Summary

- Matrixport analyzed that the crypto asset market has entered a full-fledged deleveraging phase.

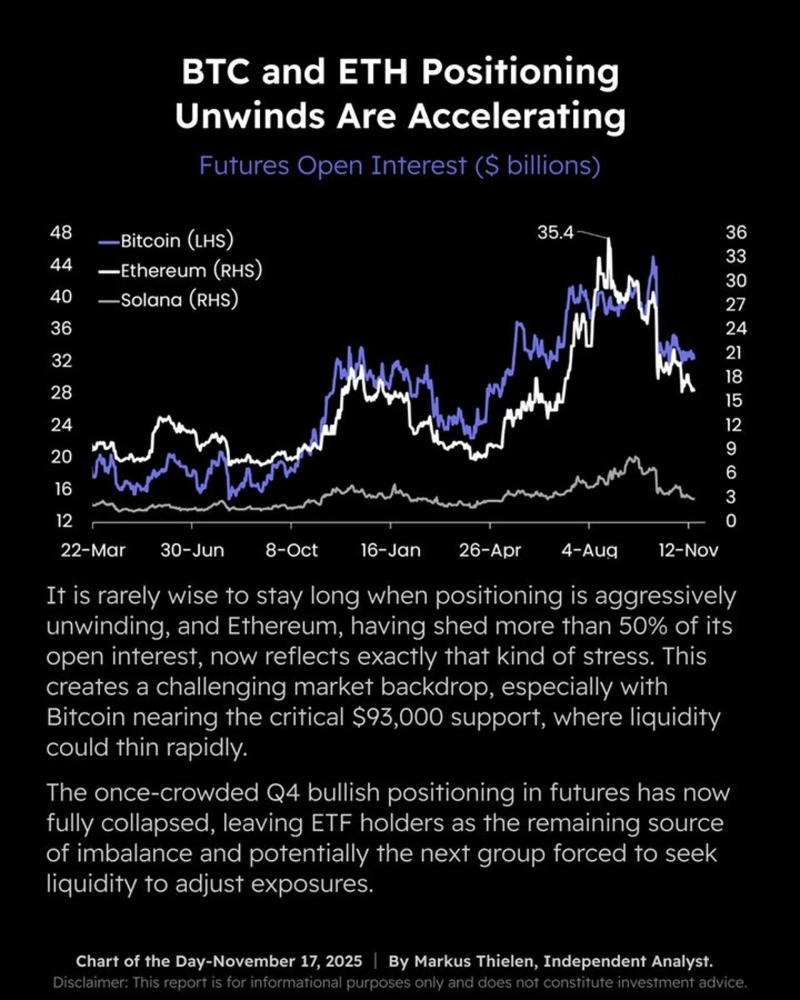

- Ethereum (ETH) futures open interest (OI) has decreased by 50%, indicating that leverage funds have been greatly reduced.

- The report said that concentration of ETF holdings could lead to additional selling pressure in a market downturn.

An analysis has been raised that the crypto asset market has entered a marked deleveraging (deleveraging) phase.

On the 17th (local time), Matrixport said in a report, "As the risk of maintaining high leverage positions increases, the market's overall risk tolerance is weakening."

According to the report, Ethereum (ETH) futures open interest (OI) has recently decreased by 50% as leverage funds are rapidly shrinking. Matrixport explained, "Leverage positions are being unwound on a large scale amid the macro environment and market volatility, increasing structural pressure."

Bitcoin (BTC) is close to the key support level of $93,000. Matrixport analyzed, "Liquidity at the current price range is weakening, so additional short-term pressure may appear." In recent days, Bitcoin has repeatedly undergone short-term adjustments under deleveraging pressure.

In the futures market, long positions that had been concentrated during the fourth quarter have mostly been unwound, easing the leverage burden. However, the report pointed out that ETF holdings are concentrated in certain ranges, so if the market weakness continues, additional selling pressure from ETFs could occur, leading to a new liquidity risk.

Suehyeon Lee

shlee@bloomingbit.ioI'm reporter Suehyeon Lee, your Web3 Moderator.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)