"Bitcoin Absorbs Supply in the $109,000–$116,000 Range… Selling Pressure at the Top Is Limited"

Summary

- On-chain data analysis reported that Bitcoin holders are maintaining their tendency to hold.

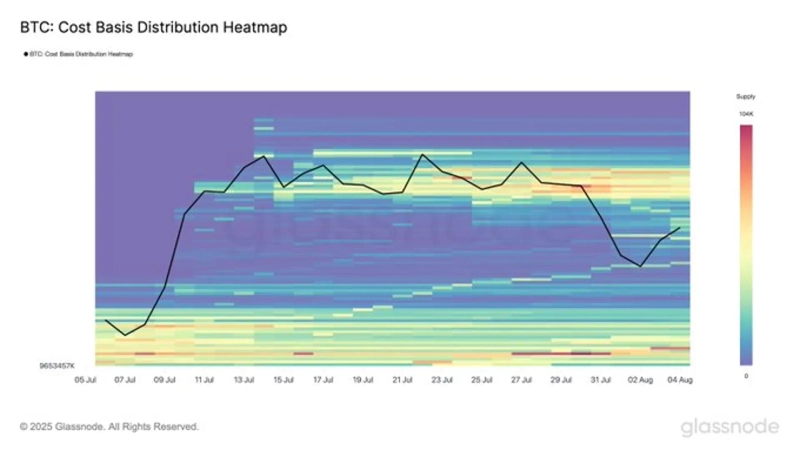

- Glassnode announced that the liquidity gap between $109,000 and $116,000 has been gradually filled during the recent price adjustment period.

- There has been no clear selling distribution observed in the $118,000–$120,000 range, suggesting that selling pressure at the top is limited.

On-chain data analysis has shown that Bitcoin (BTC) holders are maintaining their holding tendency.

On the 5th, on-chain analytics firm Glassnode announced on its official X (formerly Twitter), "The liquidity gap that existed between $109,000 and $116,000 has been gradually filled during the recent price adjustment period."

They added, "Over the past month, the price of Bitcoin has followed a stair-step pattern, showing a steady flow of investor participation," and evaluated, "This signals that the buying momentum continues even amid short-term pullbacks."

In particular, it explained, "There has been no clear (supply) distribution observed in the $118,000–$120,000 (peak) range," and "It appears that holders in this range are opting to hold (HODL) rather than sell."

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.