Editor's PiCK

U.S. spot Bitcoin ETFs saw about 534 billion won in net outflows the previous day…Large outflows from BlackRock's IBIT

Minseung Kang

Summary

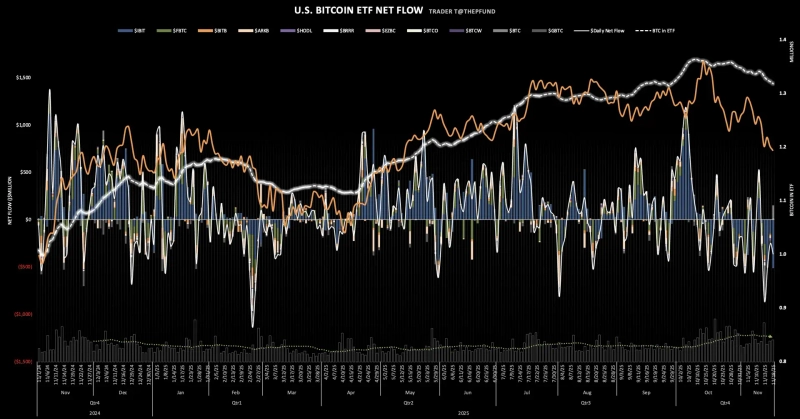

- Bitcoin (BTC) spot ETFs saw a net outflow of $363,080,000 the previous day.

- There were large outflows of $513,470,000 from BlackRock's IBIT, which significantly influenced the overall flow.

- The market analyzes that IBIT's outflows, combined with the recent Bitcoin price correction, are a factor weakening the short-term trend.

Spot Bitcoin (BTC) exchange-traded funds (ETFs) experienced a net outflow of $363,080,000 the previous day. Large outflows from BlackRock's IBIT appeared to drive the overall flow.

On the 19th, according to crypto asset (cryptocurrency) specialist account TraderT, $513,470,000 left IBIT, BlackRock's Bitcoin ETF, the previous day. By contrast, Grayscale Mini (BTC) recorded net inflows of $139,630,000, and Franklin's EZBC also saw inflows of $10,760,000. Major ETFs such as Fidelity (FBTC), ARK Invest (ARKB), and Bitwise (BITB) showed no notable changes.

Market analysts say the large outflow from IBIT, coupled with the recent Bitcoin price correction, is acting to weaken the short-term trend.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)