Summary

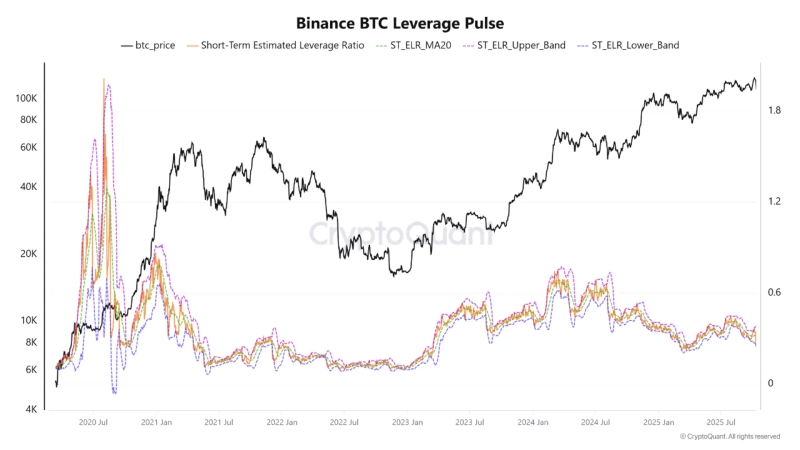

- Binance's BTC Leverage Pulse (BBLP) indicator has reportedly entered the low-risk zone (0.82).

- It said the BBLP indicator is interpreted as undervalued (buy signal) when it is 0.8 or below.

- Based on past data, it said an average 12% rebound followed upon entering the low-risk zone.

Binance's proprietary leverage analysis indicator 'Binance BTC Leverage Pulse (BBLP)', which detected market overheating just before the sharp Bitcoin (BTC) crash, has returned to the 'low-risk zone' and is showing a buy signal, an analysis said.

On the 13th (local time), a CrazyBlock CryptoQuant contributor said in a report, "Generally, when the BBLP ratio rises above 1.4 it is interpreted as an overheating (sell) signal, and when it falls below 0.8 it is interpreted as an undervalued (buy) signal," adding, "Currently BBLP has entered the low-risk zone (0.82). It will be a good entry opportunity."

He continued, "Based on data from 2023~2025, price adjustments occurred within 30 days in 57% of the instances when the ratio exceeded 1.4, and volatility more than doubled," and added, "When entering in the low-risk zone, an average 12% rebound followed."

Meanwhile, before the large $1.9 billion liquidation event on the 10th~11th, BBLP surpassed a ratio of 1.42, signaling market overheating.

Son Min

sonmin@bloomingbit.ioHello I’m Son Min, a journalist at BloomingBit

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)