Summary

- It is reported that in political circles, bills related to the KRW stablecoin are being tabled by both ruling and opposition parties, signaling visible regulatory changes.

- Most bills from both sides share a similar framework such as licensing system, issuer capital requirements, and reserve obligation, although there are differences in details like interest payment provisions.

- Despite opposition from the Bank of Korea and other monetary authorities concerned about potential monetary policy confusion, the discussion of institutional measures such as forming a related committee is leading to speculation that the bill could pass within the year.

In line with US 'Dollar Coin' Legislation...Rival Parties Compete for Issue Leadership

Issuance Licensing System·₩5 Billion in Capital, etc.

Similar Frameworks...Divergence over Interest

Ruling Party Proposes Establishing 'Digital Asset Committee'

Lee Also Pledged...Possible Passage Within the Year

Opposition from the Bank of Korea and Other Monetary Authorities Is a Variable

A flood of bills related to stablecoins is emerging in political circles. As the US legalized stablecoins, market interest has increased, prompting both ruling and opposition lawmakers to compete for the spotlight. As President Lee Jae-myung made this a presidential campaign pledge, there is speculation that related laws could be passed within the year.

Both Rival Parties Propose Stablecoin Bills

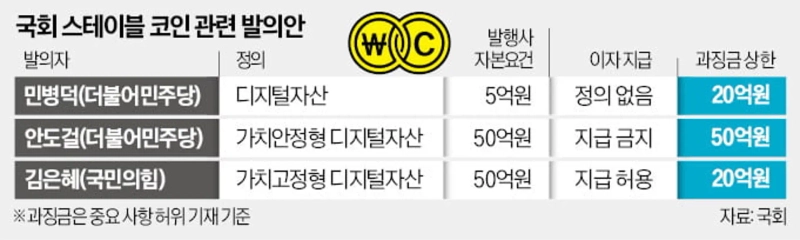

According to political sources on the 30th, Min Byung-deok, a member of the Democratic Party of Korea, submitted a stablecoin-related bill last month. It comprehensively covers the legal definitions of digital assets. On the 28th, Ahn Do-geol, another Democratic Party member, and Kim Eun-hye of the People Power Party, also proposed bills at the same time. Both lawmakers' bills specify stablecoins, presenting detailed regulations for issuance and circulation. Kang Jun-hyun, the ruling party's secretary on the National Assembly's Political Affairs Committee, is also planning to introduce a similar bill soon.

The bills proposed by lawmakers from both parties are largely similar in their framework. Both Ahn's and Kim's bills commonly require that issuance be managed through a licensing system by financial authorities and that issuers maintain more than ₩5 billion in capital. There is also a mandate to fully deposit (over 100%) reserves in cash equivalent assets like deposits or short-term bonds. This is to ensure priority repayment in the event of accidents. There are some differences as well. Ahn's proposal bans payment of interest on stablecoins. He explained, “In the early stage, excessive currency substitution should be avoided” and “Stablecoins should not become investment products.” Kim's bill takes a different stance, aiming to allow the payment of interest as an incentive.

Confusion in Monetary Policy Is a Variable

Since both opposition and ruling party lawmakers have presented similar bills, there is talk in political circles that the legislation could be passed within the year. As it is a presidential pledge, the administration is also backing it strongly. However, concerns raised by authorities such as the Bank of Korea may become an obstacle. A Democratic Party member from the Political Affairs Committee said, “Given that the US is expanding the influence of dollar stablecoins, there is consensus over the legislative intent,” but added, “Concerns must be resolved because if there is the effect of creating multiple central banks, there could be risks.” In fact, internally at the Bank of Korea, there is significant worry that if KRW stablecoins are recklessly issued beyond the banking sector into non-banking areas, it could undermine currency issuance rights and the central bank’s policy leadership.

Aiming for passage within the year, Ahn held a stablecoin bill briefing at the National Assembly that day and proactively provided explanations. Ahn's bill includes a provision to set up a 'Value-Stable Digital Asset Committee' involving the Ministry of Economy and Finance, the Bank of Korea, the Financial Services Commission, etc. He emphasized that this system would enable timely feedback from monetary and foreign exchange authorities. Through this committee, institutions are expected to be able to intervene in all processes regarding the issuance, distribution, and redemption of private stablecoins. Kang's anticipated bill is also expected to play a key role during the Political Affairs Committee’s deliberations. On the 17th of last month, Kang released a draft requiring at least ₩1 billion in capital and is reportedly undergoing close negotiations with the government.

A stablecoin is a cryptocurrency with a 1:1 exchange value with legal tender. Its price is stable, settlement is fast, and fees are almost nonexistent. The US has already fully legalized the dollar stablecoin as of the 18th of this month. Shin Sang-hoon, a professor at Yonsei University Graduate School of Business, emphasized, “The US intends to use the global spread of the dollar stablecoin to secure demand for US Treasuries and extend financial leadership into the digital sphere.”

Si-eun Lee, Reporter see@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![Bessent, U.S. Treasury Secretary: "No Bitcoin bailout"…With an AI shock, $60,000 put to the test [Kang Min-seung’s Trade Now]](https://media.bloomingbit.io/PROD/news/f9508b36-3d94-43e6-88f1-0e194ee0eb20.webp?w=250)