Summary

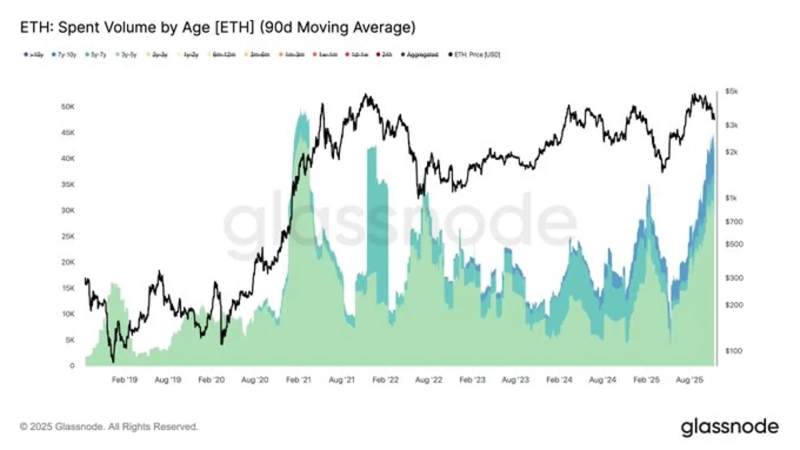

- According to on-chain analytics platform Glassnode, selling activity by Ethereum long-term holders has recently increased.

- It reported that since August, ETH prices have moved from a peak into a retracement phase, and realized selling by long-term investors has noticeably increased.

- It said the recent 90-day daily average selling volume of long-term holders exceeded 45,000 ETH, the highest level since February 2021.

An analysis found that Ethereum (ETH) has seen a noticeable increase in selling activity by long-term holders since the late-August peak.

On the 14th, on-chain analytics platform Glassnode said via X (formerly Twitter), "Since ETH peaked in August and prices entered a retracement phase, an increase in realized spending by long-term investors has been observed."

Glassnode said, "The daily average selling volume (daily average spending) of long-term holders who have held ETH for 3~10 years recently exceeded 45,000 ETH per day on a 90-day basis." This is the highest level since February 2021.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)