"Invested for 10 years for retirement…" A 5,000% Return 'Major Reversal' [Sudden Pension Wealth]

Summary

- Discussions are underway in the U.S. to include cryptocurrency in 401k retirement plans, raising the possibility of massive retirement fund inflows.

- Pensions and institutional investors are expanding their allocation to Bitcoin ETFs, and Bitcoin is increasingly being seen as 'digital gold.'

- Experts advise caution regarding volatility when investing in cryptocurrencies such as Bitcoin, recommending diversified investment and regular installment investment strategies that allocate only part of one's total assets.

The Era of Preparing for Retirement with Bitcoin…"U.S. Pension Funds Also Investing in Cryptocurrency"

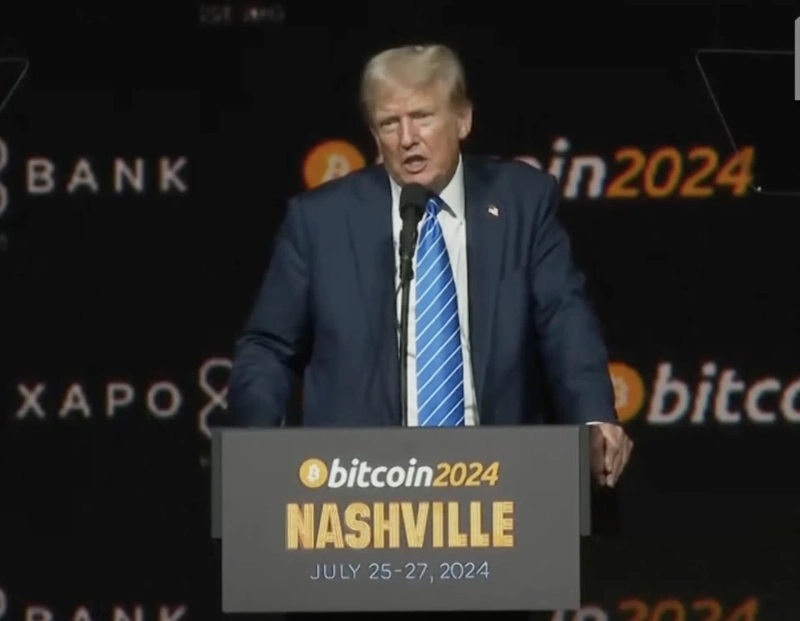

FT: "Donald Trump to Sign Executive Order"

Cryptocurrency Expected to Be Included in 13F Investment Destinations

Pensions Also Expanding Bitcoin ETF Investments

Bitcoin and pensions. It may seem like a hard-to-imagine combination, since stable retirement planning and aggressive cryptocurrency investments seem to be in partial conflict.

However, the situation began to change last year when a spot Exchange Traded Fund (ETF) based on Bitcoin launched in the United States. Pensions and other institutional investors started allocating part of their portfolios to Bitcoin ETFs.

The pace of change has accelerated recently. U.S. President Donald Trump is considering including cryptocurrency among investment options for 401k defined contribution retirement plans. The symbolism of pensions and retirement accounts investing in Bitcoin is significant.

Experts advise, "Cryptocurrencies have little correlation with traditional assets like stocks and bonds and can serve as a hedge against inflation," and recommend strategies that allocate only a portion of the portfolio to such investments.

$9 Trillion Pension Funds Expected to Flow In

The Financial Times (FT) recently reported that "President Donald Trump is expected to sign an executive order allowing cryptocurrency investments in 401k." This would expand investment options for 401k beyond stocks and bonds to include cryptocurrencies and gold.

The 401k is the most widely subscribed U.S. retirement plan for working Americans, amounting to $9 trillion (about ₩12,500 trillion). If cryptocurrency investments are permitted in 401k accounts, there is speculation that massive retirement funds will newly enter the market.

FT stated, "This reflects President Trump's intent to establish cryptocurrency as a mainstream investment asset" and commented that "a radical change in retirement fund management will occur."

U.S. pension funds are also gradually increasing their Bitcoin investments. According to Shin Young Securities, the proportion of pensions holding BlackRock's spot Bitcoin ETF 'iShares Bitcoin Trust' (ticker IBIT) is about 0.8%, up from 0.6% in February.

IBIT is the world's largest spot Bitcoin ETF, with net assets reaching approximately $86.1 billion. Simple estimates imply that the portion of IBIT held by pension funds alone is about $600–700 million.

Emerging as an Alternative Investment to 'Digital Gold'

Why are pension funds investing in Bitcoin? In the financial sector, there is much analysis that Bitcoin will establish itself as 'digital gold' in the medium to long term. With inflation eroding the value of traditional currencies like the dollar, Bitcoin is gaining attention as a store of value. Unlike the ever-increasing supply of the dollar, the total supply of Bitcoin is fixed.

Minseung Kim, head of Korbit Research Center, said, "In the short term, price fluctuations may occur due to investment sentiment or macro factors, but in the long term, the dollar price of Bitcoin will trend upward."

There is also demand to use Bitcoin as a hedge. Bitcoin exhibits distinct characteristics compared to traditional assets such as dollars, gold, and stocks. For institutional investors, including pensions, allocating part of the portfolio to Bitcoin is a way to prepare for geopolitical risks.

However, for many people, investing in Bitcoin still feels almost 'taboo' due to the high volatility of cryptocurrencies. There are also barriers to entry for Bitcoin investment; in Korea, investing in Bitcoin through pension or private retirement accounts is not allowed.

Nor can individual investors buy or sell spot Bitcoin ETFs listed in overseas markets such as the U.S.; they can only invest by buying or selling directly on cryptocurrency exchanges such as Upbit or Bithumb.

Spread Out Investments Rather Than Going 'All In'

Globally, virtual assets are rapidly entering regulatory frameworks, but aside from Bitcoin, the status of altcoins remains uncertain. While there are cases of institutional investors including Bitcoin in their portfolios, it is rare to find investments in altcoins.

Experts note, "Even when investing in Bitcoin, it is necessary to invest only a proportion, not your entire wealth."

If timing buys and sells is difficult, a regular savings investment approach is also a good option. This means investing the same amount at regular intervals in assets like stocks or cryptocurrencies, similar to saving in a recurring deposit.

There are interesting results showing how much could have been earned by investing in Bitcoin via regular installments. If you had invested $10 weekly in Bitcoin for 10 years from July 2015 to July this year, your principal would be $5,220, but the evaluation amount would be about $271,700. In terms of profit rate, that's 5,104%.

If you are considering regular installment investing in cryptocurrencies such as Bitcoin, using the 'Coin Gathering' service operated by Upbit is one way. This service allows users to set up automatic regular orders on a daily, weekly, or monthly basis. By deciding on the cryptocurrency, timing, and amount, installment investment proceeds automatically.

It is also necessary to adjust investment proportions according to one's stage of life. For example, a retiree in their 60s going 'all in' on Bitcoin may see their immediate living funds impacted by short-term price swings.

Therefore, for those nearing retirement, increasing the proportion of safe assets such as deposits and installment savings is recommended, while for those in their 20s and 30s, strategies involving greater allocation to risk assets such as cryptocurrencies or stocks are advised.

Reporter Hyunggyo Seo seogyo@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)