Volatile Bitcoin prices…"An uncertain phase likely to continue for the time being"

Summary

- Recently, Bitcoin prices have reached record highs due to increasing debt among major countries.

- Major financial institutions such as Deutsche Bank and Citi analyze that purchases by central banks and institutional investors and expanding ETF inflows are driving Bitcoin demand.

- They noted that the rekindling of U.S.-China tariff tensions led to forced liquidations and sharp price drops, and that market volatility is expected to remain high for the time being.

Bitcoin outlook and investment strategy

Price surge due to rising sovereign debt in major countries

Once exceeded $120,000 and hit record highs

Central banks may also consider investing

Recent renewed U.S.-China tariff tensions

Sharp drop to the 160 million won range

Forced liquidations of about $20 billion also occurred

Some analyses say "this may not be a simple price correction"

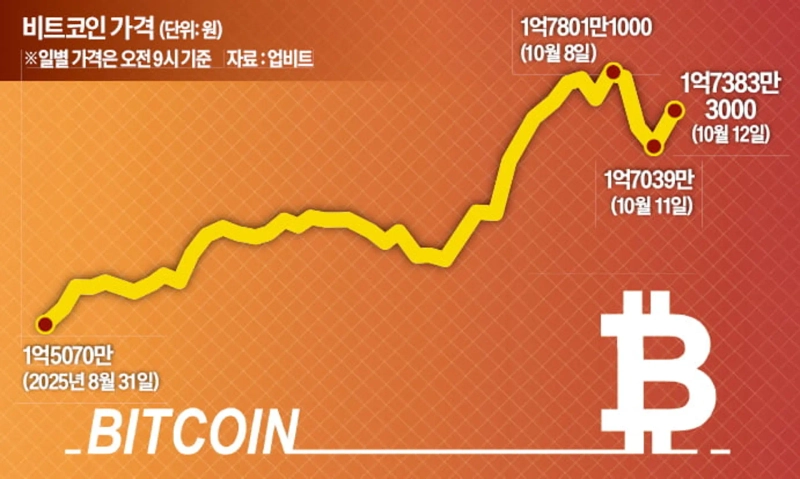

Bitcoin prices are swinging wildly. Earlier this month, amid increasing sovereign debt in major countries and buying of alternative assets to hedge against currency depreciation, Bitcoin repeatedly hit record highs, but it has recently turned into a sharp decline amid fears of a renewed tariff war between the United States and China. Due to sudden changes in international affairs, pessimism and optimism coexist, and an unclear phase is expected to continue for the time being.

◇Rising on concerns over major countries' finances

According to domestic cryptocurrency exchange Upbit on the 14th, Bitcoin exceeded 170 million won for the first time on the 2nd. After that, it repeatedly set new highs and at one point on the 8th surged into the 179 million won range. Overseas, it has been holding above 120,000 dollars this month.

Observers say the sharp rise in Bitcoin prices is linked to the issue of increasing sovereign debt in major countries. In the U.S., the budget required to run the government next year has not passed Congress, and government operations have been suspended since the 1st except for essential functions. Such a shutdown raises concerns that future debt limit negotiations will not be easy. U.S. federal government debt has swollen to about 37 trillion dollars and is approaching the limit of 41 trillion dollars. Not only the U.S., but the debts of other countries such as the U.K., France, and Japan are also steadily increasing.

As concerns grew that such sovereign debt problems could shake public finances, moves to buy alternative assets such as gold and Bitcoin to hedge against currency depreciation intensified. The so-called 'debasement trade' is spreading. J.P. Morgan, which first used the term debasement trade, said, "Retail investors are moving funds into gold and Bitcoin," and analyzed that "this phenomenon will continue."

◇Will central banks also jump into investing?

There are also prospects that major central banks will buy Bitcoin. Deutsche Bank recently said in a report that central banks are likely to hold Bitcoin as one of their key reserve assets by 2030. Deutsche Bank stated, "In the flow away from the dollar, net inflows to spot Bitcoin exchange-traded funds (ETF) reached about 4.7 billion dollars in June, an all-time high," and added, "Discussions are underway about considering Bitcoin as a reserve asset in the same way that countries began to net-buy gold from 2010." The bank cited a capped total issuance of 21 million units, gradually decreasing price volatility, and ease of account holding as reasons why Bitcoin could become a central bank reserve asset.

Recently, with large institutional investors such as pension funds emerging as new investors, Bitcoin has been building a deeper demand base. U.S. President Donald Trump signed an executive order in August to include virtual assets as an investment option in defined-contribution (DC) retirement plans such as 401(k). As a result, it became possible to include cryptocurrency ETFs, etc., in retirement accounts. The U.S. retirement market is 43 trillion dollars in size, of which about 9 trillion dollars is accumulated in 401(k). Harvard University also drew attention this year when it was revealed that it invested 120 million dollars in the iShares (IBIT) spot Bitcoin ETF.

Citi reflected these changes and recently raised its 12-month target for Bitcoin to 181,000 dollars. Citi analyzed, "Increased institutional allocation, inflows into ETF investor funds, and regulatory easing in major countries are factors driving price increases," and predicted, "About 7.5 billion dollars of new investor funds will flow in by the end of this year."

◇Tariff war concerns 'reignite' … a bear market may come

Bitcoin prices, which seemed poised to continue soaring, were abruptly halted amid signs that U.S.-China tariff tensions were restarting. Bitcoin plunged on the 11th and at one point fell below 170 million won during the trading day. Ethereum also broke the 6 million won level and at one point fell to the 5.7 million won range. Other major altcoins such as XRP and Solana also fell more than 10% in a single day. Some altcoins plunged more than 90%.

President Donald Trump's intention to restart a tariff war with China acted as a negative factor. On the 11th (local time), President Trump said on Truth Social, "Starting November 1, I will impose an additional 100% tariff on China." This was a retaliatory move after China took measures to control rare earth exports.

As concerns that a tariff war could be reignited grew, a record-scale liquidation event also occurred. According to CoinGlass data, after President Trump announced additional tariffs on China, about 20 billion dollars of forced liquidations took place in the cryptocurrency market within 24 hours. This is more than ten times the liquidations that occurred during the COVID-19 pandemic (1.2 billion dollars) and the bankruptcy of FTX (1.6 billion dollars).

Some in the financial markets analyze that the crypto boom may be over. Crypto analyst Ali Martinez said, "The atmosphere is similar to the end of 2021 when large liquidations occurred just before Bitcoin's weakness began," and added, "This crash may not be a simple price correction."

Reporter Jinseong Kim jskim1028@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.