Summary

- According to CME FedWatch, the chance of a U.S. benchmark interest rate cut in September has reached 100%.

- Rate cuts are said to act as a positive for risk asset markets by expanding market liquidity.

- A slowing U.S. labor market has raised expectations for rate cuts and has made it easier for the Fed to decide on a 25bp cut.

The possibility of a U.S. benchmark interest rate cut in September has reached 100%. Rate cuts tend to act as a positive for risk asset markets by increasing market liquidity.

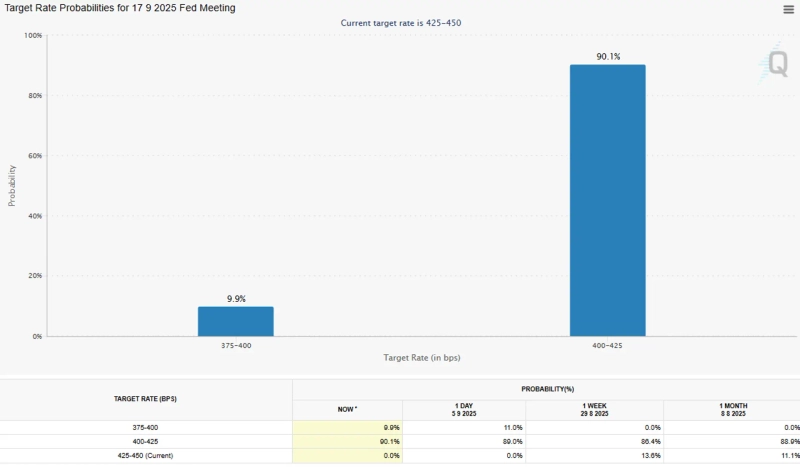

On the 8th (local time), according to CME FedWatch, the chance that the U.S. Federal Reserve (Fed) will cut rates in September has reached 100%. The probability of a 25bp cut is 90.1%, and the probability of a 50bp cut is 9.9%.

One reason expectations for rate cuts have increased is a cooled U.S. labor market. U.S. August nonfarm payrolls, released on the 5th, were 22,000, well below the market estimate (75,000). Also, the unemployment rate was 4.3%, up 0.1 percentage point from July's unemployment rate (4.2%).

Nick Timiraos, a Wall Street Journal (WSJ) reporter who is regarded as an informal spokesperson for the Fed, evaluated on X (formerly Twitter), "This slowdown in employment will make it easier for Fed officials to decide on a 25bp cut at their meeting in two weeks."

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)