Editor's PiCK

Major Altcoins Showing Steady Bullish Trends: Korean Crypto Weekly [INFCL Research]

Summary

- Upbit and Bithumb reported continued dominance and high liquidity for major assets such as XRP, DOGE, BTC, and ETH.

- Bithumb in particular saw notable strength among altcoins such as CFX, ELX, XTZ, and CKB, including some with triple-digit gains.

- In the Korean market, retail investors are focusing on ecosystem tokens and volatile plays, although overall liquidity is still centered on major assets.

1. Market Overview

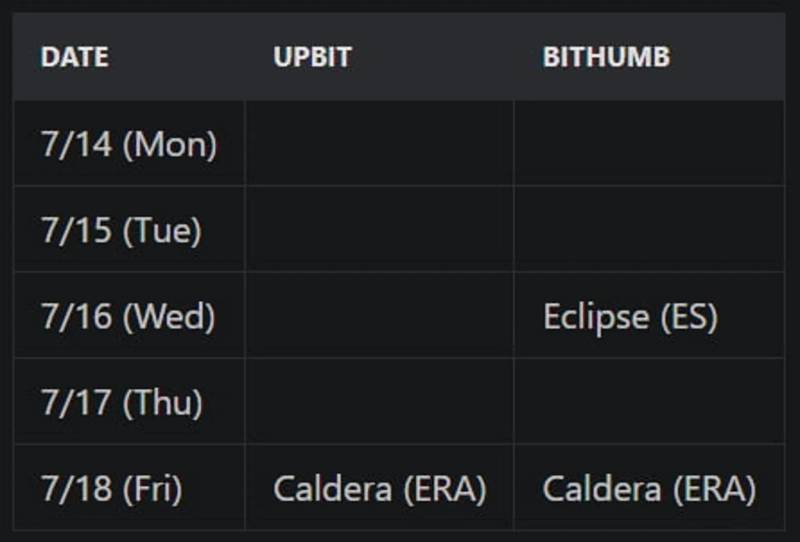

Last week, Korean exchanges continued their active operations with a series of new listings. Upbit introduced Caldera (ERA), while Bithumb listed both Caldera and Eclipse (ES), continuing the trend of adding leading ecosystem projects. These listings attracted moderate interest, especially from users participating in altcoin rotations.

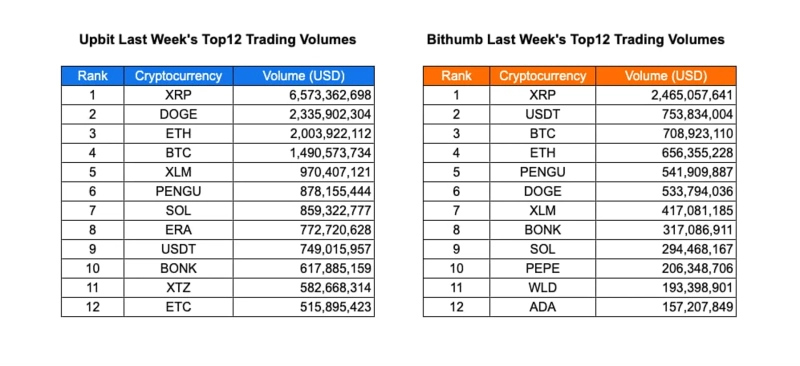

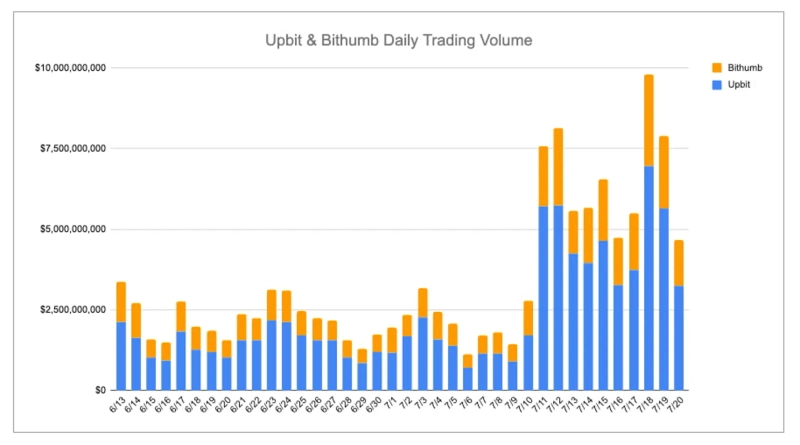

In terms of trading activity, both exchanges maintained the dominance of top KRW pairs. XRP and Dogecoin (DOGE) led Upbit's weekly trading volumes, each surpassing trillions of KRW alongside the ongoing liquidity of Bitcoin (BTC) and ETH. Bithumb reflected a similar trend, with XRP and USDT ranking at the top thanks to steady trading turnover in BTC, Ethereum, and a number of altcoins. Despite increased discussions around altcoins, overall market liquidity remained concentrated on major assets.

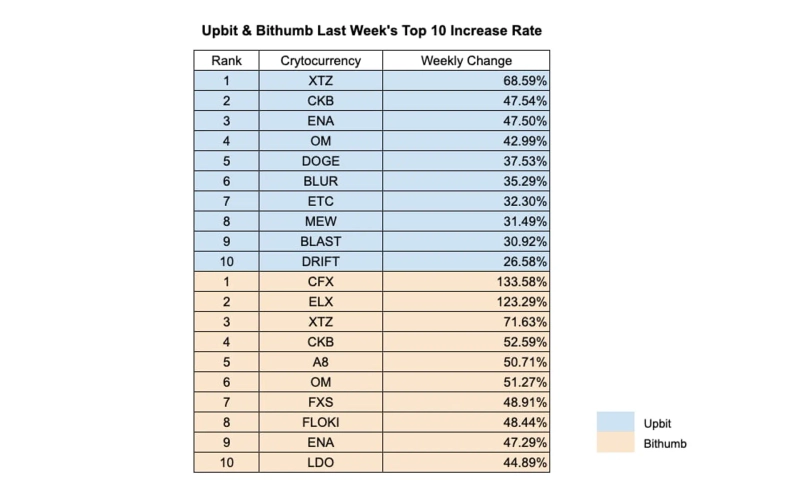

This week was also marked by dramatic movements of speculative tokens. Conflux (CFX) and Elixir (ELX) recorded triple-digit growth rates on Bithumb, and XTZ, CKB, and A8 also showed notable upward momentum. Mid-cap narratives such as OM, FXS, and Floki demonstrated strong momentum as well. The wide distribution of top gainers suggests retail traders are actively mixing ecosystem tokens with high-volatility plays.

2. Exchanges

2-1. Newly Listed Coins

Last week saw several new listings on major Korean exchanges.

Upbit listed Caldera.

Bithumb listed both Caldera and Eclipse.

Key Marketing Strategies and Implications

Eclipse (ES)

Eclipse had previously announced a seed round, but its official entry into the Korean market occurred in March 2024, at a time when interest in SVM was high and Hack VC—a favorite among Korean investors—led the round.* Hack VC's popularity in Korea stems from its high exchange listing success rate for portfolio projects and the frequent promotion of these projects through the WeCryptoTogether channel, further boosting its favorability.

Riding this momentum, Eclipse launched its mainnet and began the issuance of its flagship NFT collection, ASC (After School Club). Leveraging the heightened attention, Eclipse promoted ASC through KOL channels and achieved a complete sellout in a short period.

Not long after, the Eclipse team set ASC NFTs as profile pictures to heighten community anticipation for the airdrop exclusive to $ES token holders. This strategy was further amplified by various KOLs.

The initial price of ASC NFTs, set at 0.04 ETH, soared to over 0.7 ETH, cementing the excitement. As part of its airdrop strategy, ASC immediately launched the "Turbo Tap" game.

By utilizing NFTs to build a strong community and retaining users through regular airdrops, Eclipse maintained engagement. The community was also supported through consistent AMAs and offline meetups.

One of the most impactful strategies was Eclipse's participation in the rising "meetup airdrop meta" in Korea. In this trend, projects distributed a significant amount of tokens to offline meetup attendees—turning Seoul into the epicenter of such campaigns.

Prior to its TGE, Eclipse held a large-scale offline event, rewarding every attendee with 2,551 ES tokens. However, this approach sparked even stronger backlash than similar campaigns, as many in the community felt the amount airdropped to meetup attendees was disproportionately larger than what was allocated to early ASC holders or those actively participating in previous airdrop activities. As a result, the project still faces significant criticism to this day. * The Eclipse meetup was scheduled to start at 7 PM, but some people arrived at the venue as early as eight hours in advance to get in line. This illustrates just how intense the "meetup airdrop meta" was in Korea during Q2 and Q3 of 2025. The summer weather was hot, and the passion even hotter.

Nevertheless, Eclipse's marketing approach in Korea can be seen as emblematic. By focusing on KOL-driven promotions and consistently sharing updates on NFT minting and airdrop campaigns, Eclipse managed to maintain continuous interest and attract strong attention from the Korean market.

2-2. Trading Volume

This week's trading volume data from Upbit and Bithumb showed the continued dominance of major KRW pairs, with both exchanges recording steady volumes concentrated on the top tokens. On Upbit, XRP and DOGE both topped weekly trading volume, each breaking the trillion KRW mark and demonstrating sustained investor interest in core assets. Especially, tokens like ETH and BTC also posted high trading volumes, confirming ongoing liquidity and market relevance. Bithumb data likewise highlighted high volumes for XRP and USDT, along with leading altcoins such as BTC and ETH, significantly contributing to weekly trading activity. Overall, these volume trends demonstrate not only the market's stable preference for established tokens but also the liquidity provided across diverse assets in Korea’s crypto market.

2-3. Top 10 Gainers

This week, the KRW market was driven by both established and emerging altcoins, with Bithumb in particular showing impressive surges. Conflux (CFX) took the lead with a remarkable 133.58% spike, while Elixir (ELX) followed closely with a 123.29% increase, demonstrating strong speculative interest. Tezos (XTZ) and Nervos (CKB) continued gains of over 50%, and projects like Ancient8 (A8) and Mantle (OM) also posted robust performances exceeding 50%. Tokens such as Frax Share (FXS) and Floki (FLOKI) further emphasized the market's interest in mid-cap and narrative-based assets. This broad-based strength among Bithumb's top gainers reflects the persistent bullish sentiment of Korean retail investors, with many shifting their attention to tokens that offer both ecosystem potential and volatility.

3-1. Bitcoin Inspires Hope for Altcoins in Korea

On July 10, Bitcoin hit an all-time high in KRW terms, uplifting the Korean crypto community. ETH also showed strength, and local media suggested that this momentum might spill over into altcoins, further fueling trading activity.

Nevertheless, community sentiment remained cautious. Many traders pointed out that this is no longer a market where "everything skyrockets," with most preferring to concentrate on Bitcoin and major altcoins over small-caps.

3-2. A Busy Meetup Week with Mixed Reactions

Key projects such as Mira, Sonic Labs, and GAIB held offline meetups last week, further energizing Korea's meetup culture. Mira received positive feedback for its summer ice cream giveaway, and GAIB drew long lines despite rainy weather. However, Sonic Labs faced criticism after a video circulated of excessive merch giveaways.

While demand for meetups remains high, community discussion about the quality of these events is ramping up. Some meetups are becoming increasingly monotonous, with participants hoping projects will offer more substantial content beyond just freebies.

3-3. Community Debate on the Future of Meetups

With the recent boom in large-scale meetups, more Korean users are questioning whether these events create true value. Many noted that meetups often focus more on food than actual project introductions.

Additionally, there were discussions about more meaningful contributions such as scholarships, local hiring, and hackathons, instead of short-term airdrops. There is growing sentiment that projects need to build long-term relationships with Korean users.

*All content is provided for informational and reference purposes and is not intended as investment advice or a recommendation to invest. The information provided herein will not be liable for any aspect of investment, legal, or tax matters.

INF Crypto Lab (INFCL) is a consulting firm specializing in blockchain and Web3, providing one-stop solutions for Web3 entry strategies, tokenomics design, and global expansion. It offers strategy formulation and execution services to major domestic and international securities firms, game companies, platforms, and global Web3 companies, leveraging accumulated expertise and references to drive sustainable growth in the digital asset ecosystem.

This report is unrelated to the editorial direction of the media outlet, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)