"Up over 150% just in July"...Bonk (BONK) outperformed Doge and Shiba

Summary

- The meme coin Bonk (BONK) surged over 150% just in July, outperforming Dogecoin and Shiba Inu.

- Bonk's strong performance is attributed to the expanding market share and unique fee system of its dedicated Solana (SOL)-based launchpad, Let's Bonk Fund.

- Increased platform activity and buyback and burn measures by Let's Bonk Fund continue to reduce Bonk's supply and push its price up.

Is Bonk the Star of This Altcoin Season?

Outperformed Doge and Shiba Inu in July Gains

Bonk Scarcity Increased with 'Let's Bonk Fund'

The price of the meme coin Bonk (BONK) has soared over 160% this month. Analysts attribute the uptrend to the dedicated launchpad ‘Let's Bonk Fund.’

As of 2 p.m. on the 21st, Bonk is trading at 0.0463 KRW on the Upbit KRW market, up 3.28% from the previous day. This reflects a rise of 150% over the past two weeks.

The increase stands out even compared to other well-known meme coins. During the same period, meme coin market cap leaders Dogecoin (DOGE) and Shiba Inu (SHIB) rose only 71% and 38%, respectively.

Some anticipate that Bonk could become a major player if an altcoin season arrives—a market rally where major cryptocurrencies other than Bitcoin rise collectively.

The Force Behind the Surge: 'Let's Bonk Fund'

Let's Bonk Fund, launched in April, is a Solana-based meme coin launchpad (a platform for creating crypto assets). Right after its launch, it showed explosive growth and overtook Pump Fund (PUMP) at the beginning of this month to claim the No. 1 market share among meme coin launchpads. According to blockchain analytics platform Dune Analytics, as of the 21st, Let's Bonk Fund holds about 66% market share, maintaining its leading position.

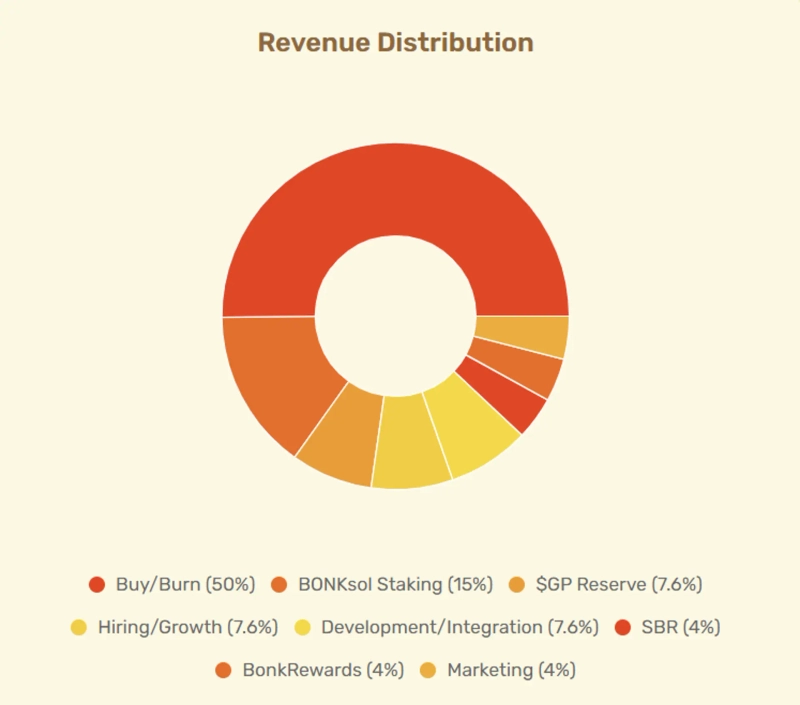

The popularity of Let's Bonk Fund positively impacts Bonk's price thanks to its unique fee system. Let's Bonk Fund charges a 1% fee in Solana (SOL) for all transactions on its platform. Half of this fee (50%) is used to buy back and burn Bonk tokens. As platform activity increases, Bonk's supply shrinks, further fueling price pressure upwards.

The amount spent on Bonk buybacks and burns is already nearing ₩20 billion. According to the industry, since its launch in April, Let's Bonk Fund has generated about ₩38 billion in fee income, with ₩19 billion—half of it—used for Bonk buybacks and burns.

Hands-on with Let's Bonk Fund

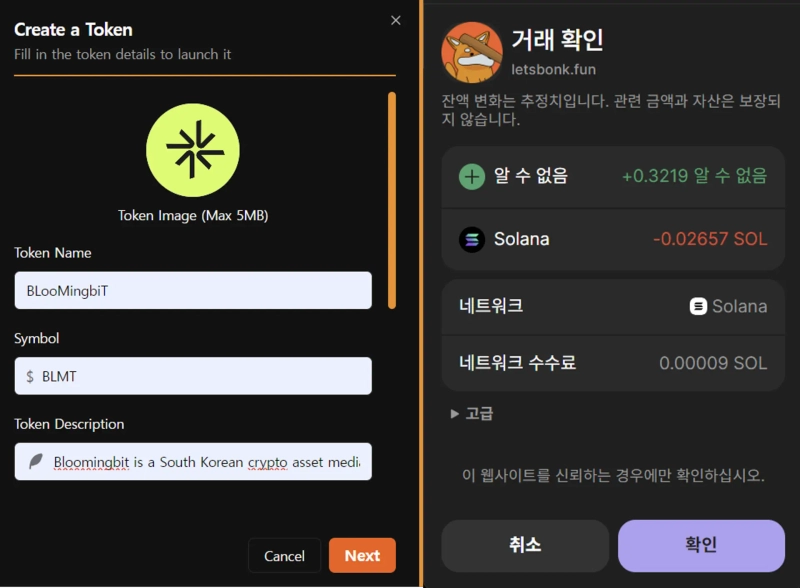

I decided to try using Let's Bonk Fund firsthand. The process was the same as other token launchpads. After connecting the Solana-based Phantom wallet to Let's Bonk Fund, I paid a creation fee of around ₩5,000, including the platform fee. Entering basic information like the coin name, image, and ticker, token creation completed easily.

However, the BloomingBit (BLMT) token I created did not ‘graduate'—industry slang meaning listing on a decentralized exchange (DEX) after launchpad creation. This was due to a lack of community interest. To graduate, new tokens typically need active promotion on social media (SNS) or an initial liquidity supply to encourage community participation.

Currently, in order for a meme coin created via Let's Bonk Fund to be listed on a DEX, it must reach a minimum market cap of $70,000. Coins such as Useless (USELESS), Hoshiko Cat (HOSICO), and Let's Bonk (LETSBONK) are among those from Let's Bonk Fund that have achieved this market cap milestone.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.