K Bank achieves record net profit in Q2… 'Surprise results' despite decreased interest income

Summary

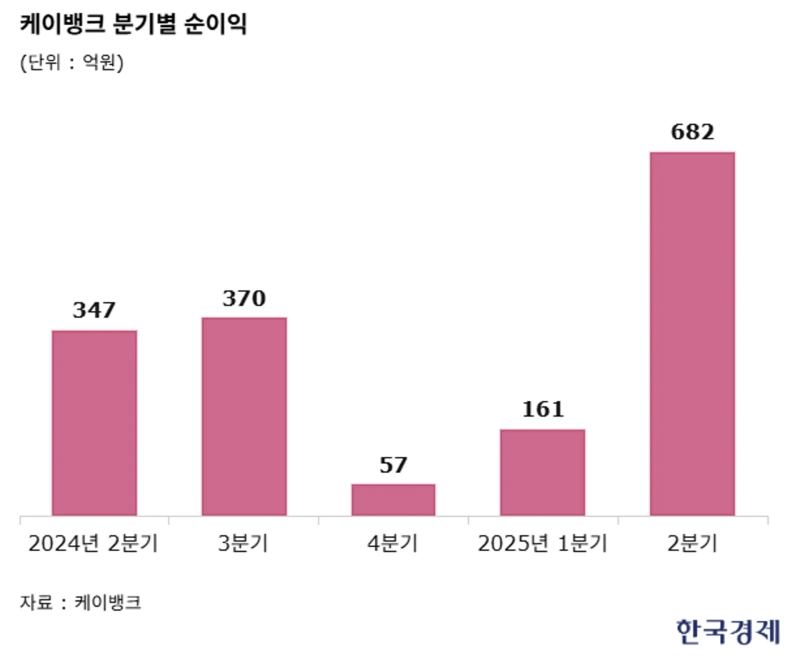

- K Bank reported record quarterly performance with net profit of ₩68.2 billion in Q2.

- The improvement was attributed to a rise in non-interest income and a reduction in credit loss expenses, despite a decline in interest income.

- The bank is seeking new growth drivers such as full-scale stablecoin business and expanding loans to individual entrepreneurs in the second half of the year.

Internet bank K Bank set a record for quarterly performance last quarter, posting net profits nearing ₩70 billion in Q2. Although interest income dropped by nearly 20%, increases in non-interest income and a decline in credit loss expenses improved results. K Bank plans to continue its growth momentum and will seek another attempt at an IPO this year.

K Bank announced on the 13th that its net profit for the second quarter was ₩68.2 billion. This represents an increase of ₩33.5 billion (96.3%) compared to the same period last year (₩34.7 billion), marking the highest quarterly net profit since its launch in April 2017.

Core banking revenue, interest income, declined from ₩128.6 billion in Q2 last year to ₩103.3 billion this year, a decrease of ₩25.3 billion (19.7%). Loan balances increased by 10.8%, from ₩15.7 trillion at the end of Q2 last year to ₩17.4 trillion at the end of the recent quarter. However, profitability declined due to lower base interest rates and higher interest expenses on Korean won deposits from Upbit, South Korea’s largest cryptocurrency exchange. K Bank increased the usage fee (interest rate) it pays on Upbit’s Korean won deposits from an annual 0.1% after the implementation of the Virtual Asset User Protection Act last July to 2.1% per year.

Non-interest income increased by 16.2%, from ₩16.9 billion in Q2 last year to ₩19.7 billion this year. In particular, platform advertising revenue more than quadrupled during this period, which K Bank attributes to its app-tech service 'Receive Allowance' that gained one million users within two months of launch early this year. K Bank stated that it will expand advertising partnerships for other app-tech services as well.

A substantial reduction in credit loss expenses was another contributor to strong performance. K Bank's credit loss expenses dropped by 26.5%, from ₩56.2 billion in Q2 last year to ₩41.3 billion this year. K Bank explained, "We improved our asset portfolio by increasing the proportion of collateralized loans and reinforced loan screening through the advancement of our Credit Scoring System (CSS), leading to reduced credit loss expenses."

In April last year, K Bank introduced Naver Pay Score, and in February this year, adopted 'EQUAL', an alternative credit evaluation model based on customer data from the three major telecom companies, advancing its CSS. Since October last year, K Bank has also utilized alternative credit data from Samsung Card and Shinhan Card in loan assessments.

Thanks to proactive risk management, K Bank’s delinquency rate at the end of Q2 was 0.59%, down 0.07 percentage points from the end of the previous quarter (0.66%). Compared to the end of Q2 last year (0.9%), it marked a significant improvement.

K Bank plans to further expand loans to individual entrepreneurs during the second half of this year. As the only internet bank already offering a full lineup of credit, guarantee, and collateral loans to sole proprietors, K Bank intends to diversify collateral types in the future. It will also expand its cooperation with local Credit Guarantee Foundations to provide wider regional coverage for guarantee-backed loans to entrepreneurs.

K Bank will also accelerate its stablecoin-related business initiatives in the second half of this year. Since April, K Bank has been conducting a proof-of-concept (PoC) for cross-border remittances between Korea and Japan using stablecoins, and last month completed trademark applications related to this field. Recently, an internal dedicated team, the Digital Asset Task Force (TF), was established to focus on research and business model development centered on digital assets.

A K Bank spokesperson said, "We achieved record quarterly results by expanding our customer base, growing loans for individual entrepreneurs such as the ‘Entrepreneur Real Estate Secured Loan’, and through thorough risk management," adding, "We will continue to pursue stable growth and bolster profitability by strengthening product competitiveness and conducting more sophisticated credit management."

Jeong Eui-jin, Reporter justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)