US-China tariff war resumes... Trump "100% additional tariffs on China from November" [Lee Sang-eun's Washington Now]

Summary

- President Trump announced he will impose a 100% additional tariff on China from November 1 and implement software export controls.

- China has implemented rare-earth export controls that are reported to have evolved into precision sanctions covering AI, semiconductors, and the defense industry.

- If ultra-high tariffs and supply-chain shocks between the U.S. and China materialize, significant uncertainty is expected for related industries and global investment markets.

President Donald Trump and Chinese President Xi Jinping hinted that they might not meet at the Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju, North Gyeongsang Province, at the end of this month. He then announced that from November 1 he would impose a 100% tariff on China and would implement export controls on software.

President Trump, in a post on Truth Social on the morning of the 10th (local time), referred to China’s sudden rare-earth export control measures and wrote, "I was scheduled to meet Chairman Xi at the APEC summit in Korea in two weeks, but it now seems there is no need for that." He also disclosed that he is considering a plan to substantially raise tariffs on China again.

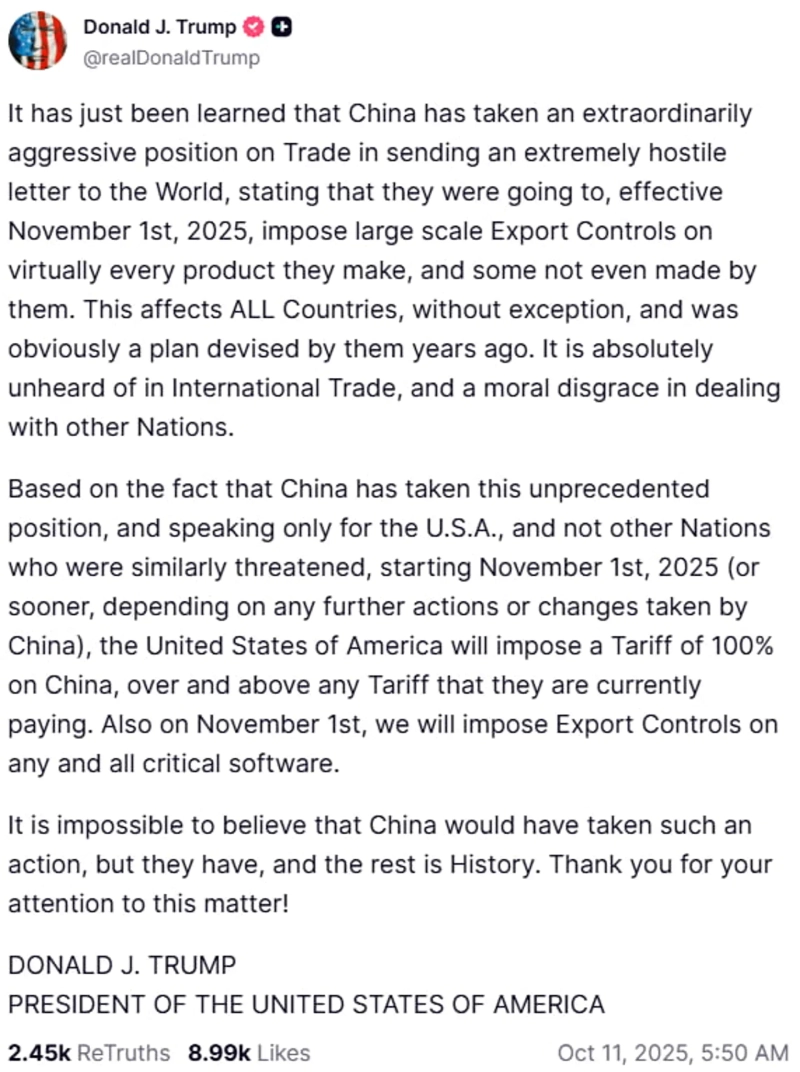

Later that afternoon he wrote, "Based on the fact that China has taken such an unprecedented position, and speaking only for the United States and not for other countries that received the same threats from China," and added, "From November 1, 2025 (or earlier if China takes other actions or measures), the United States will impose an additional 100% tariff on China in addition to the tariffs currently imposed." He also emphasized, "From November 1, we will implement export controls on all critical software." This is interpreted as the second phase of a renewed US-China tariff war under a second Trump administration.

◆"China taking the world hostage"

In a post in the morning he said, "Very strange things are happening in China," criticizing China for seeking to impose export controls on production inputs including rare earths and for targeting items not manufactured in China.

He added that such measures would "essentially 'paralyze' the market and cause difficulties for almost every country in the world." "Especially for China itself (it will cause difficulties)," he added. He said the measures came suddenly and that "relations with China had been very good over the past six months, so this action is even more surprising." He also added, "I have always felt they were waiting for an opportunity, and this time my hunch has been proven correct."

He said, "China taking the whole world 'hostage' must never be allowed," asserting, "It seems that has been their plan for a long time." He emphasized that China has "quietly secured large quantities of magnets and other rare-earth elements to form a kind of monopoly position," calling it "clearly sinister and hostile action." He also boasted, "The United States also holds monopolistic positions in many areas, and that power is much larger and broader than China’s. I have had no reason to use that power until now — until now!"

President Trump described the letter sent by China as "a very detailed export restriction list written over several pages," saying, "Things that were taken for granted are no longer taken for granted." He went on, "I have not spoken with President Xi. There was no reason to do so. This action was a big shock not only to me but to all leaders of the free world," and said it now seemed unnecessary to meet President Xi at APEC.

He did not hide his discomfort that the export controls were announced on the same day he ended the Gaza war. President Trump said, "What is even more inappropriate is that the day this letter was sent was the day peace came to the Middle East after 3000 years of turmoil and war," adding, "Depending on how China explains this hostile 'order,' I, as President of the United States, will take financial countermeasures against their actions." He also claimed, "The United States holds twice as much of all the elements that China has monopolized."

President Trump said, "There may be short-term pain, but ultimately this will be very good for the United States," and stated, "One of the policies currently under review is a large tariff increase on Chinese products." "Various other countermeasures are also being seriously discussed," he added.

◆Rare earths are the U.S. Achilles' heel

President Trump’s sensitive reaction to China’s rare-earth export control measures is tantamount to admitting that rare earths are the United States’ Achilles' heel. It demonstrates the reality that it is impossible to immediately exclude the United States and other major countries from deeply intertwined global supply chains.

In particular, China’s measures are assessed to have evolved into precision sanctions targeting not only simple minerals but also AI, semiconductors, and the defense industry as a whole.

The measures announced by China’s Ministry of Commerce on the 9th include restrictions not only on products manufactured within China but also on products made outside China that use Chinese raw materials or technology. The items designated for control include seven rare-earth elements such as samarium, dysprosium, and gadolinium, as well as alloys and oxides based on these elements such as samarium-cobalt alloys and dysprosium oxide. To export these items overseas, one must obtain a 'dual-use goods export license.' In other words, without the Chinese government’s 'OK' sign, transactions are impossible.

The list of seven rare-earth elements is the same as the one announced during the trade dispute in April. However, this time it is evaluated as a much stronger measure because the scope of regulation has been expanded to include 'offshore-produced products.' According to the wording, overseas-produced magnets or materials containing Chinese rare earths, or products that use Chinese mining, refining, or manufacturing technology, would also require Chinese government approval. If rules are strictly applied, even Chinese companies would face significant administrative burdens.

China accounts for over 70% of global rare-earth production, 90% of the refining process, and 93% of magnet manufacturing. In particular, samarium maintains strong magnetism even at high temperatures and is an essential material for fighter jet engines. Experts estimate that about 25 kilograms of samarium are needed per F-35 fighter jet.

Moreover, this measure covers not only military use but also advanced industrial sectors. China designated systems semiconductors below 14 nanometers, memory semiconductors of 256 layers or more, semiconductor manufacturing and testing equipment, and rare earths for AI R&D as items subject to individual review. It also expanded export control items to include industrial diamonds, rare-earth smelting equipment, middle rare earths such as holmium, erbium, and thulium, lithium batteries, and synthetic graphite anode materials.

The United States has recently begun investing in rare-earth mines and is working to build an independent global supply chain, but this process will take at least several years. The production volume of MP Materials' '10X facility' in California, which can produce permanent magnets, will not be available for shipment until 2028.

◆Will they really not meet?

For the host country South Korea, whether the US-China summit will actually fall through is quite important. There could be major changes to the movements and accommodations of the two leaders. It is also inevitably a matter of concern regarding the stature of the APEC summit events.

It is possible that both sides will fiercely negotiate up until just before the leaders’ meeting scheduled for October 29. It has become a matter that is hard to predict until the last minute. However, since President Trump has announced the new standard of imposing 100% tariffs from November 1, it is expected to be tight timing to resolve differences and hold a summit.

So far, President Trump has clearly preferred to meet Chairman Xi if possible. During the tariff-war phase in April, he did not hesitate to unilaterally announce very high tariffs reaching 125% on social media, but even then he viewed high tariffs as a tool to get what he wanted and planned to lower them later.

As a result, after passing through a very high tariff phase above 100% for a short period, the current level remains at an additional tariff rate of 30% over existing tariffs (10% base tariff + 20% fentanyl tariff). China’s additional tariff rate against the U.S. is 10% excluding the fentanyl tariff. Earlier, President Trump mentioned a 55% tariff on China, but that is interpreted as the sum of various tariffs applied when the Trump administration took office plus additional tariffs of 30%, not the reciprocal tariff currently suspended (34% until November 10).

Thereafter, in order to achieve a US-China summit, other policy priorities were changed or exceptions were shown toward China. Examples include his limited comment that he was "surprised" China did not mention the U.S. when it held a massive Victory Day parade in September and aligned closely with Russia and North Korea, his not lifting the U.S. soybean import ban despite pressure on his supporters, and his unusual restraint in taking special measures against China while pressuring India and Europe over Russian oil imports. The United States is imposing a 50% tariff on India based on Russia oil imports.

Differences in approaches between the Pentagon and the White House on deterrence strategy toward China have also been observed. Vice President J D Vance, Defense Secretary Pete Hegseth, and key strategists within the Department of Defense generally favor a hawkish stance toward China and view securing deterrence against China as a core U.S. task. While they may ask allies to share the burden of these expenditures, they are opposed to weakening deterrence by cutting spending. On the other hand, White House officials favoring America First, including President Trump, find large defense spending burdensome and have a tendency to refrain from making public messages that provoke China in order to manage relations between President Trump and Chairman Xi.

Nevertheless, Chairman Xi has clearly signaled that he will not easily follow President Trump’s pace. Showing force at the parade and then announcing rare-earth export controls at this juncture is clearly a strategic decision to test President Trump’s reaction and use it as leverage for a summit meeting. Just as the U.S. is testing how far it can push the world, China is testing how much President Trump is willing to accept.

President Trump initially said he was "considering" high tariffs on China, but later announced he would impose a 100% tariff from November 1. This is interpreted as raising the reciprocal tariff rate from 34% to 100% and implementing it from the 1st. Deep behind-the-scenes discussions are expected between the two countries over the next two weeks. It is uncertain whether both sides can reach an agreement as easily as during the first tariff war in April–May. At that time, both sides lowered tariff rates and limited export controls through negotiations between senior Treasury officials in Europe.

From President Trump’s perspective, he may feel he had "conceded" a lot to China and was backstabbed. On the other hand, China appears to believe it must use its cards to the fullest to blunt President Trump’s momentum.

< Status of additional tariffs on China under Trump’s second-term administration>

Reciprocal tariff 1 (34%) / suspended (~until November 10)

Reciprocal tariff 2 (100%) / threat (announced to apply from November 1)

Fentanyl tariff (20%) / in effect

Secondary tariff on Russian oil imports (50–100%) / threat

Secondary tariff on Venezuelan oil imports (25%) / threat

Source: Reed Smith

Washington=Lee Sang-eun, correspondent selee@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.