"BTC and ETH Decline but Forced Liquidation Volumes Remain Limited… Impact Driven More by Spot Selling Than Derivatives Market"

Minseung Kang

Summary

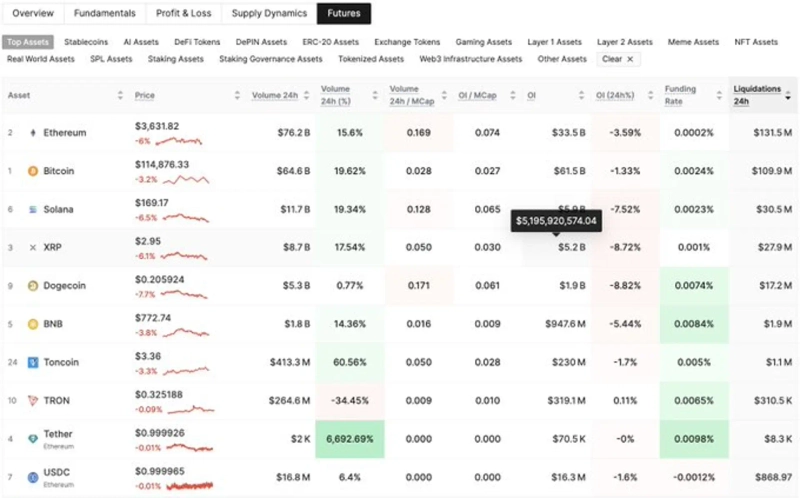

- Glassnode reported that the recent decline of Bitcoin (BTC) and Ethereum (ETH) is an adjustment driven by spot selling rather than the derivatives market.

- It was stated that the forced liquidation volume for BTC and ETH remained relatively low at $110 million and $132 million, respectively.

- The decrease in open interest is also limited, and excessive leverage liquidation flows have not yet been observed.

The recent declines of Bitcoin (BTC) and Ethereum (ETH) are analyzed to be adjustments centered on spot selling rather than liquidations in the derivatives market.

On the 1st, on-chain data analytics firm Glassnode stated via X (formerly Twitter), "Recently, Bitcoin (BTC) and Ethereum (ETH) fell by 3.2% and 6% respectively, but the liquidation volumes remained relatively low at $110 million and $132 million respectively," explaining, "This decline appears to be a correction driven more by spot sales than by derivative liquidations."

Glassnode added, "The decrease in open interest is also limited, and no excessive leverage liquidation flows have been observed yet."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.