Editor's PiCK

Anxiety mounts as Korea-U.S. tariff talks drag on…Exchange rate in the 1,420-won range after the holiday [Analysis+]

Summary

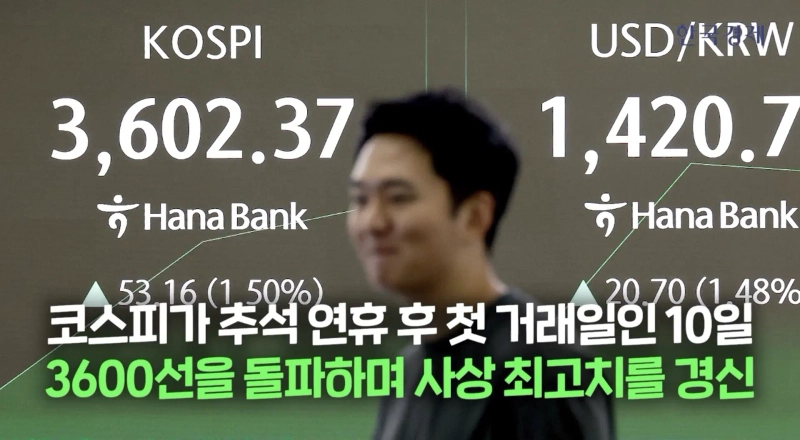

- It reported that the won–dollar exchange rate recently surged to the highest level in five months, into the 1,420-won range.

- It said that the US$350 billion Korea-U.S. investment negotiations have prolonged, increasing won weakness and foreign exchange market uncertainty.

- Experts expect fluctuations in the 1,400-won range for the time being and said attention should be paid to authorities' intervention and the outcome of the Korea-U.S. summit.

Won–dollar exchange rate hits highest in five months

Offshore trading flows reflected at once after the long holiday

Also dragged down by sharp drops in the yen and euro

Won weakens further as Korea-U.S. talks remain deadlocked

If U.S. investment deal is reached, a sharp fall is possible

"Expect fluctuations in the 1,400-won range…Watch for verbal intervention by authorities"

As the won–dollar exchange rate surged after the long holiday, anxiety has intensified mainly on online communities. As the won's decline was larger than other major currencies, some suspect that signs of friction in diplomatic relations with the United States, such as a prolonged trade negotiation, are a key factor.

"Yen fall, French crisis…Everywhere is a minefield"

On the 10th at the Seoul foreign exchange market, the won against the dollar opened at 1,423.0 won, up 23.0 won from the previous trading day's closing price (3:30 p.m.). This is the highest level in about five months since it hit 1,440 won intraday on May 2.

This is interpreted as reflecting dollar strength triggered by sharp declines in the euro and yen during the holiday. Offshore trading, where the won–dollar rate rose to the mid-1,420 won range, was reflected from the opening price that day. The offshore rate rose by more than 16 won from the 5th (1,407.06 won) to the 8th.

The dollar index, which shows the dollar's value against the currencies of six major countries, stood around 99.4. It rose by about 1.5 points from the closing of 97.9 on the 2nd. Over the past month, against the dollar the won rose 2.38%, the yen rose 3.82%, and the euro rose 1.16%.

This exchange rate rise appears to reflect several variables during the holiday, including a U.S. federal government 'shutdown' (temporary suspension of operations). The U.S. federal government has been in a 'shutdown' situation for nine days since the 1st (local time) due to delays in congressional budget approval, strengthening safe-haven demand.

Political instability in France has also been cited as a factor strengthening the dollar. After France's Prime Minister Sébastien Lecornu resigned one month after taking office, political pressure on President Emmanuel Macron intensified, putting downside pressure on the euro.

The yen plunged against the dollar after Sanae Takaichi won the Liberal Democratic Party presidential election in Japan. Takaichi has pledged to inherit Abenomics, advocating active fiscal policy and loose monetary policy. As a result, expectations of expanded issuance of deficit government bonds and a delay in Bank of Japan rate hikes were reflected, and the yen–dollar rate surged intraday to the 152-yen range.

In international financial markets, the won and the yen often move together. Park Seong-chul, a researcher at Yuanta Securities, analyzed, "Since the Korea-U.S. finance authorities signed an agreement to refrain from artificial intervention in exchange rates, moves to defend the exchange rate were limited over the Chuseok holiday, and the weak yen emerged. As the won is grouped in the same Asian currency zone, it synchronized and weakened."

Min Kyung-won, a researcher at Woori Bank, analyzed, "During the Chuseok holiday, the French prime minister resigned after one month, expanding political uncertainty from France and causing the euro to plunge, and the yen plunged as Takaichi won the LDP presidential election, with the market expecting a revival of Abenomics."

"Won weakens as Korea-U.S. talks remain deadlocked"

This rapid rise in the exchange rate comes as concerns grow in the securities industry that the $350 billion U.S. investment negotiations have stalled and the U.S. may continue imposing tariffs, prolonging the talks.

Korea and the United States reached an agreement at the end of July to lower tariffs on Korean products from 25% to 15% and to invest US$350 billion in the United States, but they have not been able to narrow differences over investment methods and profit distribution. Minister of Trade, Industry and Energy Kim Jung-kwan reportedly met with U.S. Commerce Secretary Gina Raimondo in the United States on the 4th but failed to reach a conclusion.

If, as the U.S. government demands, the US$350 billion must be invested in cash, the foreign exchange market would face unprecedented upward pressure. Since US$350 billion amounts to 84% of Korea's foreign exchange reserves, a prepaid cash investment of this scale could materialize a 'second foreign exchange crisis' due to sharp exchange rate rises and import price increases.

The Korean government has sought a breakthrough by proposing conditions for an unlimited currency swap, but it is reported that there has been no meaningful response from the U.S. side yet.

A currency swap is a mechanism in which a country deposits its currency with another country and borrows the other country's currency at a predetermined exchange rate, functioning like a negative balance account between countries to respond to extreme volatility in the foreign exchange market. It is considered more advantageous in terms of cost than exhausting foreign exchange reserves and then replenishing them.

In the past, Korea signed temporary currency swaps with the U.S. during the 2008 global financial crisis and the 2020 COVID crisis, but it is unprecedented to demand an unlimited swap for such a large-scale investment.

It is still unclear whether a favorable agreement that could support won strength will be reached at the Korea-U.S. summit scheduled for the end of this month.

Moon Da-woon, a researcher at Korea Investment & Securities, said, "Domestically, uncertainty over the US$350 billion investment negotiations is acting as an idiosyncratic weakening pressure on the won," and added, "Attention should be paid to whether the Korea-U.S. investment talks will be concluded considering the impact the two countries may have on the Korean foreign exchange market around the APEC summit at the end of October."

On the other hand, if the Korea-U.S. investment talks are concluded, there is also a possibility of a sharp fall while foreign investors' buying flows remain favorable. Park Sang-hyun, a researcher at iM Securities, forecasted, "If the Korea-U.S. investment talks are concluded in a form that reflects the investment ratios proposed by our side, the won–dollar rate could plunge sharply to the 1,360-won range."

"Fluctuations in the 1,400-won range for the time being"

The key going forward is signals of intervention by the authorities. If the exchange rate level gradually becomes a burden on the domestic stock market, authorities may send active suppression signals.

Yoo Sang-dae, Deputy Governor of the Bank of Korea, said at a "market situation review meeting" held that morning, "Global risk factors such as the possibility of a prolonged U.S. federal government shutdown and fiscal issues in major countries have somewhat increased," and added, "Given the remaining domestic and international uncertainties such as unclear U.S. tariff policy, the Fed's rate cut path, and concerns over fiscal soundness in major countries, we will remain vigilant and continue to closely monitor market conditions."

Experts expect the won–dollar exchange rate to fluctuate in the 1,400-won range for the time being while watching major countries' political events, foreign buying flows in the domestic stock market, and authorities' intervention.

Moon said, "There are not many factors to drive the exchange rate down until a clear weak-dollar trend resumes due to U.S. employment slowdown, and that has been further hampered as data releases have been temporarily suspended because of the U.S. federal government shutdown," adding, "It is also uncertain whether a Korea- and won-friendly agreement will be reached at the Korea-U.S. summit scheduled at the end of the month."

He added, "Given that the estimated appropriate exchange rate range based on current macro variables is approaching the upper end, the level burden and authorities' intervention will limit the further rise and speed of the dollar–won, and considering the strong downward rigidity expected at the big figure of 1,400 won, fluctuations in the 1,400-won range seem inevitable for the time being."

No Jeong-dong, Hankyung.com reporter dong2@hankyung.com

Ko Jeong-sam, Hankyung.com reporter jsk@hankyung.com

Jin Young-gi, Hankyung.com reporter young71@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.