Editor's PiCK

U.S. Ethereum spot ETFs saw about KRW 111 billion net outflows the previous day… six consecutive trading days of net outflows

Summary

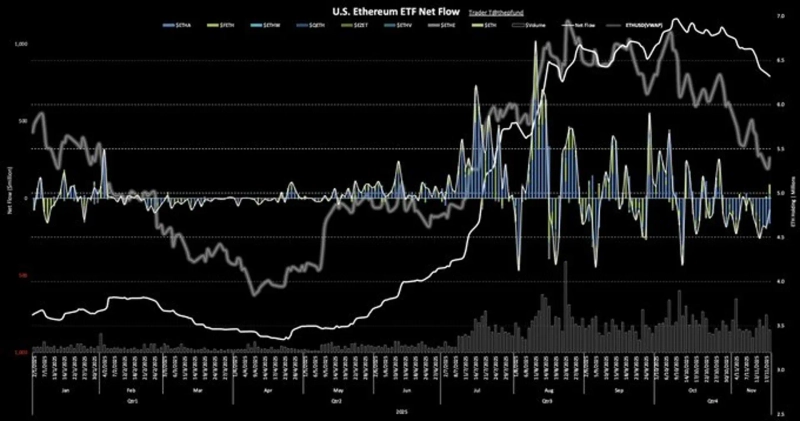

- U.S. Ethereum (ETH) spot ETFs recorded net outflows of $74.68 million (about KRW 111 billion) the previous day.

- This was the sixth consecutive trading day of net outflows, with BlackRock's ETHA seeing the largest outflow of $165.52 million.

- The market said that large-scale capital movements concentrating in specific ETFs have led to pronounced flow disparities among products.

Ethereum (ETH) spot exchange-traded funds (ETFs) recorded net outflows of $74.68 million the previous day. This marks six consecutive trading days of net outflows.

On the 19th, according to TraderT, a crypto asset (cryptocurrency)-specialized account, BlackRock's ETHA saw $165.52 million withdrawn the previous day. Meanwhile, Bitwise's ETHW had $19.10 million in inflows, and some ETFs, such as Franklin's EZET ($4.76 million) and VanEck's ETHV ($4.59 million), showed small inflows. Fidelity (FETH), 21Shares (CETH), Invesco (QETH), and the Grayscale ETHE series showed no change.

Market observers say that large-scale capital movements have concentrated in specific ETFs, making flow disparities between individual products more pronounced.

Minseung Kang

minriver@bloomingbit.ioBlockchain journalist | Writer of Trade Now & Altcoin Now, must-read content for investors.

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)