Gravity launches on-chain P2P investment platform 'GRVT Strategies'

Summary

- Gravity announced the launch of the on-chain based P2P investment platform 'GRVT Strategies'.

- The platform utilizes smart contracts to automate the investment process and emphasizes the transparency of assets.

- A rewards program is being run for early investors, providing a 20% bonus APR and 'EcoPoints'.

The hybrid virtual asset (cryptocurrency) exchange Gravity (GRVT) announced on the 15th that it has launched an on-chain-based investment marketplace, 'GRVT Strategies'. Gravity is an exchange licensed by the Bermuda Monetary Authority (BMA), and with this platform, it is officially entering the on-chain P2P investment service sector.

'GRVT Strategies' is characterized by automating the entire investment process based on smart contracts. Every procedure, from investment deposit to profit distribution, is automatically executed according to predefined rules. Investments are carried out in real time according to conditions set by the strategy operators, without any intermediary involvement.

All investment strategies operate entirely on-chain, and investors are connected directly with the strategy operators. Without a separate custody structure, investors' assets are managed from their own wallets, and both the strategy performance and the flow of funds can be transparently checked on the blockchain.

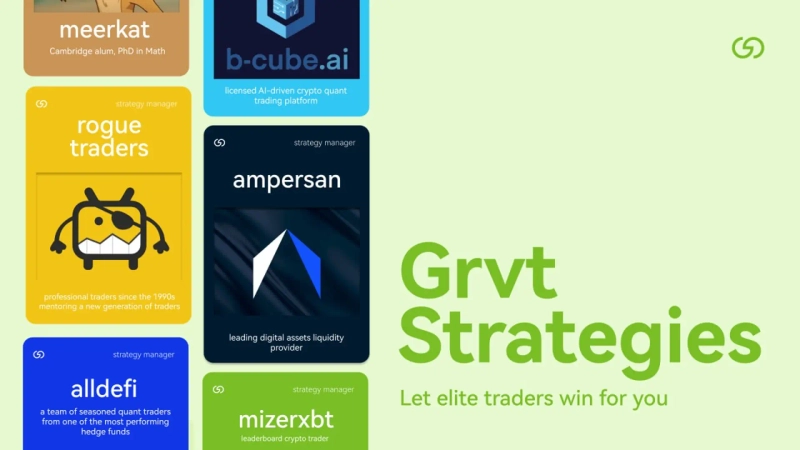

With this launch, Gravity is unveiling a total of six institutional strategies first. Participants include virtual asset liquidity provider Ampersan, AllDeFi, which operates decentralized finance (DeFi)-based strategies, b-cube ai, an AI-based quant platform, and Rogue Traders, founded by well-known hedge fund alumni. Gravity plans to introduce four additional strategies sequentially within this month and is also preparing to launch a mobile version in the fourth quarter.

A rewards program is also being operated to commemorate the launch. Early investors who use GRVT Strategies by the 29th will receive a bonus annual percentage rate (APR) of about 20% and 'EcoPoints', which can later be used for token airdrops.

Hong Yea, CEO of Gravity, said, "GRVT Strategies will serve as a starting point for the democratization of investment," adding, "We aim to create a world where anyone can manage assets as easily as sending a message or calling a car."

Daniel Ku, CEO of Ampersan, said, "We have collaborated with Gravity from the initial stage of the mainnet to jointly establish a platform equipped with liquidity and stability," and added, "This will usher in a new phase for the democratization of the investment market."

Guruprasad Venkatesha, CEO of b-cube ai, commented, "It is an ideal distribution channel to showcase a collaborative model between AI and humans to a broader group of investors," and Shane Oglow, co-founder of Rogue Traders, said, "GRVT Strategies is a model that provides a fair investment environment for both beginners and experts."

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)