Summary

- The U.S. has announced it will roll out semiconductor product tariffs in two weeks.

- Samsung Electronics and SK hynix stated that tariff imposition could reduce profitability and decrease shipment volume.

- Industry sources say that, given Korean semiconductors’ market share and key role in the U.S., the actual tariff burden is likely to be limited.

Samsung Electronics and SK hynix on Edge

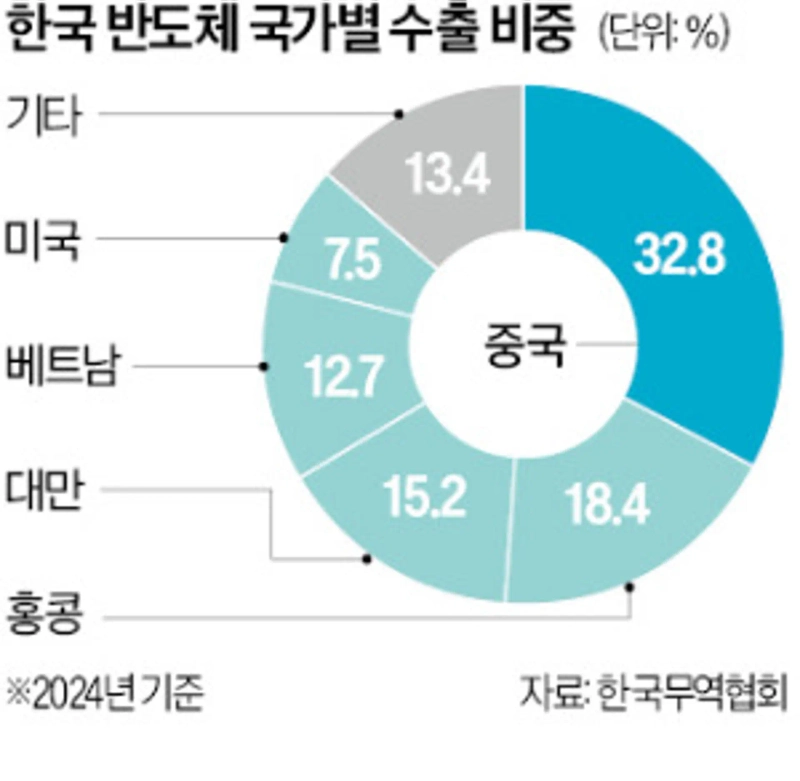

U.S. Accounts for 7.5% of Total Export Value

With the U.S. planning to announce semiconductor tariffs around the middle of next month, Samsung Electronics and SK hynix are growing increasingly tense. Since part of the tariff burden must be shared with their clients, profitability could decline. Unlike automobiles, there are few companies that can substitute for Korea in semiconductors, leading some analysts to conclude that the actual tariff burden will not be significant.

According to foreign media reports on the 28th, Howard Lutnick, U.S. Secretary of Commerce, stated on the 27th (local time) at the announcement of a trade agreement between the United States and the European Union (EU), “We expect to announce semiconductor tariffs in two weeks.” The U.S. Department of Commerce conducted an investigation under Section 232 of the Trade Expansion Act, which allows for high tariffs on imported goods for national security reasons, to assess the impact of semiconductor, semiconductor equipment, and related product imports.

Korean semiconductor companies are closely watching how the tariffs will be set. Samsung Electronics and SK hynix supply high-performance memory semiconductors to U.S. data center companies. While tariffs are fundamentally borne by importing companies, exporters could also face demands to lower supply prices and see a decrease in shipment volumes due to product price increases. Accordingly, senior management—including Kim Yong-kwan, President of the Semiconductor (DS) Business Strategy Division at Samsung Electronics—recently visited Washington, D.C. to express concerns about the imposition of tariffs to the U.S. government.

Some analysts say the impact of the tariffs may not be as significant as anticipated. Last year, the U.S. accounted for just 7.5% ($10.6 billion) of total semiconductor exports, and both Samsung Electronics and SK hynix maintain a dominant 70–80% share of the memory semiconductor market (like DRAM and NAND flash) through overwhelming product competitiveness. There is also analysis suggesting that the U.S. government will have to consider the pivotal role Korean companies play in the AI ecosystem with their advanced high-bandwidth memory (HBM) technology.

It is also seen as a relief for Korean companies building manufacturing facilities in the U.S. that the export tariff on semiconductor equipment produced in the European Union (EU) was set at a lower-than-expected 15%.

Jungsoo Hwang, Reporter hjs@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)