Summary

- It was reported that $4 billion flowed into the stablecoin market in just one week.

- With the enactment of the Genius Act resolving regulatory uncertainty, issuance of stablecoins by institutions such as banks and asset management firms has become more active.

- It was reported that traditional financial institutions—including Bank of America, JPMorgan, and Citibank—are now actively preparing to enter the stablecoin market.

It was revealed that $4 billion flowed into the stablecoin market in just one week.

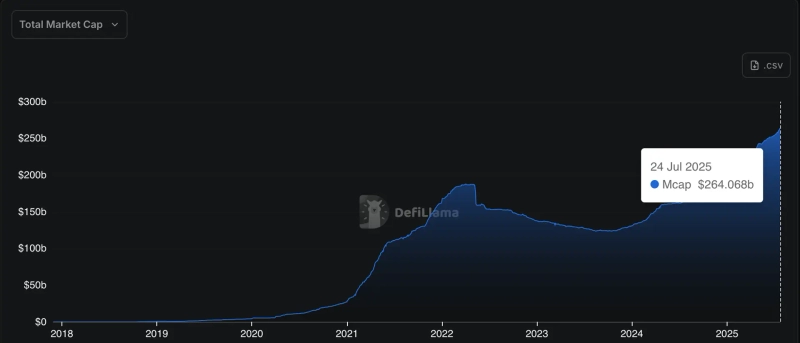

On the 25th (Korea Standard Time), cryptocurrency-focused media outlet Cointelegraph cited data from DeFiLlama, reporting that the stablecoin market cap had reached close to $264 billion as of that day, with $4 billion having flowed in over the past week.

This sharp increase in the stablecoin market is attributed to the enactment of the Genius Act. As regulatory uncertainty was resolved, a safe environment has been created for various institutions—such as banks, asset management firms, and crypto companies—to issue stablecoins. In particular, the risk of actions taken by the U.S. Securities and Exchange Commission (SEC) has been reduced, prompting more participation from traditional financial players.

Anchorage Digital, a federally chartered crypto bank, partnered with Athenalabs to begin the issuance of USDtb. Asset management firm WisdomTree also entered the market by launching USDW for dividend tokenization.

Banks are joining as well. Bank of America is considering issuing stablecoins following regulatory reforms, and both JPMorgan and Citibank are preparing to launch their own stablecoins.

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.