[Analysis] "Stocks are intact but only virtual assets plunged…Bear market created by leveraged liquidations"

Suehyeon Lee

Summary

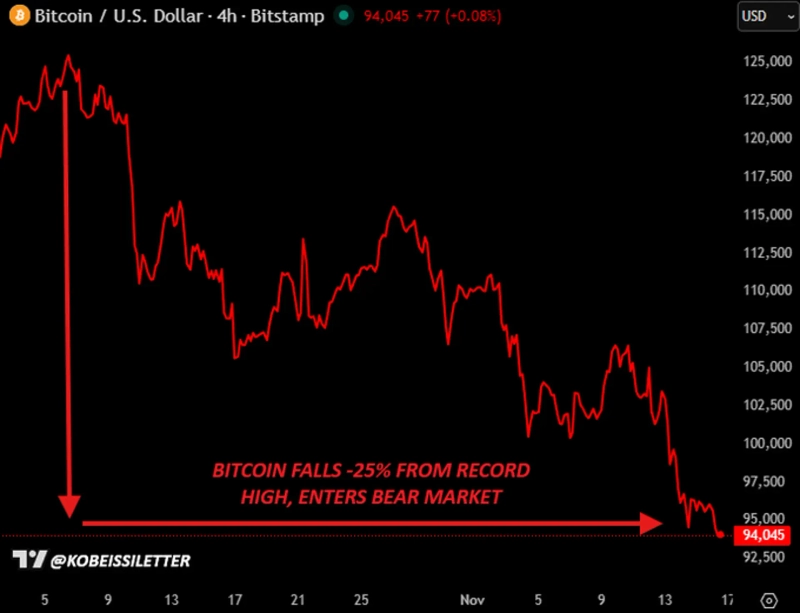

- The virtual asset market lost $100 billion in market capitalization, but the traditional financial markets appeared to be unaffected.

- It analyzed that while stocks, bonds, and gold all showed a firm trend, the reason only virtual assets plunged was the collapse of leveraged positions.

- The Kobeishi Letter stated that when market structure is reestablished, a true bottom is formed.

The virtual asset (cryptocurrency) market lost $100 billion in market capitalization over the weekend, yet traditional financial markets appeared to be hardly affected.

On the 17th (local time), according to the Kobeishi Letter, U.S. stock futures showed gains immediately after the open, regardless of the weekend virtual asset market plunge. Gold (Gold) rose above $4,100 per ounce, continuing a bullish trend, and U.S. Treasury yields also rose.

The Kobeishi Letter analyzed, "That stocks, bonds and gold were all firm while only virtual assets plunged shows that this move was caused by the collapse of excessive leveraged positions," and "a true bottom will form when the market structure is reestablished."

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)