Editor's PiCK

Cryptocurrencies remain uneasy despite end of U.S. shutdown…ETF debut 'XRP' rebounds alone [Lee Su-hyun's Coin Radar]

Summary

- Bitcoin noted that short-term box range and further downside risk have increased due to interest rate uncertainty, the U.S. federal government's risk of shutdown resumption, and ETF outflows.

- Ethereum showed weakness due to unstaking, spot ETF net outflows, and a decline in network validators, but whale accumulation and increased spot withdrawals suggest rebound potential.

- XRP showed strength backed by spot ETF listing, and whether it breaks the key level of 2.5 dollars will determine further upside or downside.

<Lee Su-hyun's Coin Radar> is a column that reviews the flow of the crypto asset (cryptocurrency) market over the week and explains its background. Beyond a simple listing of prices, it analyzes global economic issues and investor movements in a multidimensional way and provides insights to gauge the market's direction.

Major Coins

1. Bitcoin (BTC)

Bitcoin maintained an uneasy trend throughout this week. On the 10th (local time), a temporary budget to end the shutdown passed the Senate and Bitcoin briefly touched 107,000 dollars, but it failed to continue its upward momentum and as of the 14th is trading around 97,000 dollars according to CoinMarketCap.

The biggest reason for the shift to a decline is interest rate uncertainty. Inside the U.S. Federal Reserve (Fed), opinions are sharply divided over whether to cut rates further in December. Hawks argue, "Inflation is still at about 3%, below the target (2%)," and advocate keeping rates unchanged, while doves claim, "There are clear signs of employment slowdown and recession," and push for additional rate cuts.

The problem is that major economic indicators could not be released due to the shutdown. The October Consumer Price Index (CPI) and weekly initial jobless claims, which should have been released the previous day, have been delayed. Moreover, the White House said, "October's CPI and employment data may not be released permanently." The Fed is now in a situation where it must make decisions 'without data (Blind Flight)'. The market is concerned that a Fed internally divided over rate policy will have to make more cautious decisions.

There are also views that the shutdown could resume in January next year, which is adding to market unease. Currently, the U.S. federal government has decided to resume operations under a temporary budget framework until the end of January next year. Therefore, Congress must finish negotiations and voting on the full budget before the temporary budget accounting ends at the end of January. The issue that caused the shutdown is whether to extend health insurance subsidies, the so-called 'Obamacare extension.' A Republican and some Democratic members' agreement planned to present this separately in the Senate in mid-December, but there is no clear guarantee of extension. If the two sides clash over this again, the shutdown could resume at the end of January. This is why the market cannot stage a 'complete relief rally.'

In the short term, Bitcoin is likely to remain in a box range below 100,000 dollars. Crypto-focused outlet The Block said, "There are lingering burdens such as ETF outflows and delayed institutional return," forecasting sideways movement. J.P. Morgan also expects Bitcoin's downside support to be in the 94,000-dollar range, indicating a significant possibility of further declines. However, since it maintains the possibility of a rise to 170,000 dollars within 6~12 months, the medium- to long-term outlook remains intact.

2. Ethereum (ETH)

Ethereum also continued a weak trend this week and is trading sideways around 3,200 dollars. As of the 14th on CoinMarketCap, it was trading at 3,217.73 dollars, down 6.98% from the previous day.

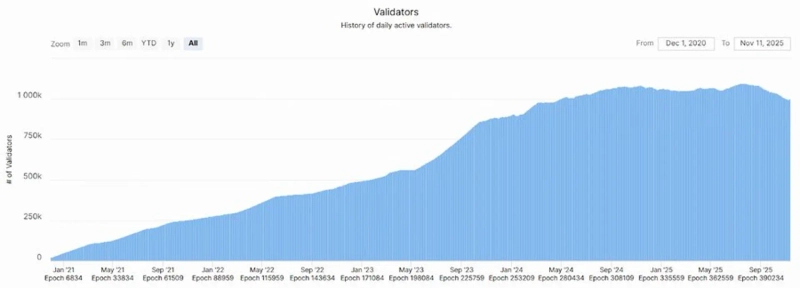

The number of network validators fell to the lowest level since April 2024, and increased supply due to unstaking has acted as short-term downward pressure. According to The Defiant, the daily active validator count fell to about 999,203, and withdrawal waiting times hit record highs. This indicates many validators are unstaking to secure liquidity. In addition, this week's Ethereum spot ETFs continued net outflows, contributing to the weak trend. Approximately 550 million dollars were net withdrawn this week, indicating waning institutional demand.

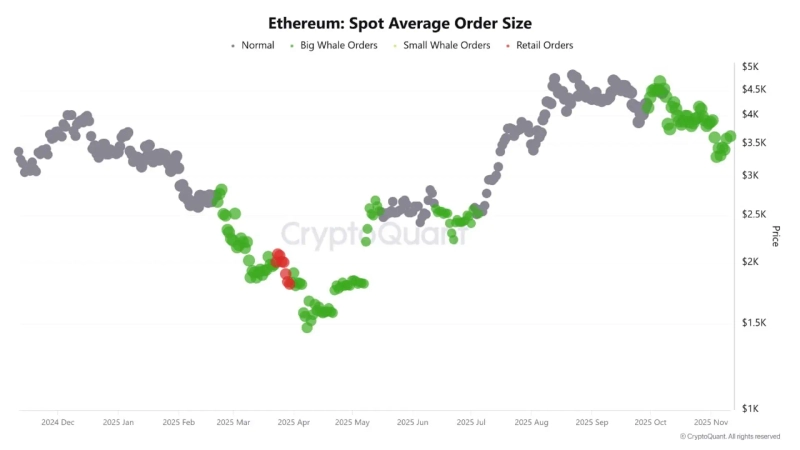

There are also factors suggesting the possibility of a rebound. The biggest is that whale accumulation remains solid. According to CryptoQuant, wallets holding 10,000–100,000 ETH increased by 52% since Q2 this year. In particular, spot buy orders surged whenever Ethereum's price adjusted near 3,000 dollars. Another positive indicator is the decrease in exchange holdings of Ethereum. According to CryptoOnChain, about 413,000 ETH (roughly 1.4 billion dollars) was withdrawn from Binance in a single day recently. This is the largest amount since February. Coins leaving exchanges are usually interpreted as a sign of reduced selling pressure, which could positively impact price rebounds.

Ethereum is currently trading at the major support level of around 3,200 dollars, so maintaining the 3,100–3,200 dollar range will be important. Investment media FXStreet set the key support at 3,100 dollars, warning that if the 3,100-dollar support base breaks, there is a risk of falling to 2,850 dollars. Crypto-focused outlet CryptoTicker also suggested Ethereum's core support is 3,200 dollars and that if the support breaks, it could fall to 2,800–2,850 dollars. To reverse into an uptrend, breaking above 3,350 dollars is crucial. If it fails to break 3,350 dollars, the downtrend could persist for a while.

3. XRP (XRP)

XRP showed the strongest performance among major coins this week. It rose about 3.7% week-on-week, climbing from 2.1 dollars to 2.3 dollars.

The rebound catalyst was, of course, the 'spot ETF listing.' On the 13th, Canary Capital's XRP spot ETF (XRPC) was officially listed in the U.S. According to James Seyffart, a Bloomberg ETF analyst, XRPC recorded about 59.1 million dollars in volume on its first trading day. This was the largest listing-day volume among new ETFs launched this year. Earlier, global investment bank J.P. Morgan had forecast, "If an XRP spot ETF is approved, 8 billion dollars could flow in during the first year," and this result supports that outlook.

The spot ETF rush is unlikely to stop here. Franklin Templeton, 21Shares, Bitwise, CoinShares, and others have already completed ticker registration and prepared for listing. This means these products are structurally ready to be traded immediately upon approval, so they are likely to hit the market soon.

For XRP to continue its positive trend, it is crucial to quickly retake the technically important level of 2.5 dollars. If it breaks through this area, 2.7 dollars and ultimately the 3-dollar level could open. Conversely, if it fails to retake that level, it could fall to 2 dollars or even 1.75 dollars. CoinDesk suggested that "XRP is forming a cup-and-handle pattern on the 3-day chart" and that "a break above 2.8 dollars could open room to rise to 5 dollars." In conclusion, it will be important to stably secure above 2.5 dollars.

Issue Coins

1. Solana (SOL)

Despite ETF inflows, Solana showed the weakest performance among major altcoins. According to CoinMarketCap, it fell more than 8% for the week and is currently trading around 140 dollars.

The biggest negative factor was the unstaking of holdings by FTX and Alameda Research. On the 11th, FTX/Alameda unstaked 193,000 SOL (about 30 million dollars), increasing supply pressure. FTX/Alameda were early key investors and leading ecosystem developers in Solana, so they initially held huge amounts of SOL. They are currently unstaking and cashing out those holdings for bankruptcy repayments, and this move can be seen as part of the creditor repayment process.

Network activity decline has compounded the problem. According to The Block, the number of active wallets dropped to 3.3 million, the lowest in a year. This reflects reduced network usage as the meme coin craze faded this year.

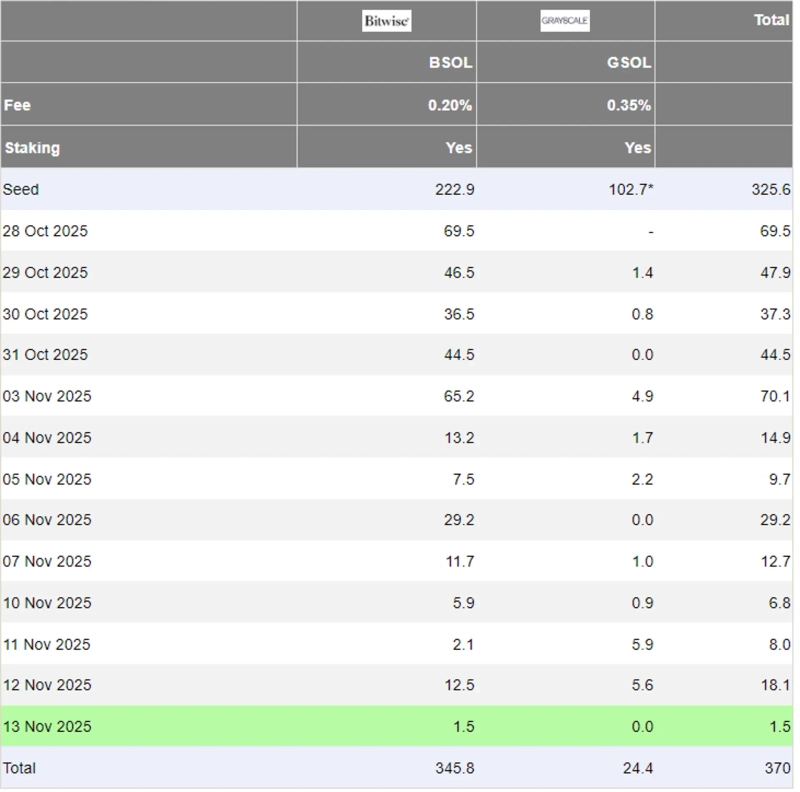

Nevertheless, institutional demand remains solid. According to Paside Investor, the Solana spot ETF recorded 13 consecutive trading days of net inflows, with cumulative inflows amounting to 370 million dollars. Institutional buying news also continued. On the 12th, Nasdaq-listed DeFi Development announced plans to raise 65 million dollars to buy Solana.

However, the bad market is likely to continue for the time being. Crypto outlet Cointelegraph analyzed that "It is important for Solana to hold support at 155 dollars." Having currently fallen below that level, it seems difficult to avoid further declines. If that level fails, it could fall to 126 dollars, and in a severe case, to 110 dollars. Conversely, breaking above 172 dollars could open room to rise to 193 dollars and possibly 210 dollars.

CoinDesk also said maintaining 152.8 dollars is necessary to rebound to the 160–165 dollar resistance area. Having fallen below that level, the decline could accelerate to 145 dollars. In the end, ETF inflows are creating a defense line, but short-term volatility is likely to persist.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)