"Billions of dollars in stablecoins move to Ethereum…Possibility of a decentralized finance cycle"

Summary

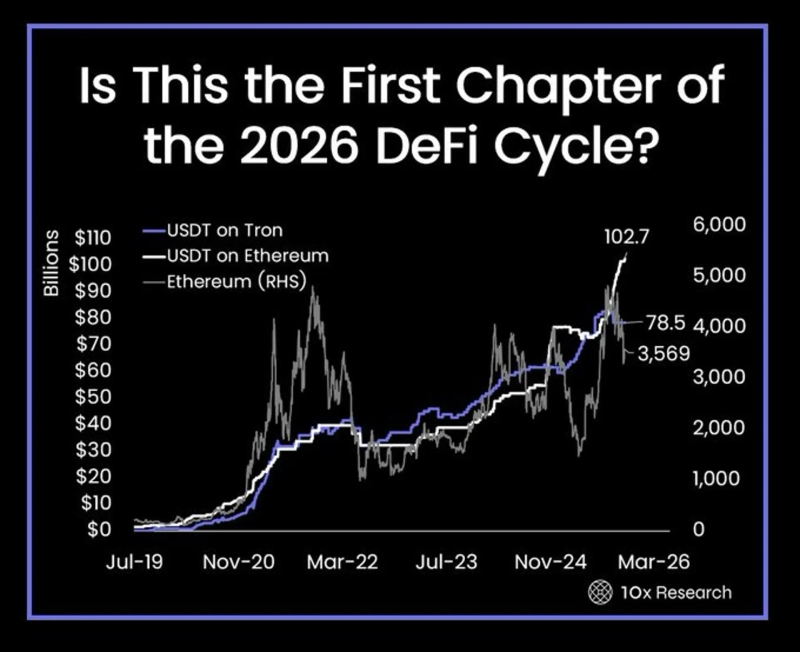

- "10x Research said that billions of dollars of stablecoins are moving to the Ethereum network."

- "A DeFi cycle could arrive in 2026; prices have not yet reacted, but it said funds are in an 'accumulation' stage."

- "10x Research explained that structural indicators on on-chain data, such as TVL (total value locked), are showing clear upward signals."

Attention is being paid to whether the decentralized finance (DeFi) sector could emerge in the virtual asset (cryptocurrency) market. As large amounts of stablecoins (virtual assets pegged to fiat currencies) have flowed into the Ethereum (ETH) network, there are forecasts that a DeFi cycle could arrive in 2026.

On the 11th (KST), 10x Research analyzed on X (formerly Twitter) that "as regulatory clarity in the U.S. is being secured, billions of dollars of stablecoins are moving to Ethereum."

They said this movement is a sign of a precursor to a full-scale cycle. 10x Research explained, "Although prices in the DeFi sector have not yet reacted, this stage is one of capital 'accumulation' rather than 'trading'," and added, "It's not a bad start."

Positive signals were also captured in on-chain data. 10x Research said, "Structural indicators such as user-based transaction volume and TVL (total value locked) evaluation models are showing clearer upward signals than price," and stated, "The market looks stagnant, but the data suggests it has entered 'setting mode'."

Uk Jin

wook9629@bloomingbit.ioH3LLO, World! I am Uk Jin.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)