Summary

- It was reported that the prices of major cryptocurrencies such as Bitcoin and major altcoins have dropped by 6~10% or more from their highs recently.

- It was stated that rising U.S. inflation and weakened expectations of a rate cut have dampened investment sentiment toward risk assets.

- There is a high possibility that crypto asset prices could fall further if expectations for delaying a rate cut spread following the Jackson Hole meeting on the 22nd.

Anxiety ahead of Jackson Hole meeting on the 22nd

Bitcoin drops 6% from its peak

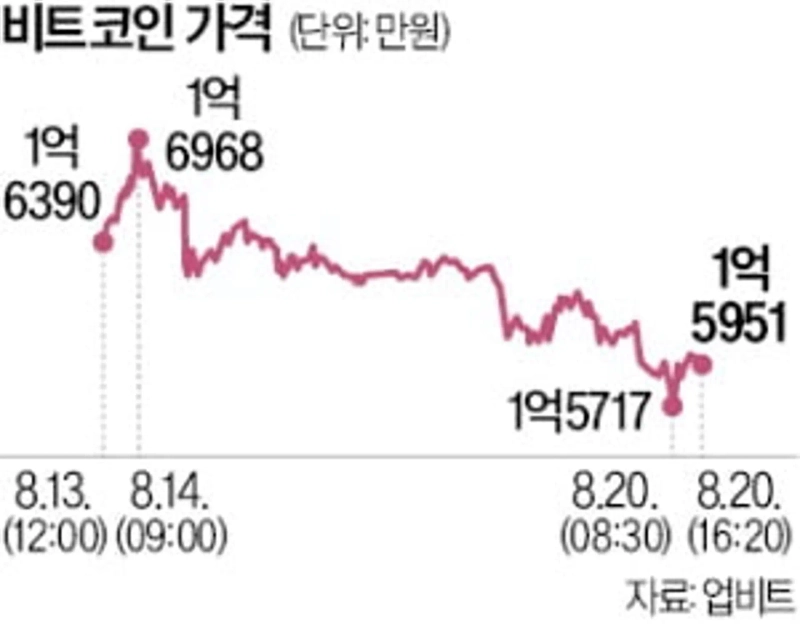

Cryptocurrency prices, which surged earlier this month, are now undergoing a correction. Over the past week, Bitcoin has dropped about 6% from its high, and both Ethereum and Ripple have plunged more than 10%. Concerns are rising that the Fed may not cut interest rates next month, weakening investor sentiment toward risk assets.

According to Upbit, the largest domestic crypto exchange, Bitcoin was trading at ₩159,200,000 at 2:30 p.m. that day. This represents a decline of approximately 6.2% compared to the record high of ₩169,680,000 on the 14th. On Coinbase, the largest U.S. crypto exchange, Bitcoin, which surpassed $124,000 on the 14th, dropped more than 8% to around $113,600 that same day.

Prices of altcoins—cryptocurrencies other than Bitcoin—fell even more sharply. Ethereum, known as the leading altcoin, plunged 10.2% from ₩6,531,000 on the 14th to ₩5,863,000 at 2:30 p.m. Ripple also dropped 10.8% from ₩4,558 to ₩4,065 over the same period.

The ongoing weakness in cryptocurrency prices on domestic and international exchanges is due to higher-than-expected U.S. inflation, which has dampened expectations for an interest rate cut. On the 14th, the U.S. Department of Labor announced that last month’s U.S. Producer Price Index (PPI) rose 3.3% from a year earlier—a figure well above the 2.5% forecasted by experts. Following the PPI release, cryptocurrency prices trended downward.

Market observers believe a wait-and-see approach will continue until the Jackson Hole meeting in Wyoming, United States, on the 22nd. If the meeting leads to further expectations that interest rate cuts will be delayed, crypto prices could fall further.

Reported by Jeong Eui-jin, justjin@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.![[Market] Bitcoin breaks below $68,000 as losses deepen](https://media.bloomingbit.io/PROD/news/3a08fe32-6a33-4a62-bb89-4afb5c5399ca.webp?w=250)

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)