"This is Madness" — Growing Theories of an AI Bubble... 'Father of ChatGPT' Makes a Pointed Statement

Summary

- It was reported that concerns over a bubble are spreading in the US stock market, particularly around the "AI" theme.

- Key figures in the industry, including Sam Altman, CEO of OpenAI, pointed out the excessive rise in AI company valuations and overheated investor sentiment.

- Some experts diagnosed that the recent tech rally and the AI revolution could offer long-term investment opportunities.

Growing AI Bubble Concerns in the US Stock Market... 'Madness' vs 'Continued Bull Market'

Since 2023, a wave of skepticism has emerged over whether there's a bubble in the artificial intelligence (AI) trend that has driven the stock prices of technology companies. Analysts have raised concerns that the scale of corporate investments in AI may be outpacing the actual returns. There has also been criticism about the irrationality of small companies raising enormous amounts of capital.

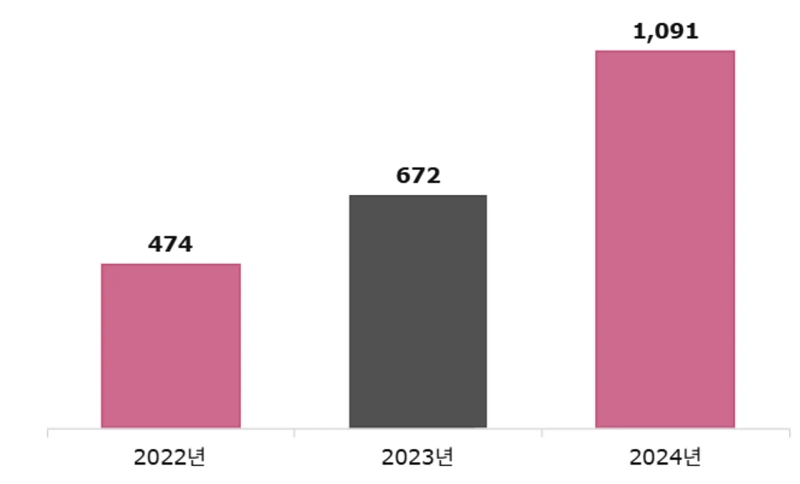

On the 19th (local time), the Nasdaq index in the New York stock market closed at 21,314.95, down 1.46% from the previous day. The accumulation of pessimistic analyses on the AI sector appears to have spurred investors to sell. The previous day, a research team affiliated with the Massachusetts Institute of Technology (MIT) issued a report stating, "Only 5% of AI pilot programs are generating millions of dollars in value, while the remaining 95% are not earning any revenue." The analysis suggests that while companies are using customized AI tools, most AI projects do not offer practical benefits. According to Stanford University, US private AI investment rose from $47.4 billion in 2022 to $109.1 billion last year, more than doubling.

Adding to these concerns, Sam Altman, CEO of OpenAI, made remarks suggesting that there may indeed be a bubble forming in the AI industry. According to CNBC, he recently said in an interview with technology-focused media outlet The Verge, "It's true that investors are overly excited about AI," and added, "The valuations of AI companies are already out of control." It is reported that Altman used the word "bubble" three times in his 15-second statement. He also described the situation—where startups with only three employees are raising hundreds of millions of dollars—as "madness."

As a result, major technology companies with a market capitalization of over $1 trillion, including NVIDIA (-3.5%), Broadcom (-3.55%), and Microsoft (-1.42%), saw simultaneous declines. Palantir, the AI defense company that had reported strong earnings recently, also plunged by 9.35% that day, marking its fifth consecutive session of losses. Financial Times (FT) reported, "In January, concerns were raised over American dominance in the AI market and semiconductor demand after the appearance of DeepSeek in China," adding, "While share prices have since recovered, this is a vivid illustration of how sensitive investors can be to negative news about AI." Apollo Global Management warned that the AI frenzy could surpass the dot-com bubble in scale.

However, some in the market believe the Nasdaq's over 40% rise since its April low is simply a pause after a rapid climb. Jason Broncati, Chief Investment Officer (CIO) at Lincoln Financial, said, "It is historically normal for markets to pause temporarily as they readjust."

Optimism about AI persists on Wall Street. This is attributed to major tech companies not only beating market expectations in their latest earnings but also expanding AI-related investment plans. Dan Ives, Head of Global Tech Research at Wedbush Securities, explained in an interview with Fortune, "(AI investment) is a situation where trillions of dollars are being poured in to build the infrastructure of the Fourth Industrial Revolution." He continued, "The AI revolution will drive a tech bull market for the next 2 to 3 years," diagnosing that "this is an opportunity like 1996, not a collapse like 1999." The CIO of Saperstein Treasury Partners also forecast, "Large-cap tech stocks will continue to lead the market and drive returns going forward."

Journalist: Han Kyungjae hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)