Editor's PiCK

Fading Hopes for US Rate Cuts… Market Watches Powell’s Every Word

Summary

- A growing sense of caution around the Fed’s rate cut policy has rapidly pushed up expectations for a September rate hold.

- Fed officials are taking a cautious approach to rate cuts, citing mixed signals from inflation and labor market data.

- The market is closely watching Fed Chair Jerome Powell’s Jackson Hole speech, expecting it to provide key hints about future rate policy.

A tone of caution regarding interest rate cuts continues at the US central bank (Fed). In the market, there are increasing opinions that a September rate cut is far from certain.

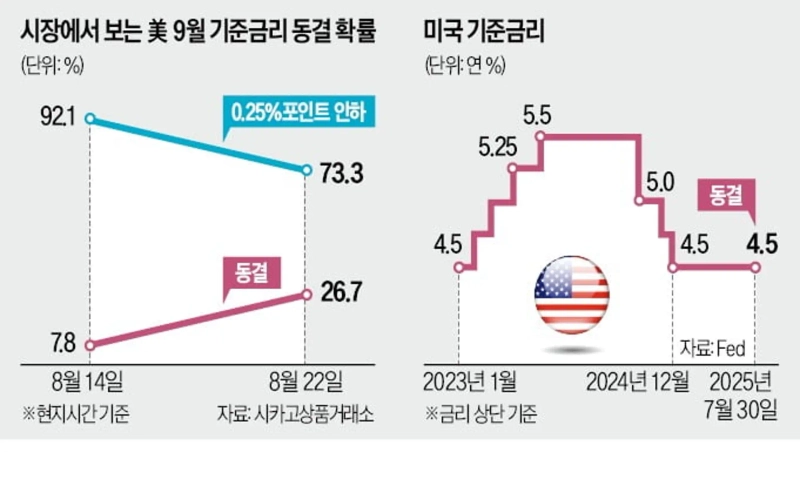

According to the Chicago Mercantile Exchange (CME) FedWatch on the 22nd, the market sees a 26.7% probability that the Fed will hold the federal funds rate steady at the September Federal Open Market Committee (FOMC) meeting. This is higher than the 7.8% figure from the 14th. While most investors still expect a rate cut, the number of those betting on a hold has risen rapidly. The market is focused on Jerome Powell’s speech at the Jackson Hole meeting.

Growing Caution on US Rate Cuts… Probability of Hold in September Rises from 8% to 27%

All Eyes on the Jackson Hole Meeting… Divergence in Fed’s Internal Policy Views

Concerns over inflation from Donald Trump’s tariff policies, combined with signs of a cooling labor market, are weighing on the Fed. Market expectations for a September rate cut once rose as high as 95% but have recently dropped to 73%. The mood is turning toward bets on a hold.

◇ Soaring Expectations for Rate Hold

According to CME FedWatch, on the 22nd, the fed funds futures market priced in a 26.7% chance of the Fed holding rates steady (annual 4.25~4.5%) at the September meeting, and a 73.3% chance of a 0.25% point cut.

At the 'Jackson Hole meeting', which began on the 21st (local time) in Jackson Hole, Wyoming, Fed officials showed caution about a September rate cut, leading the market to raise the odds of a hold. Jeffrey Schmid, President of the Federal Reserve Bank of Kansas City, said in a CNBC interview, "There needs to be decisive data to move policy rates," adding, "There’s much to be discussed between now and September."

If indicators on inflation or employment before the next FOMC meeting (September 16~17) do not warrant a rate cut, a cut appears unlikely. President Schmid holds a vote at this year’s FOMC. At last month's FOMC meeting, he voted to hold, and the July meeting minutes noted the US labor market remains "solid."

On the same day, Beth Hammack, President of the Cleveland Fed attending the Jackson Hole meeting, told Yahoo Finance that inflation risks outweigh employment concerns. She said, "We are experiencing excessively high inflation, which has persisted over the past year," and "Based on the data I have, if the meeting were tomorrow, I don’t see grounds to lower rates." She noted that while companies have delayed tariff-related price hikes, the full impact may emerge next year.

Conversely, Susan Collins, President of the Boston Fed, focused a bit more on the labor market in a Wall Street Journal (WSJ) interview. Collins said, "If data before the September FOMC suggests that the risk of worsening labor market conditions outweighs rising inflation risks, it may be appropriate to start cutting rates soon."

According to the US Department of Labor, new unemployment claims for the week of August 10–16 were 235,000, up 11,000 from the previous week—the biggest increase in about three months. Continuing claims for two or more weeks stood at 1,972,000 as of August 9, the highest level since November 2021.

Reuters reported, "A debate is ongoing within the Fed about whether inflation is merely a temporary shock or the start of a sustained trend." The labor and inflation data the Fed relies on for rate decisions are sending mixed signals. The painful memory remains of the Fed’s premature rate cuts during the COVID-19 pandemic of 2021–2022, which ultimately fueled high inflation.

Raghuram Rajan, former Governor of the Reserve Bank of India, told The New York Times (NYT), "Having to reverse a rate cut severely damages credibility," and "Central banks can afford to wait and watch, but they cannot change policy in an instant."

Meanwhile, President Trump continues to pressure for rate cuts, attempting to replace or seeking to replace Fed governors appointed under the previous Joe Biden administration with pro-Trump members who are favorable to rate cuts. US Treasury Secretary Scott Besant went further, calling for a 'big cut' (a one-shot 0.5% point rate reduction).

That’s why the market is closely watching Jerome Powell’s keynote speech at Jackson Hole. Notably, this speech is effectively Powell’s last keynote at the Jackson Hole meeting since he became Fed Chair in 2018.

◇ Walmart: "Costs Will Rise Through Year-End"

Amid concerns that President Trump’s tariff policy will stoke inflation, retailers reported lackluster results. Walmart, the largest US retailer, saw its profits fall below market expectations for the first time in three years. In the earnings announcement, Walmart CEO Doug McMillon said, "Weekly costs have risen as we replenish inventory at new price levels following the imposition of tariffs," adding, "This trend is expected to continue into Q3 and Q4." He added, "Some middle- and low-income households have stopped buying discretionary items whose prices have increased," but stressed they would postpone price hikes as long as possible. Last May, when Walmart signaled price increases due to tariffs, President Trump pressured them to scrap the plan.

Target, another major retailer, also reported declines in both sales and net profit in the second quarter, while Home Depot’s results missed market expectations, and the company signaled price hikes for some products.

Reporter Han Kyungjae/Wyoming = Correspondent Bin Nansae hankyung@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.

![[Market] Bitcoin breaks below $70,000… Korea premium at 0.31%](https://media.bloomingbit.io/PROD/news/74018332-717e-4495-9965-328fe6f56cb4.webp?w=250)