[Analysis] "Bitcoin on-chain activity surged in November… Institutional liquidity reallocation"

Summary

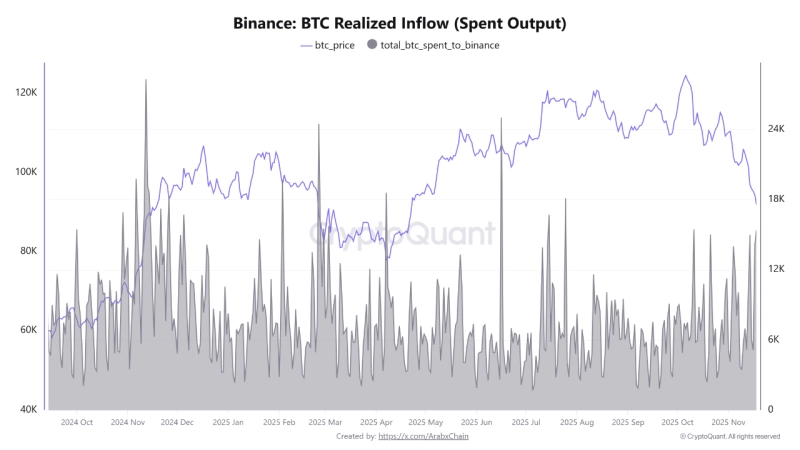

- A CryptoQuant contributor from Arab Chain said this month that Bitcoin on-chain activity has clearly increased.

- Arab Chain analyzed that this movement could be a signal of liquidity reallocation by institutional investors.

- Binance's Realized Inflow indicator also showed an increase, but reported that network activity rose without a sharp price collapse in the market.

This month, on-chain activity for Bitcoin (BTC) has surged.

Arab Chain, a CryptoQuant contributor, said on the 19th (local time) via CryptoQuant, "According to the Bitcoin SO (Spent Output) indicator, on-chain activity clearly increased throughout this month," and added, "On some days, Spent Volume exceeded 1,000,000 bitcoins on a daily basis." They continued, "The period average (daily) also approached about 841,000 bitcoins, the highest in recent months," saying, "It is a sign that a considerable amount of previously inactive bitcoin has started moving again."

Arab Chain viewed this trend as suggesting 'liquidity reallocation.' Arab Chain said, "(The increase in on-chain activity) may be a signal of wallet structure reorganization, liquidity reallocation by whales (large investors) or institutional-level players," and analyzed, "In particular, the steady rise of the 7-day moving average (SMA-7d) generally aligns with behavioral patterns related to position rebalancing or preparation for future liquidity."

They also referred to the Realized Inflow indicator of global cryptocurrency exchange Binance. Arab Chain said, "The Binance Realized Inflow indicator shows that the amount of bitcoin actually flowing into the exchange has clearly increased this month," and added, "The increase in inflows occurred in conjunction with the period when the Bitcoin price fell from $105,000 to $91,000." They noted, "This indicates that some of the moved liquidity may have been related to selling pressure or redeployment of funds within the market," adding, "It is noteworthy that both network and exchange-related activity increased significantly, yet the market did not experience a sharp price collapse."

JOON HYOUNG LEE

gilson@bloomingbit.ioCrypto Journalist based in Seoul

!['Easy money is over' as Trump pick triggers turmoil…Bitcoin tumbles too [Bin Nansa’s Wall Street, No Gaps]](https://media.bloomingbit.io/PROD/news/c5552397-3200-4794-a27b-2fabde64d4e2.webp?w=250)

![[Market] Bitcoin falls below $82,000...$320 million liquidated over the past hour](https://media.bloomingbit.io/PROD/news/93660260-0bc7-402a-bf2a-b4a42b9388aa.webp?w=250)