Editor's PiCK

Weakening economic strength and trade risks…"The 1,400-won range is the new exchange-rate benchmark"

Summary

- It reported that the recent won-dollar exchange rate has been consistently maintained in the 1,400-won range and has become a new benchmark.

- It stated that the won has the largest depreciation and volatility compared with other major currencies, and that the weakening of domestic fundamentals, such as a decline in economic growth, is the background.

- It said that, in the short term, the direction of the trade war and the outcome of the Korea-U.S. finance ministers' bilateral meeting will be important variables for changes in the won's value.

Foreign exchange authorities, verbal intervention after 1 year and 6 months

Plummeting won value

Exchange rate takes a direct hit as tariff negotiations fail to reach agreement

Uniquely weak compared with major currencies such as the euro

Has been moving in the 1,400-won range all year

Growth rate in the 0% range; fundamentals worst

Demand for currency exchange by Seohak gaemi also steady

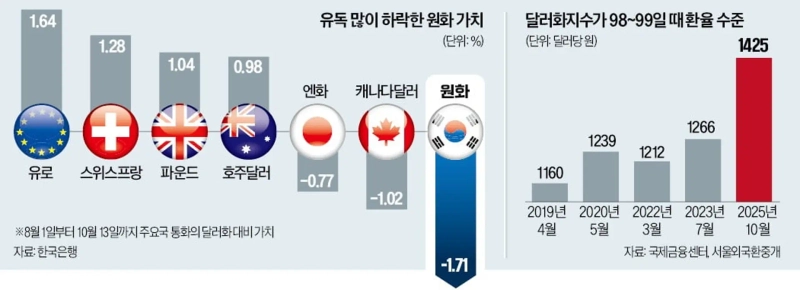

The reason the Ministry of Economy and Finance and the Bank of Korea engaged in verbal intervention in the foreign exchange market on the afternoon of the 13th for the first time in one and a half years was that they judged the won's depreciation and volatility to be excessive compared with the international financial market trend. While major countries also experience currency value swings as global uncertainty grows, the won has shown particularly unstable movements compared with other currencies.

◇ Weakest in value, highest in volatility

According to the Bank of Korea and the Korea Financial Investment Association, the won has recently recorded the largest depreciation among major currencies. From August to the day in question, the won's value against the dollar depreciated by 1.71%. This is the result of the won-dollar exchange rate rising from 1401 won 40 jeon to 1425 won 80 jeon during the period. In contrast, the euro (1.64%), the British pound (1.04%), and the Swiss franc (1.28%) each appreciated by more than 1% against the dollar. The Japanese yen (-0.77%) and the Canadian dollar (-1.02%) also fell in value but not as much as the won.

With U.S. President Donald Trump engaging in a trade war with the world, Korea—where tariff negotiations have not been settled—appears to have taken a direct hit. Unlike many major currencies that are mainly classified as safe-haven assets, the won is regarded as a risk asset and has been significantly affected by the spread of global risk-avoidance sentiment.

Even looking at a single day, the won exchange rates against major currencies all rose. The won-euro rate rose by more than 10 won from 1643 won 95 jeon per euro on the 10th to 1657 won 71 jeon on the day. The won-yen rate rose from 929 won 64 jeon per 100 yen to 939 won 11 jeon. The pound rose from 1890 won 50 jeon to 1905 won 58 jeon, and the Swiss franc rose from 1763 won 36 jeon to 1781 won 69 jeon.

These currencies and the won are not directly traded against each other in a dedicated market. They are traded via cross rates calculated from the won-dollar rate and each currency's value against the dollar. On the day, the dollar weakened, and other countries' currencies uniformly strengthened, but the won alone showed particular weakness, which is seen as the cause. Min Kyung-won, an economist at Woori Bank, explained, "The won is a currency that reacts sensitively to the trade war and a contraction in risk appetite," adding, "The fact that foreign investor sentiment in the domestic stock market has turned to net selling is also increasing pressure on the exchange rate."

The won's volatility is also higher than that of other currencies. According to the Bank of Korea, as of August, the won's average daily volatility was 0.42%, higher than the U.S. (0.35%), the euro (0.35%), the pound (0.3%), and the yen (0.4%).

◇ The 1,400-won new normal

The won-dollar exchange rate has been moving in the 1,400-won range throughout this year. The average exchange rate this year up to recently is 1412 won, higher than the 1394 won 97 jeon recorded in 1998 when the exchange rate surged briefly due to the foreign exchange crisis. If this trend continues through the end of the year, it could result in the highest annual average exchange rate on record. As the exchange rate has remained in the 1,400-won range this year, some evaluate that this level is becoming a new benchmark.

The won's value against the dollar has become noticeably lower than in the past. The U.S. dollar index, which shows the dollar's value against the currencies of six major countries, has recently been around 98–99. In the past, when the dollar index was at this level, the won-dollar exchange rate moved in the 1,200-won range. Around July 2023 it was about 1260 won, and in March–April 2022 it was about 1212 won.

Experts point to Korea's weakened economic fundamentals as the reason for the won's weakness. Considering a low economic growth rate in the 0% range and rapidly increasing welfare spending due to low birthrates and population aging, they say the structure makes an exchange rate rise inevitable. The Bank of Korea views that the environment surrounding the exchange rate has structurally changed as nationals' overseas investment has increased.

In the short term, the direction of the trade war is the biggest variable. Lee Min-hyuk, an economist at Kookmin Bank, forecasted, "If the standoff between the U.S. and China is a one-off, the rise in the won-dollar exchange rate will also calm down." Kwon A-min, a researcher at NH Investment & Securities, said, "Attention should be paid to whether an agreement will be reached at the Korea-U.S. finance ministers' bilateral meeting."

Reporter Kang Jin-gyu josep@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.