"Fired a shot at the US economy"… Beneficiaries of the US-China rare earths war [Bin Nansae's Wall Street Without Gaps]

Summary

- Reported that China's rare earth export controls tightening has brought attention to supply-chain reorganization and investment in rare earth companies in the US and other Western countries.

- Stated that the US government and financial institutions are increasing direct investment and equity stakes in domestic and allied rare earth and strategic mineral producers, including MP Materials, Energy Fuels, Lynas Rare Earths.

- Noted that global companies like Tesla are focusing on non-rare-earth replacement technologies and power-efficiency improvement solutions, but that commercialization of replacement technologies will require time.

The long-dormant trade war between the US and China is shaking the market again. The core is, once more, rare earths. On the 9th, China's unprecedented tightening of rare earth export controls became the 'downward trigger' for a market already looking for a reason to correct. The US called it an "economic declaration of war" and announced 100% tariffs on China, triggering a sharp drop in risky assets.

Of course, US President Donald Trump later tried to calm the market by saying, "Don't worry (about China)." Wall Street, accustomed to the recurring pattern of US-China conflict, is not overly concerned. Many expect that if a meeting between President Trump and Chinese President Xi Jinping is arranged at the APEC meeting to be held in Korea at the end of this month, some form of ceasefire will be reached. The rising tensions between the US and China are seen as calculated blows to raise negotiating leverage ahead of that. This is why the 'buy-the-dip' crowd supports the downside every time the stock market falls.

Nevertheless, the fundamental risk surrounding rare earths is growing. The construction of rare earth supply chains is evolving into a core axis of the technological hegemony war in the AI era.

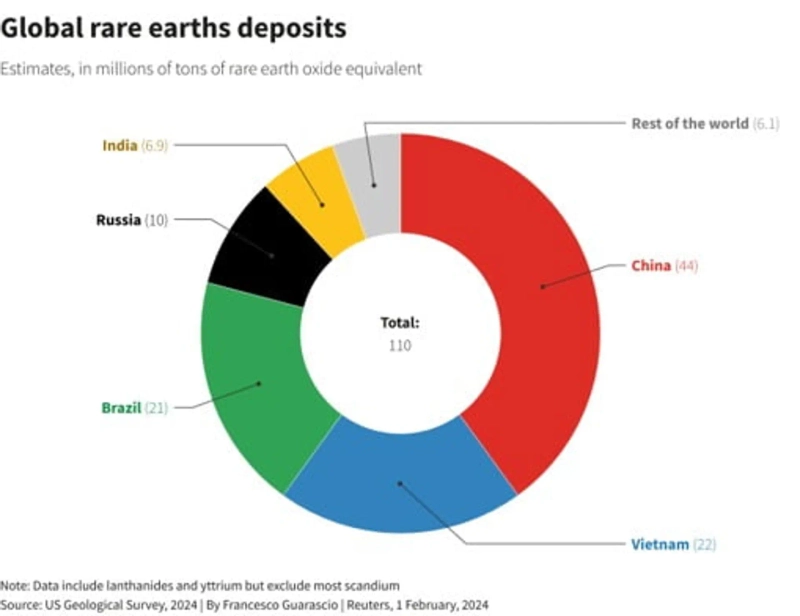

China's 'weaponization of rare earths' enters a new phase

Rare earths are literally rare elements in the ground. Although not truly scarce and relatively abundant on Earth, nearly half (44%) of known reserves are in China. More importantly, the processes of separation, extraction, refining, and processing are technically difficult and pose significant environmental pollution risks, which is why they are treated as rare. These rare earths are used in semiconductors, semiconductor equipment, electric vehicle motors, fighter jets, wind turbines, AI server cooling motors, and so on, making them essential to advanced technology and national security industries. China is wielding rare earths as a weapon in the AI hegemony competition, and the US is investing nationally to decouple supply chains from China.

Rare earths have been at the center of US-China trade wars before. In 2019, when the first Trump administration imposed 25% tariffs on China and implemented export controls on Huawei technology, President Xi inspected rare earth mines in Jiangxi Province. It was a message that rare earths could be weaponized. That implicit action alone caused rare earth prices to spike at the time.

China began wielding rare earths as a weapon during the Biden administration in 2023. When the Biden administration tightened export controls on AI chips to China from Nvidia and AMD, China announced export controls on gallium and germanium. It also banned the overseas transfer of rare earth mining and refining technology then.

And this year, in response to the Trump administration's trade war, China's 'weaponization of rare earths' entered a new phase. After introducing an export licensing system for seven types of rare earths in April, on the 9th it applied the 'Foreign Direct Product Rule (FDPR)' to rare earth raw materials, magnets, and technology. Under this rule, foreign companies must obtain China's permission when exporting products to third countries if they used even 0.1% Chinese rare earths or employed Chinese mining, smelting, separation, recycling, or magnet manufacturing technologies to produce the product, even if the product was not manufactured in China. This is essentially the rule the US has applied to regulate semiconductor exports to China, and China has directly adopted it for rare earths.

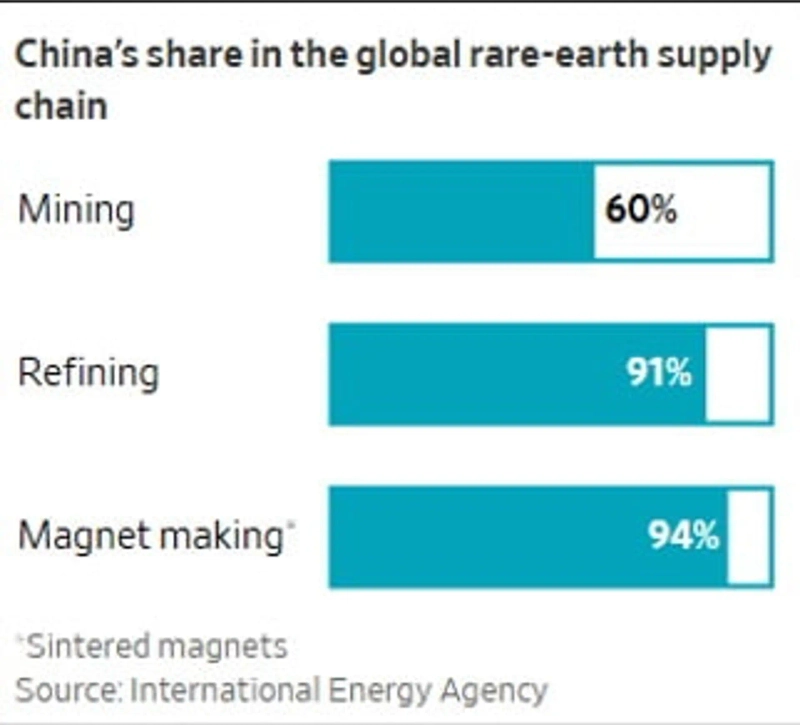

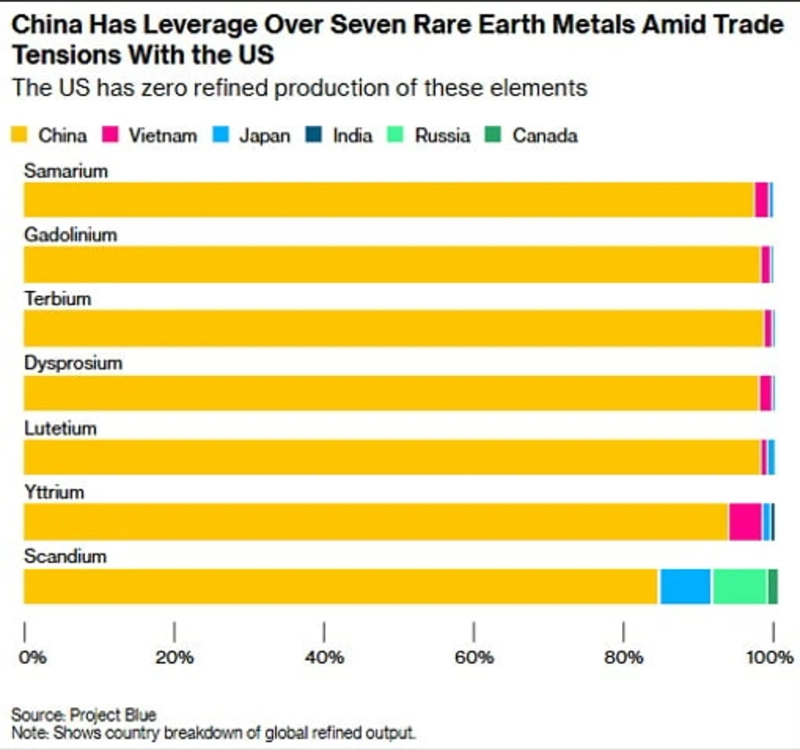

This regulation is powerful because China effectively monopolizes almost every step of the rare earth supply chain. China accounts for about 60% of the world's rare earth mining industry, 91% of refining and separation, and 94% of rare earth magnet production. Producing products without using Chinese refining or magnet manufacturing technology is nearly impossible. In particular, the separation process for heavy rare earths (HREE) required for high-value permanent magnets is effectively 99% dominated by China. This is why the US criticized the measure, with Rep. John Mullenar, chairman of the House China subcommittee, saying, "They fired a gun at the US economy."

"The US is in a wartime economy situation"

In fact, until the 1980s the US was also a key player in the rare earth market. But rare earth production is highly polluting and has low margins. Unlike China, which developed the rare earth industry under sustained state-led support over decades, Western producers, unable to bear the environmental costs, withdrew one after another and came to rely on Chinese supply chains. China's low-cost offensive, a method of driving out competitors and monopolizing the market, also operated here.

This dependence on Chinese rare earths became the biggest headache for the Trump administration's push to decouple supply chains. Permanent magnets that use heavy rare earths are core components of defense and advanced technology industries—AI servers, electric vehicles, missiles, fighter jets, wind turbines—and China controls those rare earths.

Permanent magnets maintain their magnetism without external current. Rare earth permanent magnets, containing elements such as neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and samarium (Sm), are more than ten times stronger than ordinary magnets. Without rare earths, magnet size and power consumption would increase severalfold. China holds more than 90% of the production of neodymium and samarium magnets.

As a result, most countries worldwide, not just the US, could see core strategic industries taken hostage by China's weaponization of rare earths. According to the US Geological Survey, if trade in 13 types of rare earths were blocked, the potential GDP loss for the US could amount to $130 billion.

Even if another ceasefire is reached around the US-China summit at the end of this month, the US will have to continue driving supply-chain decoupling from China. According to a report by Academy Securities, China's tightening of rare earth regulations "has clearly realigned US policy investment decisions toward security-based production capacity," adding that "investment in domestic self-sufficiency infrastructure across energy, power, components, semiconductors, and bio sectors is likely to double, and all regulations will be re-examined with practicality prioritized at 'wartime economy' levels."

Beneficiaries in the rare earth supply-chain reorganization

In this environment, investors should pay attention to: ① US efforts to build its own rare earth supply chain; ② efforts to develop technologies that reduce or replace rare earth use; and ③ efforts to solve potential power bottlenecks that could deepen during supply-chain reorganization.

The US has already decided to ban the use of Chinese rare earth magnets in defense from 2027. To that end, government support and investment are increasing significantly: expanding strategic stockpiles of rare earths and critical minerals, direct investment and funding for rare earth producers, and guarantees of minimum production prices.

Private investment, led by major Wall Street financial firms in coordination with the government, is also becoming active. On the 14th, JPMorgan announced support for $1.5 trillion in financing for sectors critical to US interests and security—key minerals, defense, energy, and technology—and said it would use $10 billion for direct equity investments.

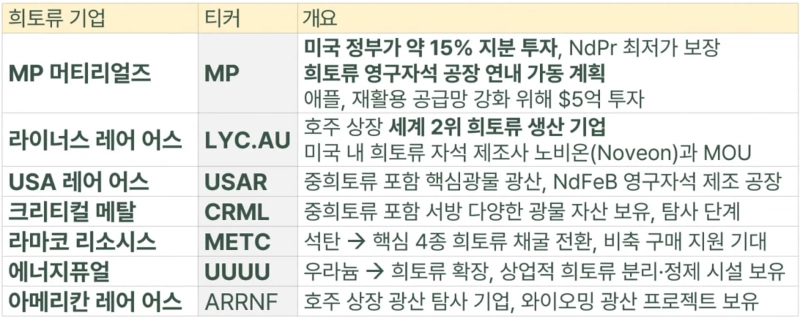

In this environment, companies targeting domestic rare earth production in the US—MP Materials (MP), USA Rare Earths (USAR), Critical Metals (CRML), Ramaco Resources (METC), Energy Fuels (UUUU)—are expected to be the biggest beneficiaries. MP Materials, which even received a 15% equity investment from the US Department of Defense, has already surged sixfold this year but has repeatedly gap-upped whenever US-China tensions flare. Energy Fuels, expanding from the largest US uranium producer into rare earth mining, refining, and separation, is also benefiting from expectations of expanded strategic stockpiles.

In line with the US government's push for a 'Western minerals alliance,' Australian firms are also mentioned as beneficiaries. Lynas Rare Earths (LYC), the world's second-largest rare earth producer listed in Australia, is a representative example. The company recently signed a strategic cooperation MOU with US rare earth magnet manufacturer NOVEON to build a rare earth permanent magnet supply chain.

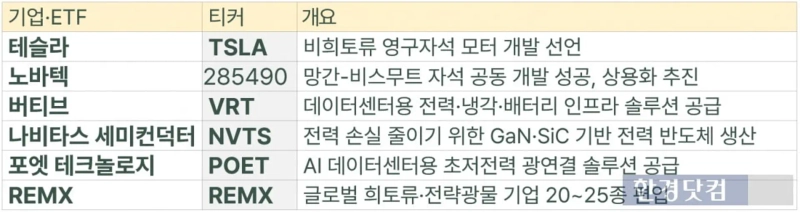

Beyond rare earths, self-sufficiency in key mineral supply chains—lithium, uranium, nickel, cobalt—is also a policy focus for the US government. To that end, the Trump administration acquired stakes in Lithium Americas (LAC), which holds the largest lithium deposit in North America, and Trilogy Metals (TMQ), which is developing multi-metal deposits of copper, zinc, and cobalt in the Ambler mining district in northwest Alaska. Wall Street is exploring the next 'Trump picks,' including companies such as The Metals Company (TMC), which explores deep-sea minerals, and Niocorp (NB), which is pursuing strategic metal production projects. A representative ETF is VanEck's Rare Earth/Strategic Metals ETF (REMX), which includes 20–25 global rare earth and strategic mineral companies.

Efforts to develop technologies that reduce or replace rare earth use are also underway. Tesla (TSLA) has declared it will develop non-rare-earth permanent magnet motors. Many global companies and research institutions are researching alternatives—neodymium-reduced magnets, high-performance ferrite magnets, manganese-based magnets—but commercialization will take time.

Market attention may focus on solutions to power issues that could be exacerbated during the rare earth supply-chain reorganization. Solutions that reduce power consumption—the biggest bottleneck for the spread of AI data centers—and produce and utilize power more efficiently have become core themes. AI server cooling solution leader Vertiv (VRT), power semiconductor companies such as Navitas Semiconductor (NVTS) and Power Integrations (POWI), and ultra-low-power optical interconnect solution provider PoET Technologies (POET) are receiving recent attention.

New York=Correspondent Bin Nansae binthere@hankyung.com

Korea Economic Daily

hankyung@bloomingbit.ioThe Korea Economic Daily Global is a digital media where latest news on Korean companies, industries, and financial markets.