Summary

- Over the past 24 hours, sharp declines in major virtual asset prices led to the liquidation of approximately ₩870 billion worth of positions in the futures market.

- According to CoinGlass data, ₩640 billion was liquidated from long positions, and ₩230 billion from short positions.

- It was emphasized that liquidation amounts were largest for Bitcoin, followed by Ethereum and Solana.

With the sharp decline in major virtual assets (cryptocurrencies) such as Bitcoin (BTC), a substantial volume of futures positions were liquidated.

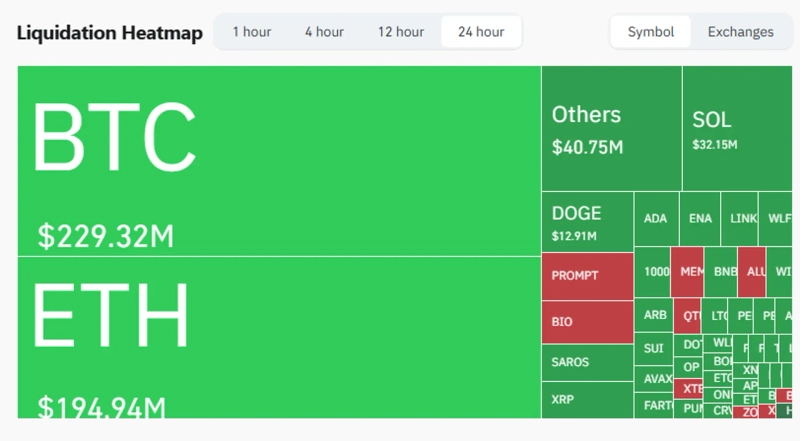

According to CoinGlass data on the 25th (KST), a total of $628 million (approximately ₩870 billion) worth of futures positions were liquidated across the entire network in the past 24 hours. Of this, $459 million (about ₩640 billion) came from long positions, while the remaining $168 million (about ₩230 billion) came from short positions.

The largest liquidations were seen in Bitcoin (BTC), followed by Ethereum (ETH) and Solana (SOL).

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

![[Market] Bitcoin steadies after 'wash shock'…reclaims the $79,000 level](https://media.bloomingbit.io/PROD/news/2d67445a-aa24-46b9-a72d-5d98b73b6aec.webp?w=250)

![[Today’s Key Economic & Crypto Calendar] Atlanta Fed GDPNow, More](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[New York Stock Market Briefing] Rebound on bargain hunting in blue chips…Apple jumps 4%](https://media.bloomingbit.io/PROD/news/3710ded9-1248-489c-ae01-8ba047cfb9a2.webp?w=250)