Summary

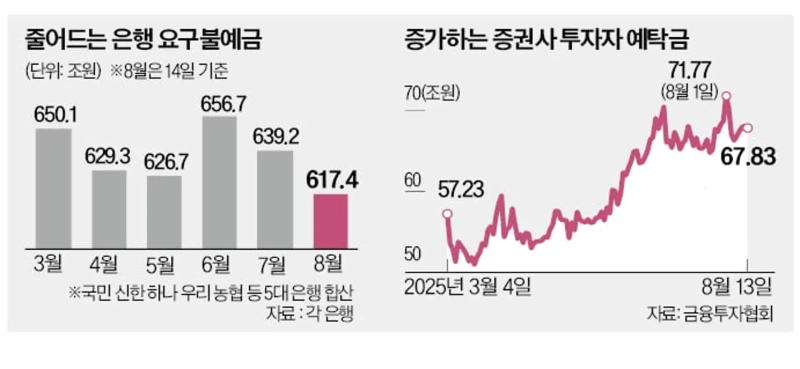

- Demand deposits at Korea’s top five banks have fallen by about ₩39 trillion in the second half of this year, accelerating the exodus of funds from the banking sector.

- As bank deposit interest rates fall to an average of 2.54%% per year, investors are moving their money to the stock market and crypto market in search of higher returns.

- If interest rates are cut further and the economic slump continues, it is projected that funds will leave banks even more rapidly.

₩21.7 Trillion Withdrawn from Demand Deposits Just This Month

Stock Investment Deposits Up by ₩10.5 Trillion in Two and a Half Months

Demand deposits, which act as investment standby money, have seen nearly ₩40 trillion withdrawn from the top five banks in the second half of this year alone. There is analysis that, with the ongoing economic downturn, even the total funds staying in banks have shrunk. Even the surplus cash that does exist is quickly moving to other investments such as stocks and crypto due to disappointment with low interest rates.

The amount deposited in banks has decreased amid the economic slowdown. An executive at a commercial bank explained, "With the recession continuing, corporate deposits are decreasing, and sole proprietors are even using their reserve funds to keep their businesses running." As interest rates repeatedly fall, the speed of fund outflow from banks is accelerating. According to the Korea Federation of Banks, as of today, the highest interest rate among the 38 fixed deposits offered by banks nationwide averages just 2.54% per year.

Due to this situation, there is widespread evaluation that more investors are leaving banks in search of financial products with higher expected returns. The strong stock market is a prime example. According to the Korea Financial Investment Association, as of the 13th, investor deposits in the domestic stock market (excluding margin for derivatives trading) reached ₩67.8339 trillion, up ₩10.5368 trillion since the end of May (₩57.2971 trillion), just before the Lee Jae-myung administration began. On the 1st of this month, it broke through ₩70 trillion for the first time in three and a half years (₩71.7777 trillion).

The crypto market has also been heating up again recently. As Bitcoin and Ethereum keep setting new record highs, the buying momentum is growing stronger. On the 14th, the size of cryptocurrency transactions on Upbit reached ₩8.14 trillion. Daily trading volume had been only about ₩1-2 trillion in June, but surged to ₩5-10 trillion after last month.

Interest Rates Fall to the 2% Range… "If Further Cuts, Bank Fund Outflow Will Accelerate"

With Higher Yields in Stocks and Crypto, Raising the Deposit Protection Limit Acts as a 'Breakwater'

As the demand deposits at the nation’s top five banks plunged by almost ₩40 trillion in the second half, the exodus of idle funds from the banking sector is accelerating. As interest rates keep dropping, disappointment is growing among so-called 'YeTech' (deposit+technique) investors, and there is a forecast that the decline in bank deposits will become more pronounced.

According to the financial sector on the 18th, demand deposits at KB Kookmin Bank, Shinhan Bank, Hana Bank, Woori Bank, and NongHyup Bank totaled ₩617.4606 trillion as of the 14th, down ₩39.22 trillion since the end of June. Especially this month, balances fell by ₩21.7308 trillion in just 10 business days. There is even speculation that the total decrease for the month could exceed ₩30 trillion. The only time monthly declines exceeded ₩30 trillion in the past two years was April last year (₩31.5511 trillion).

With stagnating demand due to the sluggish economy and sliding interest rates, there is analysis that more people are simply seeking alternative investments. According to the Korea Federation of Banks, as of today, the highest interest rate among the 38 term deposits at domestic banks averaged only 2.54% per year. Even in the primary banking sector, it is hard to find deposits yielding even 3% annually, even with all preferential rates included.

Commercial banks expect that the increase of the deposit protection limit from ₩50 million to ₩100 million next month will serve as a 'breakwater.' When the amount recoverable in the event of a bank failure increases, some funds dispersed into various institutions could flow back into banks. However, even in the secondary financial sector, such as savings banks and mutual finance companies, not a few products yield above 3% per year. This is why there are opinions that the increase in bank deposits could soon reverse. As of the 14th, the balance of time deposits at the five major banks was ₩946.6102 trillion, up about ₩14 trillion in the second half of the year.

A commercial bank executive said, "There is a growing trend of people thinking it’s better to invest in stocks, ETFs, or cryptocurrencies while those markets are booming," and "Although there is still a sentiment to lock in deposits before interest rates drop further, if deposit rates fall below the current level, there could be competition for deposits from the secondary financial sector."

The financial sector anticipates that the Bank of Korea could lower the base rate further within the year to stimulate the economy. Korea’s economic growth rate has remained below 1% for five consecutive quarters up to the second quarter of this year. The overdue loan ratio at domestic banks shot up to 0.64% in May, the highest in eight and a half years. From the second half of this year, the U.S. “mirror tariff” (15%) shock is expected to impact Korea’s exports. The Asian Development Bank (ADB) lowered this year’s growth forecast for Korea from 1.5% to 0.8% last month for this reason. Korea Development Institute (KDI) has also maintained its forecast at 0.8%.

Reporter Jinseong Kim jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)