Summary

- Governor of the Financial Supervisory Service Lee Chan-jin emphasized internal communication by stating he would not make any decisions autocratically.

- As the new government's push for productive finance and education tax increases intensifies, there have been concerns in the financial sector that Governor Lee may directly drive related policies.

- Due to foreign selling, financial stocks fell across the board, and investor disappointment with government policies is adversely affecting financial company share prices.

The Financial Sector's Focus on the Influential Governor of the Financial Supervisory Service

Begins Work by Encouraging Internal Organization

First Lunch with the Stock Manipulation Eradication Task Force

Maintained a Low Profile Since Inauguration

Persistent Concerns About Pressures for Coexistence in the Financial Sector

Sharp Drop in Financial Stocks Due to Foreign Selling

The entire financial sector is focusing its attention on 'influential' Governor of the Financial Supervisory Service, who is a close aide to President Lee Jae-myung. Since his inauguration on the 14th, he has maintained a modest stance through internal and external remarks, but concerns are growing that his presence will soon be felt amid growing 'coexistence pressures' such as productive finance and increased education tax rates.

◇ The Quiet Actions of the Influential Governor

According to the financial sector on the 18th, Lee Chan-jin, newly appointed Governor of the Financial Supervisory Service (pictured), officially began his duties on this day. His first priority was to 'solidify the internal organization.' For his first lunch, he invited employees from the 'Stock Manipulation Eradication Joint Task Force.' This joint task force was established after President Lee Jae-myung gave the directive, "Stock manipulators must be thoroughly ruined," bringing together the Financial Supervisory Service, the Financial Services Commission, and the Korea Exchange.

However, when it became known that there had been a 'dispute over who should pay for the meal' between employees of the Financial Supervisory Service and the Korea Exchange within the joint task force, Governor Lee reportedly called in those employees for encouragement.

He also made efforts to dispel concerns about taking radical actions as the 'influential' governor. During a tea time with executives that day, Governor Lee pledged, "I will not make any decisions autocratically in the future." He emphasized his intent to make decisions through ample internal communication and feedback. A high-ranking official in the financial sector commented, "He is always known for his humble character, and as he has been categorized as a close aide to the president, he appears to be even more modest in the early days of his term."

◇ Financial Sector Gripped by Anxiety

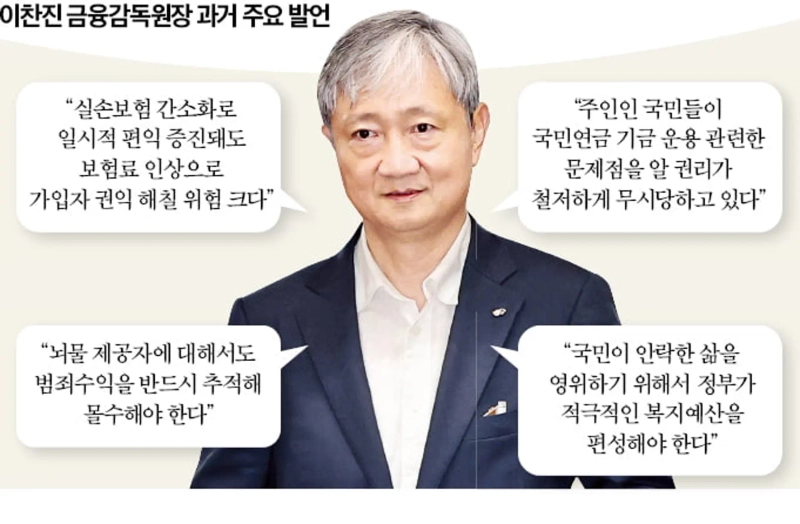

In contrast to Governor Lee's quiet early steps, there are considerable concerns in the market. This is due to his record of making strong statements on major issues such as insurance, pensions, and national finance. During his tenure as Vice President of Lawyers for a Democratic Society, Governor Lee asserted that 'those who offer bribes for economic gain must also have their criminal proceeds strictly traced and confiscated,' and 'if fund management is left to financial experts, inevitably only short-term results and high returns will be pursued,' thus expressing radical opinions. While involved in the Ministry of Health and Welfare's Committee for Clearing Deep-Rooted Evils, he also proclaimed that 'the National Pension Service's approval of the Samsung C&T Corporation–Cheil Industries merger must be eliminated as a corrupt practice,' receiving criticism for providing grounds for an attack by the US hedge fund Elliott Management.

The financial sector believes it is highly likely that Governor Lee will directly drive the ongoing pressures under the new government for productive finance and increased education tax. An industry insider stated, "With the president's close aide taking the helm at the supervisory authority, there are substantial concerns that the burden on the financial sector could increase even more."

Foreign investors also sold a large volume of domestic financial stocks that day. KB Financial Group plunged by 5.3% to close at ₩107,200. Shinhan Financial Group (-2.32%), Hana Financial Group (-4.06%), and Woori Financial Group (-2.95%) also all declined. In the case of KB Financial Group, the sector's leader, it had soared to ₩126,600 on the 25th of last month, but has fallen by 15.32% from that peak in less than a month. An analyst at a securities firm pointed out, "Even in the early days of the new government, there were many foreign investment banks (IBs) that designated financial stocks as their top picks," adding, "However, as government policies have repeatedly treated financial companies as little more than ATMs, disappointment has reached its peak."

Jaewon Park / Hyungyo Seo, wonderful@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)