Korean Won Stablecoins Find Practical Usage in Tokenized Securities [ASA Opinion #5]

Summary

- The synergy between Korean won stablecoins and tokenized securities is emerging as a key use case, with a BCG report indicating that about 3% of global stablecoin transactions in 2024 were used for tokenized security settlements.

- Given the high proportion of Korean government bonds (KTB) held by local financial institutions and their links with existing securities infrastructure, KTB tokenization represents a strategic transformation—improving practical efficiency, grounded in institutional demand.

- Coordinated introduction of tokenized securities and the three digital asset laws is an essential prerequisite for the Korean won stablecoin to function as a core asset in Korea’s digital asset market.

1. Finding Partners for Korean Won Stablecoins

A consensus has already formed in Korea regarding the necessity of a Korean won-based stablecoin. At the national level, many discussions frame the won stablecoin as indispensable for maintaining currency sovereignty in the digital age. But a more important question follows: Where and how can it actually be used? Technological experiments without real-world applications often lead to policy failures. If the won stablecoin is promoted without a clear purpose—like the metaverse once was—similar failures may repeat.

Notably, dollar-based stablecoins (such as USDC, USDT) can serve real purposes in emerging markets: hedging against inflation or providing access to dollar-denominated assets. However, as the won is not a globally accepted currency, a won-based stablecoin cannot justify its existence on its own. Thus, it must function as a ‘means’ rather than an ‘end,’ and only derives significance from concrete use cases.

So, in what areas can the won stablecoin actually be applied? Options include simple payment systems, online commerce, digital asset platforms, and cross-border payments. Among these, the most prominent current direction is synergy with financial assets—especially tokenized securities. According to a recent BCG report, out of the total $26.1 trillion stablecoin transaction amount in 2024, about $800 billion (3%) was used for payments for tokenized securities. This accounts for the largest share among actual use cases outside of crypto trading (88%) and on/off ramping (4%), demonstrating that stablecoins are beginning to serve a tangible role as the distribution and settlement infrastructure for security-type assets.

This data suggests that the 'won stablecoin - tokenized securities' combination is not just an idea, but a structure being validated in the global market, supporting the possibility that it could become a major use case within Korea's financial system as well.

2. Is Tokenization of Korean Government Bonds (KTB) Attractive?

Currently, the most spotlighted asset in the tokenization market is the U.S. Treasury (UST). Various cases have already been introduced—such as BlackRock’s BUIDL and Franklin Templeton’s BENJI—drawing significant attention as stable, income-generating assets operable on-chain. Can a ‘won stablecoin - KTB token’ structure be as attractive as the ‘dollar stablecoin - U.S. Treasury token’ structure?

The main demand for U.S. Treasury tokens is divided into two groups: traditional financial institutions who want exposure to Treasuries, and retail investors interested in on-chain finance. In the case of KTBs, global investor interest is likely limited, so the latter group is relatively small. However, the former, that is, domestic institutional investors that actually need KTBs, clearly exists.

For example, Korean banks and insurers hold large amounts of KTBs as high-quality liquid assets (HQLA) to meet Basel III requirements. Brokerages also use KTBs as collateral for RP, futures, and options trades. In this way, KTBs already play a core role as collateral assets in Korea’s financial system. The real question now is: Can tokenization make this structure more efficient?

2.1 DTCC x Digital Asset’s UST Collateral Management Pilot

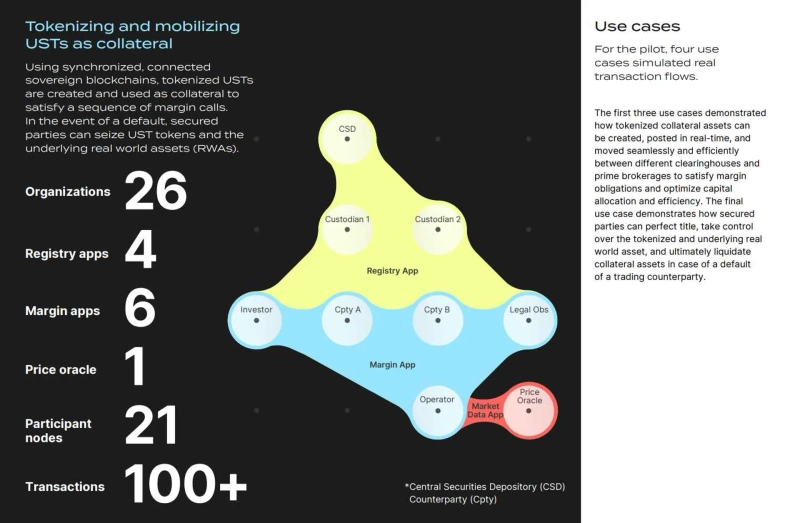

The answer can be found in the U.S. DTCC and Digital Asset’s UST tokenization pilot. In this pilot, a total of 26 banks, investors, CCPs, custodians, and other participants demonstrated that tokenized UST could bring real improvements as collateral throughout the entire margin trading cycle.

The main tested features in the pilot were as follows:

Tokenized Asset Creation: Investors request the creation of tokenized assets based on their UST holdings. The custodian segregates actual UST in line with DTCC balances.

Collateral Submission: When the CCP or prime broker issues a margin call, investors select the UST token as collateral; tokenized UST is pledged in real time.

Collateral Withdrawal: When investors request margin return, the tokens are immediately unlocked, making them liquid or available as collateral for other trades. This dramatically improves cash turnover compared to traditional T+1 or T+2 cycles.

Default Liquidation: A scenario was tested where collateral was legally seized in a hypothetical default; procedures followed master agreements (ISDA etc.), with smart contracts automatically transferring ownership.

2.2 Implications for KTBs

This experiment demonstrates that tokenization is not simply about digitizing government bonds, but also a fundamental redesign of margin trading, collateral management, repo structures, and other capital market operations.

In particular, KTBs are already widely utilized as core collateral assets by Korean financial institutions. Banks and insurers hold government bonds en masse as HQLA to meet Basel III Liquidity Coverage Ratio (LCR) requirements, while brokerages use them as collateral for RP (repurchase agreements), futures/options margins, and securities lending transactions.

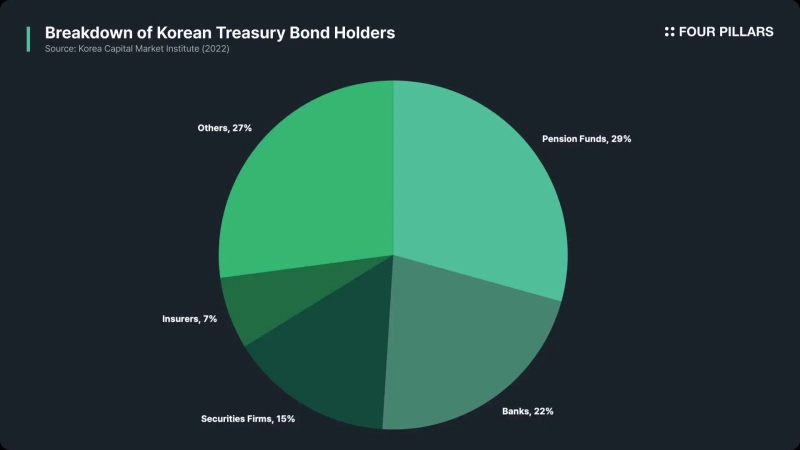

As of 2022, pension funds held 29.3% of all outstanding government bonds, banks 21.7%, brokerages 15.2%, and insurers 6.7%. Collectively, this accounts for about 77% of total holdings—showing that KTBs are not just investment products but operational assets sustained by institutional demand.

If KTBs are tokenized within this structure, technical efficiency is added to an already actively utilized market framework. For example, in the Bank of Korea’s RP transaction system, brokerages’ margin management, and institutional collateral exchange, automation of collateral registration and release, 24-hour usage, real-time withdrawal and reuse, as well as liquidation via smart contracts all become feasible. This is a strategic transformation backed by institutional demand, not simply a technical experiment.

3. If Not Bonds, What Else?

Apart from KTBs, what other securities are attractive for tokenization? I believe the fundamental value of tokenization lies in making illiquid securities liquid.

With this perspective, unlisted (private) stocks or private equity funds are promising targets. Each has different advantages. Private shares are perhaps the number one target, as evidenced by Robinhood’s recent announcement that it plans to support European investors in trading private shares of companies such as OpenAI and SpaceX. Regarding private funds, which typically require subscription amounts of at least several hundred million KRW and disallow redemptions before maturity, tokenization could address much of their illiquidity.

Examples of tokenized alternatives beyond bonds include Apollo’s Apollo Diversified Credit Securitize Fund (ACRED) and Blockchain Capital’s Blockchain Capital III Digital Liquid Venture Fund (BCAP), both available on the leading platform Securitize. These two products, representing private credit and venture capital, respectively, are the largest in their categories on the Securitize platform.

3.1 Apollo’s ACRED

The Apollo Diversified Credit Securitize Fund (ACRED) is a multi-strategy private credit fund managed by global alternative asset manager Apollo and tokenized through Securitize. The fund is registered under U.S. securities Regulation D, available to accredited U.S. investors, and legally incorporated in the British Virgin Islands.

ACRED invests across five pillars: senior corporate loans, asset-backed loans, highly liquid quality bonds, temporarily mispriced assets, and structured debt (CLOs, RMBS, CMBS, etc.), targeting stable income and capital gains through diversified credit positions.

The minimum investment is $50,000, and it is issued in ERC-20 or native token forms on Ethereum, Solana, Aptos, Avalanche, and other public blockchains. As of its January 2025 launch, AUM stands at about $98 million, NAV at $1,036, annual management fee at 2%, and no performance fee.

3.2 Blockchain Capital's BCAP

Blockchain Capital III Digital Liquid Venture Fund (BCAP) is the world's first tokenized venture fund, launched in 2017 by the blockchain-specialized VC Blockchain Capital. Issued through Singapore-based TokenHub, the fund operates under the U.S. Regulation D private fund framework, with legal dispute jurisdiction in the Cayman Islands.

BCAP invests in major blockchain companies such as Coinbase, Circle, Kraken, Securitize, OpenSea, and Ripple, as well as assets like Filecoin, Bitcoin, and Ethereum. Its strategy spans early and growth-stage ventures using a variety of asset formats such as SAFEs, SAFTs, private equity, and convertible notes.

The minimum investment is $20,000, with tokens currently circulating as ERC-20 on zkSync Era. As of June 2025, total assets are valued at about $148 million, NAV at $16.29, management fee at 2.5% per year, and performance fee at 25%. Profits are calculated annually as carried interest, with some profits potentially reserved for reinvestment.

4. Infrastructure for Tokenized Securities

Successful implementation of tokenized securities requires suitable blockchain infrastructure. Various players are currently competing in this space.

Ethereum and other EVM family chains, for example, face structural constraints handling tokenized securities. These require mechanisms to determine whether investors can trade based on KYC, nationality, and eligibility. To address this, many projects use specialized tokenization platforms like Securitize, which controls token movement via its own DS Protocol based on investor qualification data, servicing major issuers such as BlackRock, Apollo, and VanEck.

Stellar, on the other hand, natively supports functions like this at the protocol level. For instance, Franklin Templeton’s BENJI has its largest issuance on Stellar, thanks to Stellar’s trust-line feature. This allows specifying in advance which addresses are authorized to hold certain assets, effectively enforcing investor restrictions. Ripple has a similar structure, making it often mentioned in discussions about real-world asset (RWA) tokenization.

Another axis is private chain-based infrastructure. A prime example is the Canton Network, which uses the Daml smart contract language and provides privacy—transactions visible only to direct participants. The previously mentioned U.S. Treasury experiment was also conducted on Canton, and traditional financial institutions like Circle, Hashnote, and Broadridge are testing on it.

In my view, the most critical points for tokenized securities infrastructure are:

Built-in RBAC (role-based access control)

Connectivity with fund back-office systems (e.g., accounting, trade matching, compliance systems)

A balance between public chain openness and private chain controllability

Delta Network, for example, aims to meet these points through a two-tier system of global asset ledgers and private domains.

5. The Importance of the Three Digital Asset Laws

Tokenized securities are not just the next step for stablecoins, but can also be a key practical use case for the won stablecoin. In the U.S., traditional financial institutions are already tokenizing assets such as Treasuries, private funds, and real estate to build a new financial infrastructure.

If Korea is considering issuing a won-based stablecoin, it should also consider Security Token Offerings (STO) in tandem. As mentioned in the interview with Min Byung-deok, the National Assembly member who authored the Digital Asset Basic Act, it would be ideal from a regulatory perspective to organically design and pursue the so-called “three digital asset laws”—the Digital Asset Basic Act, STO regulations, and virtual asset ETFs. Only with such an integrated approach can the won stablecoin truly function as the central asset of Korea’s digital asset market.

*The Asia Stablecoin Alliance was launched by Hee-chang Kang and Jin-sol Bok of Populus, along with Alex Lim (Jong-kyu Lim), the representative of LayerZero Korea. Its mission is to promote stablecoin adoption across Asia, build a clear regulatory environment, and develop robust tech infrastructure through a research and exchange platform.

The opinions contributed by outside writers may not reflect the editorial direction of this publication.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)