Editor's PiCK

Last week global crypto investment products saw $352 million in net outflows

Summary

- CoinShares said in a report that global crypto investment products saw net outflows of $352 million last week.

- In particular, Ethereum products led the weakness with $912 million in outflows, while Bitcoin products saw net inflows of $524 million.

- Major altcoins such as XRP (XRP) and Solana (SOL) continued to show steady inflows.

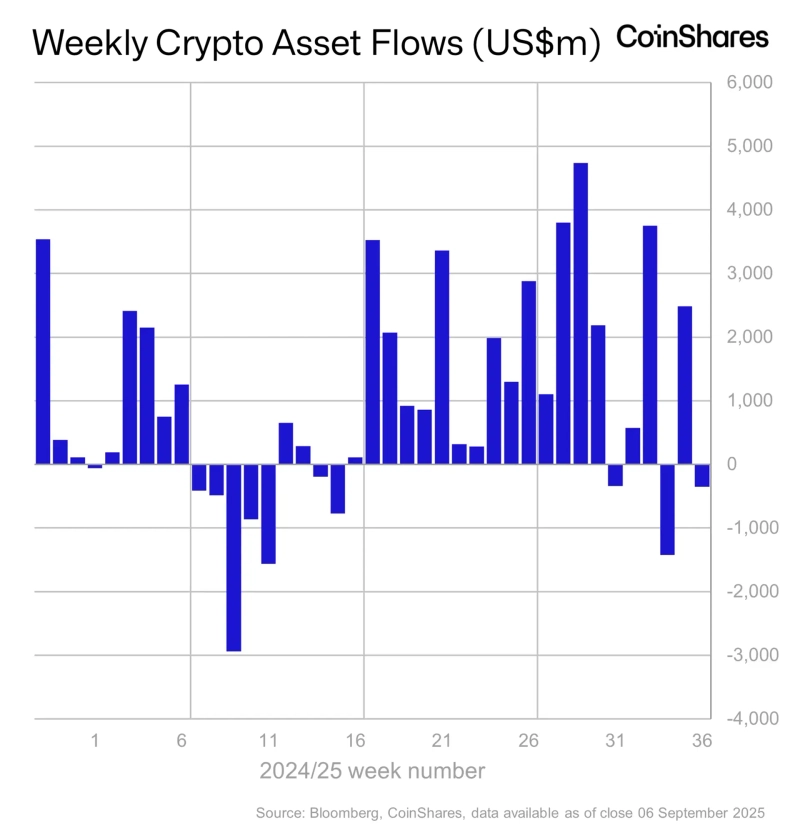

Last week, global crypto (cryptocurrency) investment products saw outflows of $352 million (₩488.1 billion).

On the 8th (local time), CoinShares said in a report, 'Last week crypto investment products saw outflows of $352 million,' and 'Trading volume also fell 27% compared with the previous week, showing market caution.'

However, it said bullish outlooks remain. The report added, 'Although there were net outflows, the year-to-date cumulative inflows are $35.2 billion,' and 'the long-term bullish view remains positive.'

By asset, Ethereum (ETH) products led outflows, with $912 million in redemptions. The report said, 'Global Ethereum products recorded net outflows for seven consecutive trading days,' and 'year-to-date cumulative inflows have fallen to $11.2 billion.' By contrast, Bitcoin (BTC) products had net inflows of $524 million.

Major altcoins showed positive flows. XRP and Solana (SOL) saw net inflows of $14.7 million and $16.1 million respectively. The report said, 'XRP and Solana continue to see consistent inflows,' noting that over the past 21 weeks the cumulative inflows for XRP and Solana have approached $12.2 billion and $11.6 billion, respectively.

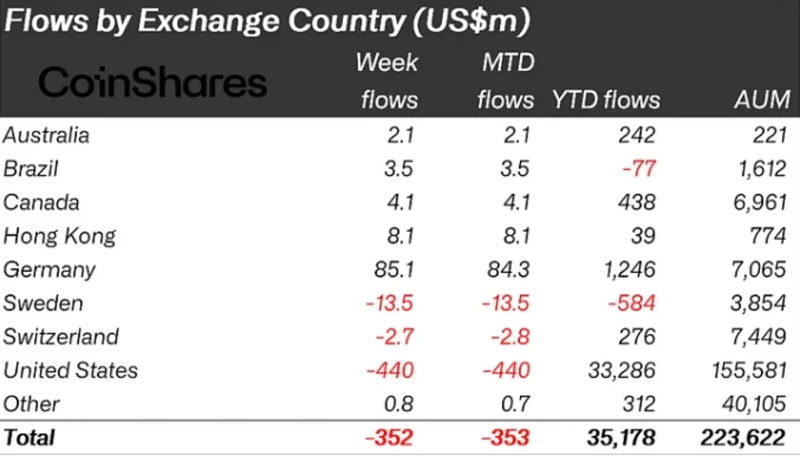

By country, outflows from the US were strong. US-based crypto products saw net outflows of about $440 million, while Sweden and Switzerland had outflows of $13.5 million and $2.7 million, respectively. Meanwhile, Germany and Hong Kong had net inflows of $85.1 million and $8.1 million, respectively.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit![[Today’s Key Economic & Crypto Calendar] US January Manufacturing PMI, etc.](https://media.bloomingbit.io/static/news/brief_en.webp?w=250)

![[Market] Bitcoin breaks below $76,000 as selloff shows no sign of easing](https://media.bloomingbit.io/PROD/news/0b328b54-f0e6-48fd-aeb0-687b3adede85.webp?w=250)

![[Market] Bitcoin slips below $77,000…Ethereum also breaks below $2,300](https://media.bloomingbit.io/PROD/news/f368fdee-cfea-4682-a5a1-926caa66b807.webp?w=250)