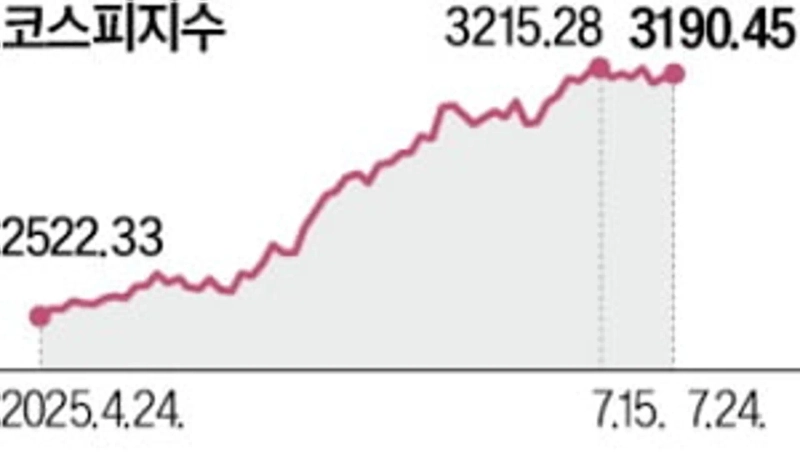

KOSPI Surpassed Its High... Returns to Previous Level Amid Postponement of Trade Talks

Summary

- The KOSPI index set a new high in early trading due to expectations around Korea-US tariff negotiations, but gave up most gains following news of a postponement in the talks.

- While foreign investors and institutions net bought ₩741.5 billion and ₩128.9 billion, respectively, individual investors net sold ₩951.1 billion worth of shares, realizing profits.

- Secondary battery, biotech stocks, and SK Hynix performed strongly due to favorable earnings and a patent lawsuit victory.

After Opening, Soared to 3237

Closed at 3190 as Korea-US Talks Were Delayed

Foreign Investors and Institutions Net Bought ₩870 Billion

Retail Investors Realized ₩950 Billion in Profits

The domestic stock market experienced significant fluctuations ahead of tariff negotiations with the United States. The KOSPI index set a new annual high early in the session on expectations of improved corporate earnings and progress in Korea-US tariff negotiations, but gave up most of its gains following unexpected news of a postponement in the talks.

On the 24th, the KOSPI finished trading up 0.21% at 3,190.45. Right after the market opened, the KOSPI climbed as high as 3,237.97, surpassing the annual peak (3,220.27) recorded on the 22nd. Before opening, blue chips such as SK Hynix announced robust Q2 results, and there was hope that Korea-US tariff negotiations could yield a better outcome than feared, as was the case with Japan, boosting the index.

However, when news broke that the Korea-US trade consultations scheduled for the 25th had been suddenly postponed, the gains quickly faded. Foreign investors, who had built up long positions in KOSPI200 futures since morning, also switched to net selling. Car stocks, which had hoped for tariff adjustments similar to Japan's (25%→12.5%) on the 22nd, suffered considerable declines. Hyundai Motor dropped 2.03% and Kia fell 1.04%.

Kyung-Min Lee, a researcher at Daishin Securities, explained, "As expectations for smooth tariff negotiations were dashed, investors rushed to realize profits." Individual investors net sold ₩951.1 billion worth of shares on the main stock market, expressing their disappointment. Foreign investors net bought ₩741.5 billion, and institutions net bought ₩128.9 billion.

Foreign investors net bought ₩107 billion worth of SK Hynix, which announced its highest-ever quarterly performance. SK Hynix achieved over ₩9 trillion in operating profit in the second quarter. The stock, which at one point had risen as much as 3.7%, closed up 0.19% at ₩269,500.

By industry, secondary battery and biotech-related stocks showed notable strength. LG Energy Solution soared 9.36% to close at ₩368,000. This was attributed to news of winning a battery structure patent lawsuit against Chinese battery maker Sunwoda. Recent increases in lithium carbonate futures prices, due to limited lithium production in China, also had a positive impact on secondary battery stocks. Samsung Biologics, which announced strong Q2 earnings the previous day, rose 2.26%. Semiconductor-related stocks also performed well following Alphabet Inc.'s announcement of increased capital expenditure plans.

Jae-Won Lee, a researcher at Shinhan Investment Corp., said, "For share prices to rise further, it is necessary to confirm whether tariff negotiations with the US can be finalized at the same tariff level imposed on Japan."

Reporter Seong-Mi Sim smshim@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.