$ENA: Can It Be Circle’s Catch-up Trade? [Four Pillars Research]

Summary

- StablecoinX is incorporating $ENA as a strategic asset, becoming the first Nasdaq-listed company to trigger a potential supply shock.

- $ENA is projected to see about 10% of its circulating supply stored in the public company’s treasury through a $260 million cash purchase and the addition of approximately $60 million worth of locked ENA.

- With Korean investors’ CRCL rally experience and simultaneous Upbit listing, Korea is highly likely to emerge as the early hub of demand for $ENA.

With the entry into the stablecoin supercycle imminent, Ethena is emerging as the next high-beta trade. Ethena has already secured a firm position in the crypto industry, but it may be a relatively unfamiliar name for stock investors. This article reviews the structure of the upcoming SPAC merger and analyzes whether Ethena can establish itself as a key player in the forthcoming stablecoin cycle.

1. SPAC Merger Overview

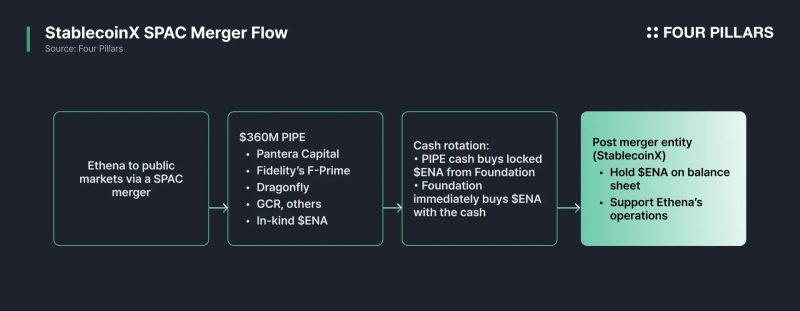

TLGY Acquisition Corp., a special purpose acquisition company, will merge with Ethena Infrastructure Inc., changing its name to StablecoinX upon closing, and plans to list on Nasdaq under the ticker symbol "USDE." This deal will raise approximately $360 million in a single tranche, with about $260 million in cash from investors such as Pantera Capital, ParaFi, and Dragonfly, and the remaining approximately $60 million contributed by the Ethena Foundation in the form of ENA tokens as an in-kind investment.

After signing, the cash portion is immediately used to purchase locked ENA held by the Foundation, and the Foundation will reinvest the full sale proceeds into open market purchases of $ENA. The acquired tokens will be classified as permanent assets on StablecoinX's balance sheet, thereby excluded from circulating supply.

At the same time, StablecoinX plans to secure and operate core infrastructure such as validator nodes to support the Ethena ecosystem. As a result, the company will function as a listed entity holding a large $ENA treasury and as a network operating partner, acting as a publicly traded Ethena proxy for investors.

2. Circle’s High-Beta Trade

Stablecoin investments have been accelerating sharply. Circle Internet (ticker: CRCL) saw its stock jump about sevenfold within 18 trading days of its early June IPO, with its market cap briefly reaching $77 billion—momentarily surpassing the total USDC in circulation. With Tether Holdings, a key competitor, remaining private, investors are searching for the next stablecoin play.

This is where Ethena draws attention. The outstanding supply of Ethena’s stablecoin USDe has reached around $6 billion, ranking third among dollar stablecoins after USDT and USDC, and it has been the fastest-growing dollar-based asset over the past year. For reference, BlackRock-backed, US Treasury-collateralized stablecoin USDtb also expanded to $1.46 billion, demonstrating strong institutional demand.

In this environment, $ENA is highlighted as a high-beta means of exposure to the stablecoin theme. If CRCL represents an equity-collateral beta asset linked to USDC reserves under regulatory frameworks, $ENA offers even higher scalability and leverage via its delta-neutral synthetic dollar structure—explaining why market attention could naturally shift to $ENA after the CRCL rally.

3. Supply Shock

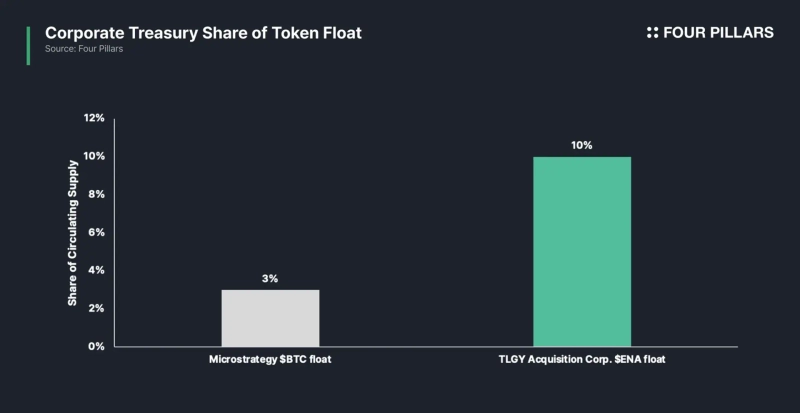

Approximately $260 million in cash will be used to purchase $ENA on the spot market immediately after signing. At the July 22 price of about $0.54 per token, that equates to roughly 480 million $ENA, about 7% of the circulating supply. Adding the Foundation’s locked ENA worth approximately $60 million (about 110 million tokens), StablecoinX’s initial treasury will hold a total of roughly 670 million tokens, or about 10% of supply. Unlike typical token burns or market-maker inventory, these $ENA are locked as permanent assets of a public company and cannot be traded.

With $ENA on the balance sheet of a Nasdaq-listed company, its holdings will be disclosed in quarterly reports and appear in figures on traditional outlets like Bloomberg and ETF screeners. Over time, $ENA could be included in indices or developed into structured products like 3x leveraged ETFs. In summary, each share of USDE stock is structured to confer rights over the $ENA treasury; even those who do not hold tokens directly effectively contribute to increased demand.

4. K-Market Flywheel

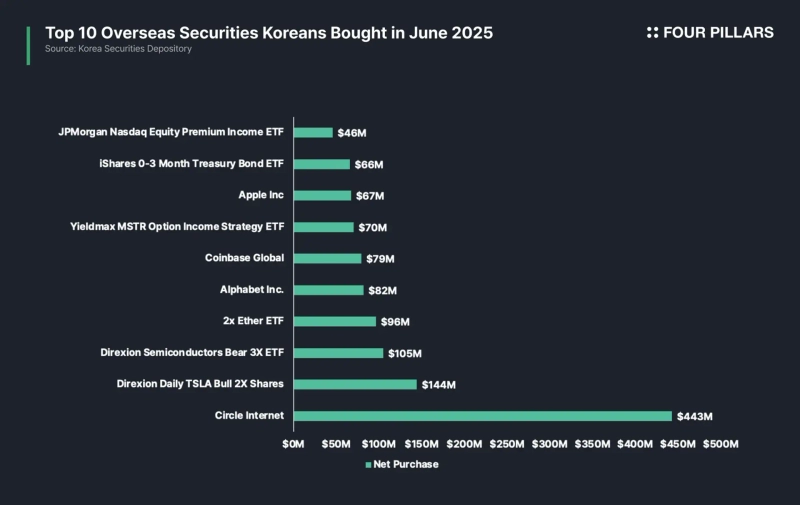

Stablecoin demand from Korean retail investors is already proven. Last month, CRCL ranked first in net overseas stock purchases by domestic investors, with a net buy amount of about $443 million. This buying momentum drove a rapid jump in share price and firmly established the stablecoin theme.

On July 11, Upbit simultaneously listed $ENA in the KRW, BTC, and USDT markets. Within the first 24 hours, trading volume surpassed $1 billion (+300% from the previous day), providing Korean investors with an early on-ramp to $ENA spot before the listing of StablecoinX (USDE) shares. Should the Ethena merger finalize or further momentum develop, the pattern of CRCL rally abroad → expanded local buying → further gains could be repeated with $ENA. In other words, the Upbit listing, Circle’s success, and expectations for a USDE listing could converge to make Korea the early hub of $ENA demand.

5. Conclusion

StablecoinX is the first Nasdaq-listed company to strategically include $ENA as an asset. By combining the $260 million cash purchase with the Foundation’s contribution, about 10% of the circulating supply will be held in the listed company’s treasury—a structural supply shock reminiscent of the MicroStrategy model. With Korea’s recent experience of the CRCL frenzy and ENA listing, the timing appears apt, and the growing trend toward Crypto Treasury Companies (CTC) is expected to accelerate further.

Four Pillars is a global blockchain research firm staffed by experts with years of real-world experience, providing research services to worldwide clients. Since its establishment in 2023, it has conducted over 100 research projects on protocols and companies, covering stablecoins, DeFi, infrastructure, and tokenomics, aiming to mitigate industry information asymmetry and support the genuine adoption and growth of blockchain technology.

Disclaimer

This article is based on the independent research of the author, sponsored by Stable. It is intended solely for general informational purposes and does not constitute legal, business, investment, or tax advice. You should not make investment decisions or use this material as accounting, legal, or tax guidance. Any reference to specific assets or securities is for informational purposes only and does not constitute an investment recommendation. Opinions expressed are those of the author only and may not reflect the views of any associated organization, entity, or individual. These opinions are subject to change without notice.

This report is independent from media editorial direction, and all responsibility lies with the information provider.

Bloomingbit Newsroom

news@bloomingbit.ioFor news reports, news@bloomingbit.io

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)