit’s tick size reduction, soaring tokens like CROSS, M, and PENGU, and ongoing discussions around KRW stablecoins have kept domestic investor participation high. From the rise in altcoin volume to the growing conversation around stablecoin policy, Korea’s market clearly signals a renewed risk appetite.

2. Exchanges

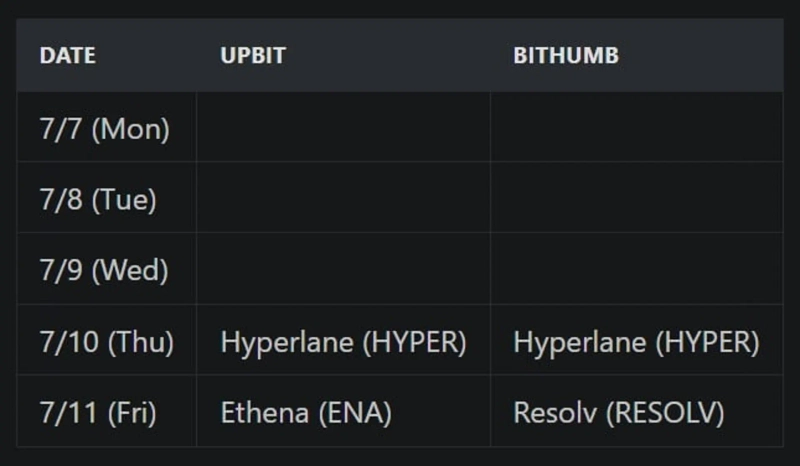

2-1. New Listings

Last week, several new tokens were listed on major Korean exchanges.

Upbit listed Hyperlane and Ethena.

Bithumb listed Hyperlane and Resolv.

Main Marketing Strategies & Key Points

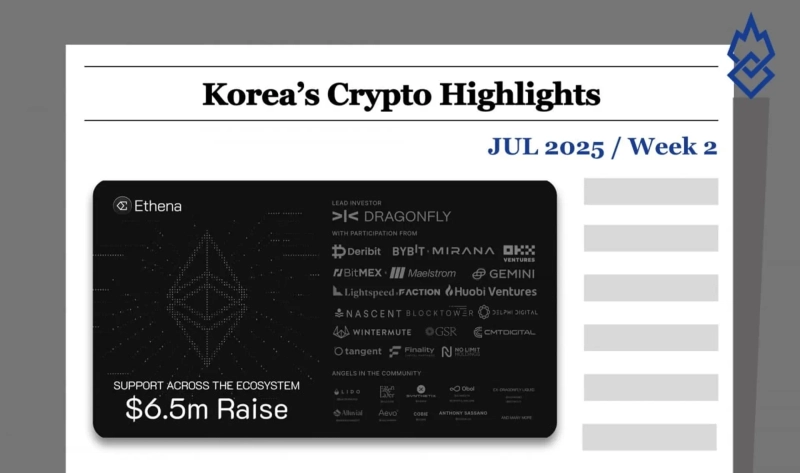

Ethena (ENA)

Ethena entered the Korean market in early 2024. There was little marketing at the time, but it drew significant attention thanks to its robust VC investors, partners, and supporters. Many users joined campaigns by staking assets in anticipation of airdrops.

Following a successful TGE, Ethena has maintained communication in Korea via KOL channels, regularly explaining the distinct nature of USDe versus other stablecoins, the utility of $ENA, and the future roadmap.

Because USDe is a yield-bearing stablecoin, Ethena has made continuous efforts to prove its stability, messaging this through KOLs as well. For example, during a Bybit hacking incident, USDe briefly showed signs of depegging, but no real losses occurred. Ethena quickly reassured users that assets were already managed with an external custody solution.

Ethena appears to have a deep understanding of Korea’s Web3 user base, especially those focused on staking and farming. This is a good example of locally tailored, efficient KOL-driven marketing.

Hyperlane (HYPER)

Hyperlane has long been a well-known project in Korea, especially for its airdrop campaign. During Korea’s widespread airdrop farming phase, Hyperlane was recognized as a project requiring users to generate on-chain transactions. Its backing by Circle Ventures also played a key role in raising early expectations.

However, Hyperlane did not engage in large-scale marketing in Korea either prior to or immediately after its TGE.

Recently, interest in the Korean market has picked up again. Domestic research institutions have published reports on Hyperlane, which KOLs are using to create content introducing Hyperlane to Korean users and sharing updates on the project.

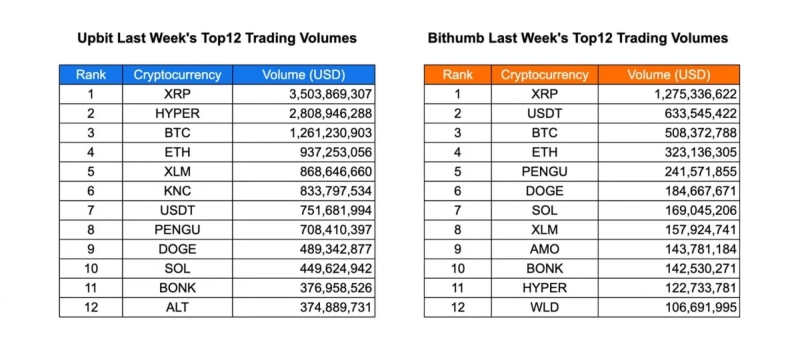

2-2. Trading Volume

Upbit and Bithumb saw a notable surge in trading volumes last week, peaking on July 11. On Upbit, XRP alone posted over $3.5 billion in weekly trading volume, followed by HYPER ($2.8 billion), BTC ($1.26 billion), and ETH ($937 million). On Bithumb, XRP topped with $1.28 billion, followed by USDT ($633 million) and BTC ($508 million). This indicates both exchanges continue to show a preference for high-liquidity tokens.

Trading activity on Upbit was marked by strong speculative momentum in mid-cap tokens like HYPER, PENGU, and BONK, each surpassing a combined $1.5 billion. Bithumb showed a relatively balanced distribution, with PENGU, AMO, and BONK in the top 10, suggesting growing user participation in altcoins outside the major market caps.

Since July 10, daily volumes have soared, with Upbit contributing the most to the record high of about $9 billion on July 11. This spike appears to coincide with broad retail inflows and heightened volatility across the altcoin sector. Overall, Upbit maintains its lead in trading volume, especially with notable activity in new and small-cap assets.

2-3. Top 10 Weekly Gainers

This week, Korean exchanges showed robust gains across mid-caps and ecosystem tokens, with both Upbit and Bithumb recording triple-digit rallies on certain assets. On Upbit, XLM surged 89.28%, leading the chart, followed by PENGU (+85.48%), KNC (+72.93%), and 1INCH (+68.82%), signaling renewed interest in Layer 1 and DEX-related tokens. HBAR, ALGO, and IOTA also gained 35–50%, reflecting broad altcoin strength.

Bithumb saw OMNI jump 98.98% and PENGU 94.32%, highlighting high market interest in speculative or meme tokens. XLM and KNC rose by 86.63% and 73.39%, respectively, indicating similar demand across both platforms. Newcomers INIT and KERNEL also ranked among the top gainers, suggesting active exploration of emerging tokens.

This week’s rally demonstrates that Korean retail investors are shifting toward high-volatility, narrative-driven investing. The overlap in popular tokens on both Upbit and Bithumb shows this momentum is not limited to any single exchange but reflects a market-wide demand for mid-cap gains and ecosystem revitalization.

3. Korean Community Buzz

3-1. Upbit's Tick Size Rollback Fuels Bullish Sentiment

Upbit announced that starting July 31, it will change the KRW market quote units, reducing the tick size in certain price ranges. The update was welcomed in the community, with many calling it a "bull market signal."

Traders, in particular, mentioned the new 5,000 KRW tier and joked that tokens like XRP and XRL would benefit if they broke above previous highs. Comments such as "Time to rocket to 5,000 KRW!" and "Even the exchange is stoking the bull run" were seen frequently. Upbit also lowered BTC withdrawal fees from 0.0008 BTC to 0.0002 BTC, further adding to the positive sentiment.

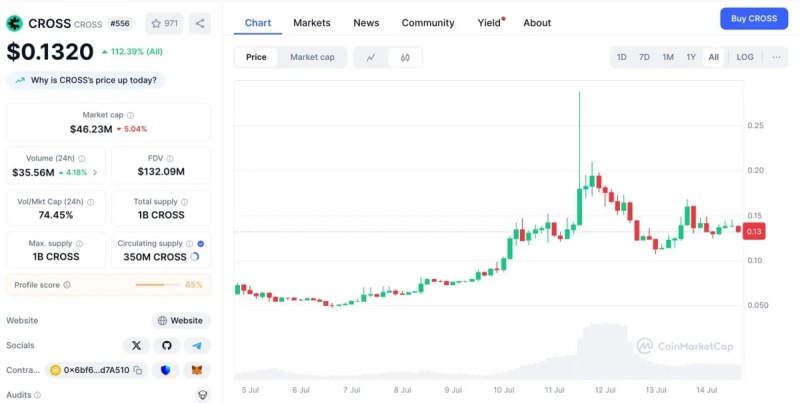

3-2. $CROSS TGE: The Community Meme of 'Everybody's Saved'

CROSS, a token backed by well-known Web3 star Jang Hyun-guk, made a surprise rebound. CROSS rebounded above its sale price and temporarily even doubled, leading to a viral community meme: "everybody's saved."

Posts such as "Should've bought the dip," "Captain Jang never disappoints," and "Everything pumps in a bull market!" appeared across the board. KOLs flooded Telegram with profit screenshots and meme charts, while traders mentioned $CROSS alongside $M and $PENGU as this week’s breakout tokens.

3-3. KRW Stablecoin Sandbox Debate Heats Up Locally

The Korean government and the Financial Supervisory Service are reportedly reviewing a KRW stablecoin sandbox program. This could include participation by banks, fintech companies, crypto exchanges, Upbit, Naver Pay, and other platforms. Some see this as means to strengthen monetary sovereignty and fintech competitiveness, while others are concerned about managing reserves and ensuring issuer transparency.

A fun moment: after the news broke, the SAND token surged 8%—not because of actual involvement, but because of its name. The community responded with jokes like "Sandbox miss, folks," and "Korean equities investors always read the market wrong."

*All information is for informational purposes only and is not intended as the basis for investment decisions or as a recommendation or advice. The information herein carries no responsibility regarding investments, legal, or tax matters.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing a one-stop service for enterprise Web3 strategy, tokenomics design, and global market entry. INFCL offers strategy and execution services to leading domestic and international securities firms, gaming companies, platforms, and global Web3 firms, contributing to the sustainable growth of the digital asset ecosystem with its accumulated expertise and references.

This report is independent of the editorial direction of the media, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)