BlackRock Ethereum ETF surpasses $10 billion in total assets under management... Third fastest in history

Summary

- BlackRock's spot Ethereum ETF (ETHA) has surpassed $10 billion in assets under management.

- ETHA has seen nearly a twofold surge in the past 10 days, reflecting active inflows.

- Decrypt reported that policy changes such as the GENIUS Act are expected to positively affect Ethereum and related ETFs.

The assets under management (AUM) of BlackRock's spot Ethereum (ETH) exchange-traded fund (ETF) product, ETHA, have surpassed $10 billion.

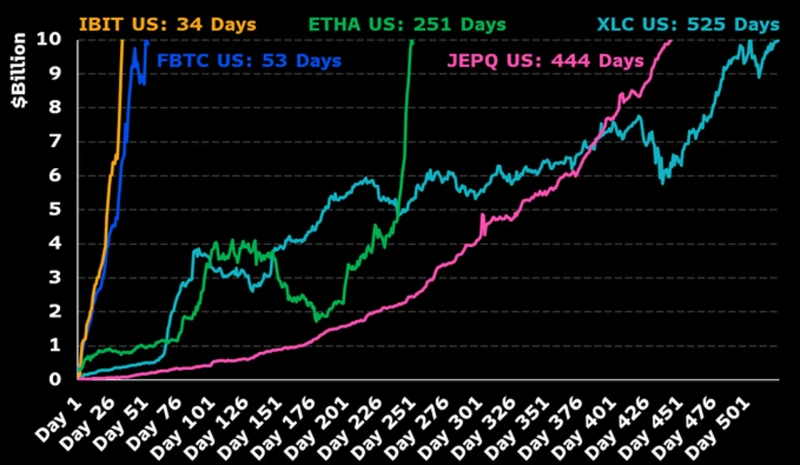

According to Decrypt, a virtual asset-focused media outlet, on the 24th (local time), ETHA's AUM reached $10 billion that day. This is the third fastest pace among all ETFs in history.

The only ETFs that reached $10 billion in AUM faster than ETHA are BlackRock’s spot Bitcoin (BTC) ETF, IBIT, and Fidelity’s spot Bitcoin ETF, FBTC.

Notably, ETHA's AUM has nearly doubled in just the past 10 days along with the upward trend of its underlying asset, Ethereum. Eric Balchunas, a Bloomberg ETF analyst, analyzed, “In the past 10 days, ETHA's AUM increased by $5 billion,” adding, “This is thanks to Ethereum's rally and active capital inflows.”

Decrypt commented that “While spot Ethereum ETFs previously attracted little attention compared to Bitcoin spot ETFs, they are now receiving significant interest due to digital asset promotion policies by the Trump administration.” It further added, “In particular, the recently passed GENIUS Act is expected to have a positive impact on Ethereum, a major platform for stablecoins.”

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.